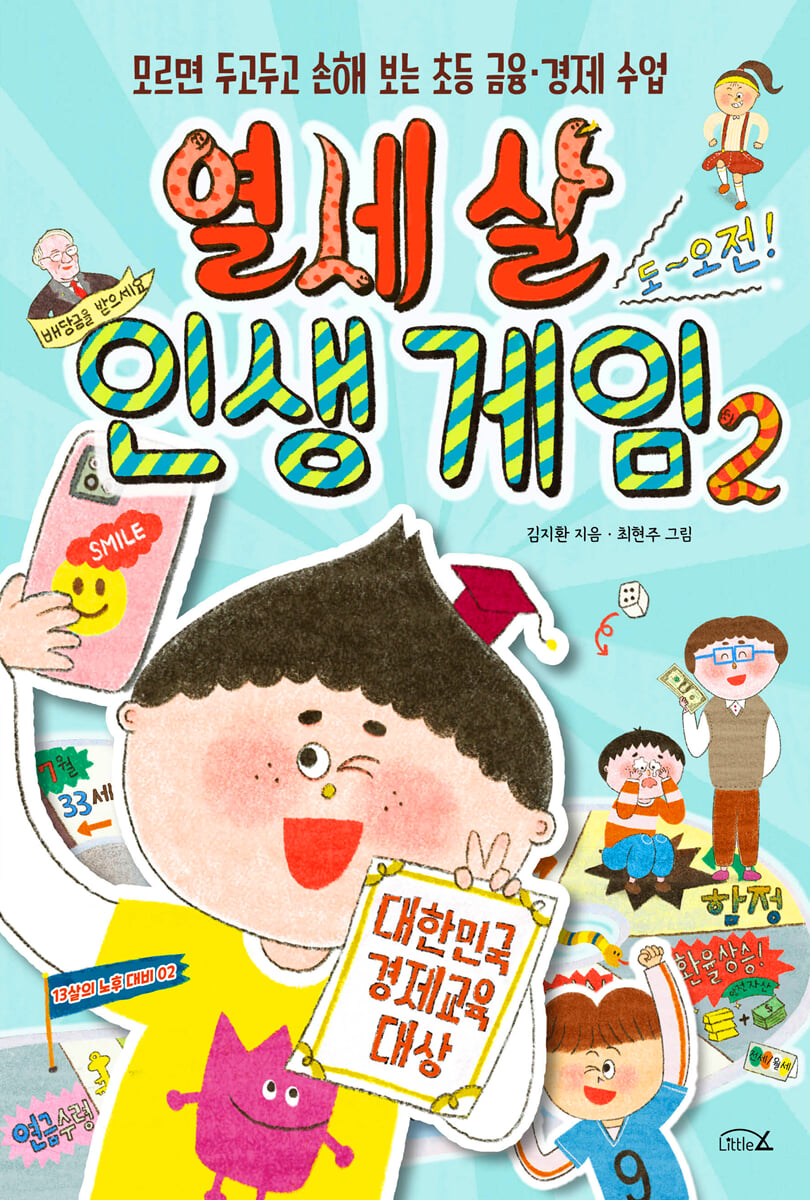

Thirteen Year Old Life Game 2

|

Description

Book Introduction

“I’m getting five years older every month.

“You’re living life in advance?”

“From 33 to retirement, these are real adult issues!”

-Pension, studio apartment, investment strategy, and even retirement.

Life simulation set in an elementary school classroom! "Thirteen-Year-Old Life Game 2" is out now!

"The Thirteen-Year-Old Life Game 2," which allows elementary school children to age five years each month and experience life from ages 33 to 58, has been published. Based on the "Preparing for Retirement at Age 13" lesson, which was featured in EBS's In-Depth Planning and major economic media outlets and was verified by the Korea Economic Education Award and the Financial Supervisory Service Governor's Award, this book is being evaluated as an innovative content in the field of financial education, combining games and experiments to teach children about the real economy "through their bodies."

Are you ready to join the 'second half' of the game of life?

If the first volume of 'The Game of Life' covered major life events up to the age of 28, such as military enlistment, college admission, marriage, and first investment, 'The Game of Life at 13', which unfolds from the age of 33, takes readers through the process of becoming a 'real adult' step by step, like a game, from signing up for the national pension, investing strategies, finding a studio apartment, preparing for old age, and retirement, and makes them think deeply about the best economic choice for each individual.

“You’re living life in advance?”

“From 33 to retirement, these are real adult issues!”

-Pension, studio apartment, investment strategy, and even retirement.

Life simulation set in an elementary school classroom! "Thirteen-Year-Old Life Game 2" is out now!

"The Thirteen-Year-Old Life Game 2," which allows elementary school children to age five years each month and experience life from ages 33 to 58, has been published. Based on the "Preparing for Retirement at Age 13" lesson, which was featured in EBS's In-Depth Planning and major economic media outlets and was verified by the Korea Economic Education Award and the Financial Supervisory Service Governor's Award, this book is being evaluated as an innovative content in the field of financial education, combining games and experiments to teach children about the real economy "through their bodies."

Are you ready to join the 'second half' of the game of life?

If the first volume of 'The Game of Life' covered major life events up to the age of 28, such as military enlistment, college admission, marriage, and first investment, 'The Game of Life at 13', which unfolds from the age of 33, takes readers through the process of becoming a 'real adult' step by step, like a game, from signing up for the national pension, investing strategies, finding a studio apartment, preparing for old age, and retirement, and makes them think deeply about the best economic choice for each individual.

- You can preview some of the book's contents.

Preview

index

Entering? The second half of the game begins!

[Game of Life] Introducing the Contestants

Chapter 1.

My class is 33 years old, let's join the National Pension!

You have insurance for your old age?

Life Game Golden Card ① ▶You have to think about your ‘January self’ in advance!

Life Game Golden Card ② ▶Does everyone pay the same amount of national pension?

Chapter 2.

Our class is 38 years old. Let's study the strongest money in the universe, the 'dollar'!

How did the dollar become the most powerful currency on earth?

Life Game Golden Card ▶How much money would you have to give to get $1?

Chapter 3.

The dollar, a strong friend who gives you strength in times of crisis!

What happened in our country in 1977?

Life Game Golden Card ▶Are there any other safe assets?

Chapter 4.

How to buy stocks in 500 companies for just 10,000 won

Just like you can split a bankbook, you can split stocks too!

Life Game Golden Card ▶ Want to know more about ETFs?

Chapter 5.

Let's make steady profits with stocks!

Making money with stocks isn't just about price differences!

Life Game Golden Card ▶ Interest rate for interest, dividend rate for dividend

Chapter 6.

In soccer, it's formation, in investment, it's portfolio!

Whether it's soccer or investing, 'strategy diversification' is important!

Life Game Golden Card ▶What assets play the roles of attacker, defender, and midfielder?

Chapter 7.

Should we invest in the 'country' rather than the company?

Emerging or developed, that is the question.

Life Game Golden Card ① ▶How do you display the stock prices of hundreds of stocks at once?

Life Game Golden Card ② ▶Don't make investment decisions based solely on recent trends!

Chapter 8.

Let's create your own investment portfolio!

If you're persistent, you're invincible! Develop your own winning strategy.

The Golden Card of Life Game ▶ Are the dollar and gold "perfectly safe" assets?

Chapter 9.

My classmate is 43 years old. Buying my own home? Buying my own room!

Buy vs.

Borrowing for a while, how on earth do you rent a house?

Life Game Golden Card ▶Which is better, monthly rent or a deposit?

Chapter 10.

Find the 'best room' that suits you!

Prices vary greatly depending on location and environment! What are your priorities?

Life Game Golden Card ▶Rental Fraud? Give me my deposit back!

Chapter 11.

My classmate is 48 years old. Should I sell it? Or not? How much should I sell it for?

Investing can be exciting and tedious at times. There's no right answer in the world of investing!

Life Game Golden Card ▶What if you could travel back in time and invest?

Chapter 12. The Magic of Compound Interest: A Game of Zombie Tag

The principle of money duplication, where interest accrues even on interest

Life Game Golden Card ▶How long does it take for my money to double?

Chapter 13.

My class is 53 years old. Are you prepared for retirement?

How much money do you need to live comfortably in your old age?

Life Game Golden Card ▶When and how much can I receive from the National Pension?

Chapter 14. 'My class is 58 years old, finally retired!

Knock knock knock knock, did my friends manage to prepare for retirement?

Going out? Towards real life, towards real values!

Appendix? Curriculum Linkage Table

[Game of Life] Introducing the Contestants

Chapter 1.

My class is 33 years old, let's join the National Pension!

You have insurance for your old age?

Life Game Golden Card ① ▶You have to think about your ‘January self’ in advance!

Life Game Golden Card ② ▶Does everyone pay the same amount of national pension?

Chapter 2.

Our class is 38 years old. Let's study the strongest money in the universe, the 'dollar'!

How did the dollar become the most powerful currency on earth?

Life Game Golden Card ▶How much money would you have to give to get $1?

Chapter 3.

The dollar, a strong friend who gives you strength in times of crisis!

What happened in our country in 1977?

Life Game Golden Card ▶Are there any other safe assets?

Chapter 4.

How to buy stocks in 500 companies for just 10,000 won

Just like you can split a bankbook, you can split stocks too!

Life Game Golden Card ▶ Want to know more about ETFs?

Chapter 5.

Let's make steady profits with stocks!

Making money with stocks isn't just about price differences!

Life Game Golden Card ▶ Interest rate for interest, dividend rate for dividend

Chapter 6.

In soccer, it's formation, in investment, it's portfolio!

Whether it's soccer or investing, 'strategy diversification' is important!

Life Game Golden Card ▶What assets play the roles of attacker, defender, and midfielder?

Chapter 7.

Should we invest in the 'country' rather than the company?

Emerging or developed, that is the question.

Life Game Golden Card ① ▶How do you display the stock prices of hundreds of stocks at once?

Life Game Golden Card ② ▶Don't make investment decisions based solely on recent trends!

Chapter 8.

Let's create your own investment portfolio!

If you're persistent, you're invincible! Develop your own winning strategy.

The Golden Card of Life Game ▶ Are the dollar and gold "perfectly safe" assets?

Chapter 9.

My classmate is 43 years old. Buying my own home? Buying my own room!

Buy vs.

Borrowing for a while, how on earth do you rent a house?

Life Game Golden Card ▶Which is better, monthly rent or a deposit?

Chapter 10.

Find the 'best room' that suits you!

Prices vary greatly depending on location and environment! What are your priorities?

Life Game Golden Card ▶Rental Fraud? Give me my deposit back!

Chapter 11.

My classmate is 48 years old. Should I sell it? Or not? How much should I sell it for?

Investing can be exciting and tedious at times. There's no right answer in the world of investing!

Life Game Golden Card ▶What if you could travel back in time and invest?

Chapter 12. The Magic of Compound Interest: A Game of Zombie Tag

The principle of money duplication, where interest accrues even on interest

Life Game Golden Card ▶How long does it take for my money to double?

Chapter 13.

My class is 53 years old. Are you prepared for retirement?

How much money do you need to live comfortably in your old age?

Life Game Golden Card ▶When and how much can I receive from the National Pension?

Chapter 14. 'My class is 58 years old, finally retired!

Knock knock knock knock, did my friends manage to prepare for retirement?

Going out? Towards real life, towards real values!

Appendix? Curriculum Linkage Table

Detailed image

Into the book

But one thing is clear.

The truth is that as teachers and all of you get older, you will eventually stop working and 'retire' from your jobs.

So, in that case, we should prepare for retirement when we can no longer earn money through work, right?

Many financial experts say that it's essential to know "safe investment methods" to prepare for retirement.

When you're young, you have time to recover by working if you lose money in an investment, but when you're older, if you lose money in a risky investment, you don't have much time to recover!

So, in the second half of my life, I plan to study ways to make "safe investments" through various experiments and games.

Now, shall we begin the 'second half of the game of life' for the second time in life?

--- p.5

“I’m sorry, but joining the National Pension is not optional, it’s mandatory!”

“Ugh, no~”

Naeun and some of her friends shouted.

In the life games he had played with his teacher so far, there were always many cases where he had to make 'choices' and take 'responsibility' for them, but Kang-ho was surprised that when it came to 'pension', it was not a choice but an 'obligation'.

"Paying an extra 30,000 won a week isn't that burdensome, is it? I wonder if I'll regret signing up for the National Pension when I retire in December! Well, that's all for today's lesson!"

--- p.24

“Hey, hurry up! Let’s go get the dollars and gold!”

“I’m doing my best too.

“Don’t rush me too much.”

While his friends were frantically making their names with consonant and vowel cards, Dong-Hyeon, who was helping the teacher put gold on the blackboard and exchange dollars for gold, spoke with a very embarrassed expression.

“Uh… Teacher… But… All the gold I prepared is gone?”

Then the teacher smiled and shouted as if he had been waiting for it.

“Stop the trade game!”

The friends who were absorbed in the game looked at the teacher with bewildered expressions at the sudden announcement of the suspension.

“Unfortunately, all the gold we had prepared has run out.

From now on, even if you bring dollars, we can't exchange them for gold."

--- p.35

“Um… I was so scared that I would have sold all my Korean stocks and run away, even if it meant losing money.”

The teacher said, looking at the frightened Naeun.

“When the stock market actually starts to crash, people get really scared.

And as Naeun said, he got scared and sold the stocks he had.

“This is called a ‘panic cell.’”

“They say everyone’s heart is the same, but I’m not the only one who thinks that way!”

--- p.51

“The teacher only gave me 200,000 won, but each share was so expensive.

So I couldn't diversify my investments across different stocks."

“Naver went up the most, but Naver was worth 250,000 won per share, so I couldn’t even buy one share.”

“Yeah, that’s right.

“The discomfort you feel has been felt by adults for a long time.”

The teacher continued speaking with a smile, as if he had anticipated the children's complaints.

“Okay, now let’s open the box of cookies and pour all the cookies inside onto the desk.”

--- p.68

“Dong-Hyeon, how many types of stocks can you put in one ETF basket?”

“Well… there’s a limit to the number of items you can put in a supermarket shopping cart, so wouldn’t putting in about 30 be too much?”

“No, that’s not true.

“It can hold thousands of stock pieces.”

The teacher, who was listening to Kang-ho and Dong-hyeon's conversation, answered from the side.

“Wow~”

My friends were amazed that they could diversify their investments across thousands of stocks by purchasing just one basket called an ETF.

"Ah! I get it. There's an investment adage, 'Don't put all your eggs in one basket.' So ETFs are a product that helps you diversify your investments by allowing you to spread your eggs across multiple baskets, making for a safer investment."

--- p.71

“Grandfather Warren Buffett began investing in Coca-Cola in earnest in 1988.

In 1988, if you bought one share of Coca-Cola, it would give you about $0.03.03 in dividends per year.”

“$0.03?”

“Hey, isn’t $0.03 too little, let alone $1?”

“It doesn’t seem like much, does it? But Grandpa Buffett has been steadily buying Coca-Cola stock.

And now, he says he's collected '400 million' Coca-Cola shares." "Wow! 400 million?"

“To be exact, it would be correct to say ‘400 million shares’, right?”

"Does Grandpa Buffett find Coca-Cola so delicious? Why did he buy so much Coca-Cola stock?"

“Wow, he owns 400 million shares of dividend stocks, so Grandpa Buffett must have made a fortune from dividends!”

As the children were whispering among themselves, Hyunji retorted.

--- p.86

"Guys, if everyone's just attacking, who's going to pass the ball from the middle? And who's going to defend? Excluding the goalkeeper, if all ten of us attack together and then all run back to defend, it's just too inefficient."

Dong-Hyeon's words made his friends recall the last game against Class 3.

This is because everyone wanted to score, so they became attackers and rushed around looking at the ball without properly distributing roles, and ended up losing 3-0.

“Let’s not do that, let’s divide the roles this time.

You know what your formation is, right? For example, a 4-3-3 formation has four defenders, three midfielders, and three attackers.

“Then let’s start with a 4-3-3 formation.

Who wants to be the three attackers?

--- p.100

“The name of the portfolio I created is ‘Korea-US Alliance.’”

“ROK-US alliance?”

“We will invest half in 200 companies representing our country and half in 500 companies representing the United States!”

Naeun spoke proudly.

Naeun, who originally planned to invest only in the United States, added Korean stocks to her portfolio after hearing the teacher's explanation.

"Huh? But Naeun's portfolio doesn't have any safe assets."

Kang-ho scratched his head and asked.

"Kang-ho! I won first place in the first semester investment competition.

“If you had just diversified your investments across 700 companies, why would you need safe assets?”

--- p.129

As each friend picked a person, some cheered and some made a fuss.

“Wow! I have a whopping 100 million won in deposit money to use!”

“I only have 50 million won.

“Will this help me find the studio apartment I want?”

"Okay! Then, let's each try to find a studio apartment within our budget."

Kang-ho looked at Dong-hyeon and Hyeon-ji with envious eyes.

“Wow~ I really envy you guys.

“You have a bigger budget than me, so you can probably get a better room.”

"Hey, what difference could there be? Then let's find our own studio apartment!"

When I went to the site the teacher told me about, there were a lot of listings.

Kang-ho and his friends were looking for a studio apartment with high hopes, but Dong-hyeon and Hyun-ji's expressions suddenly turned sour.

"Huh...? This is all I can get for this amount of money? This is so far from the studio apartment I've always dreamed of."

The truth is that as teachers and all of you get older, you will eventually stop working and 'retire' from your jobs.

So, in that case, we should prepare for retirement when we can no longer earn money through work, right?

Many financial experts say that it's essential to know "safe investment methods" to prepare for retirement.

When you're young, you have time to recover by working if you lose money in an investment, but when you're older, if you lose money in a risky investment, you don't have much time to recover!

So, in the second half of my life, I plan to study ways to make "safe investments" through various experiments and games.

Now, shall we begin the 'second half of the game of life' for the second time in life?

--- p.5

“I’m sorry, but joining the National Pension is not optional, it’s mandatory!”

“Ugh, no~”

Naeun and some of her friends shouted.

In the life games he had played with his teacher so far, there were always many cases where he had to make 'choices' and take 'responsibility' for them, but Kang-ho was surprised that when it came to 'pension', it was not a choice but an 'obligation'.

"Paying an extra 30,000 won a week isn't that burdensome, is it? I wonder if I'll regret signing up for the National Pension when I retire in December! Well, that's all for today's lesson!"

--- p.24

“Hey, hurry up! Let’s go get the dollars and gold!”

“I’m doing my best too.

“Don’t rush me too much.”

While his friends were frantically making their names with consonant and vowel cards, Dong-Hyeon, who was helping the teacher put gold on the blackboard and exchange dollars for gold, spoke with a very embarrassed expression.

“Uh… Teacher… But… All the gold I prepared is gone?”

Then the teacher smiled and shouted as if he had been waiting for it.

“Stop the trade game!”

The friends who were absorbed in the game looked at the teacher with bewildered expressions at the sudden announcement of the suspension.

“Unfortunately, all the gold we had prepared has run out.

From now on, even if you bring dollars, we can't exchange them for gold."

--- p.35

“Um… I was so scared that I would have sold all my Korean stocks and run away, even if it meant losing money.”

The teacher said, looking at the frightened Naeun.

“When the stock market actually starts to crash, people get really scared.

And as Naeun said, he got scared and sold the stocks he had.

“This is called a ‘panic cell.’”

“They say everyone’s heart is the same, but I’m not the only one who thinks that way!”

--- p.51

“The teacher only gave me 200,000 won, but each share was so expensive.

So I couldn't diversify my investments across different stocks."

“Naver went up the most, but Naver was worth 250,000 won per share, so I couldn’t even buy one share.”

“Yeah, that’s right.

“The discomfort you feel has been felt by adults for a long time.”

The teacher continued speaking with a smile, as if he had anticipated the children's complaints.

“Okay, now let’s open the box of cookies and pour all the cookies inside onto the desk.”

--- p.68

“Dong-Hyeon, how many types of stocks can you put in one ETF basket?”

“Well… there’s a limit to the number of items you can put in a supermarket shopping cart, so wouldn’t putting in about 30 be too much?”

“No, that’s not true.

“It can hold thousands of stock pieces.”

The teacher, who was listening to Kang-ho and Dong-hyeon's conversation, answered from the side.

“Wow~”

My friends were amazed that they could diversify their investments across thousands of stocks by purchasing just one basket called an ETF.

"Ah! I get it. There's an investment adage, 'Don't put all your eggs in one basket.' So ETFs are a product that helps you diversify your investments by allowing you to spread your eggs across multiple baskets, making for a safer investment."

--- p.71

“Grandfather Warren Buffett began investing in Coca-Cola in earnest in 1988.

In 1988, if you bought one share of Coca-Cola, it would give you about $0.03.03 in dividends per year.”

“$0.03?”

“Hey, isn’t $0.03 too little, let alone $1?”

“It doesn’t seem like much, does it? But Grandpa Buffett has been steadily buying Coca-Cola stock.

And now, he says he's collected '400 million' Coca-Cola shares." "Wow! 400 million?"

“To be exact, it would be correct to say ‘400 million shares’, right?”

"Does Grandpa Buffett find Coca-Cola so delicious? Why did he buy so much Coca-Cola stock?"

“Wow, he owns 400 million shares of dividend stocks, so Grandpa Buffett must have made a fortune from dividends!”

As the children were whispering among themselves, Hyunji retorted.

--- p.86

"Guys, if everyone's just attacking, who's going to pass the ball from the middle? And who's going to defend? Excluding the goalkeeper, if all ten of us attack together and then all run back to defend, it's just too inefficient."

Dong-Hyeon's words made his friends recall the last game against Class 3.

This is because everyone wanted to score, so they became attackers and rushed around looking at the ball without properly distributing roles, and ended up losing 3-0.

“Let’s not do that, let’s divide the roles this time.

You know what your formation is, right? For example, a 4-3-3 formation has four defenders, three midfielders, and three attackers.

“Then let’s start with a 4-3-3 formation.

Who wants to be the three attackers?

--- p.100

“The name of the portfolio I created is ‘Korea-US Alliance.’”

“ROK-US alliance?”

“We will invest half in 200 companies representing our country and half in 500 companies representing the United States!”

Naeun spoke proudly.

Naeun, who originally planned to invest only in the United States, added Korean stocks to her portfolio after hearing the teacher's explanation.

"Huh? But Naeun's portfolio doesn't have any safe assets."

Kang-ho scratched his head and asked.

"Kang-ho! I won first place in the first semester investment competition.

“If you had just diversified your investments across 700 companies, why would you need safe assets?”

--- p.129

As each friend picked a person, some cheered and some made a fuss.

“Wow! I have a whopping 100 million won in deposit money to use!”

“I only have 50 million won.

“Will this help me find the studio apartment I want?”

"Okay! Then, let's each try to find a studio apartment within our budget."

Kang-ho looked at Dong-hyeon and Hyeon-ji with envious eyes.

“Wow~ I really envy you guys.

“You have a bigger budget than me, so you can probably get a better room.”

"Hey, what difference could there be? Then let's find our own studio apartment!"

When I went to the site the teacher told me about, there were a lot of listings.

Kang-ho and his friends were looking for a studio apartment with high hopes, but Dong-hyeon and Hyun-ji's expressions suddenly turned sour.

"Huh...? This is all I can get for this amount of money? This is so far from the studio apartment I've always dreamed of."

--- p.158

Publisher's Review

"The financial education children truly need is now available."

From actual ETF structures and diversified investments to studio apartment contracts and national pensions…

The hottest 'real survival finance' training you've ever seen!

Investment, stocks, real estate, pensions...

How can we teach elementary school students about financial issues that even adults find difficult? This class, which breaks away from rigid, theory-based financial education and allows students to engage directly through hands-on experience, vividly illustrates the process of students growing into economic agents through a unique nine-month journey through time.

In "Thirteen Year Old Life Game 2," children who are now 33 years old learn about ETF structure and diversified investment through simulated investments that reflect actual stock price and exchange rate trends. They also learn the role of safe assets like the dollar and gold, the time magic of dividends and compound interest, and how to manage risk through interest rate scenarios.

This process transforms economic concepts from "knowing" to "practicing," and helps children develop financial acumen to safely manage risk in a world where "doing is risky, not doing is risky."

Studying economics and finance is just as important as studying Korean, English, and math!

From youth, middle age, and retirement

Learn the essential 'lifelong financial knowledge' through life-cycle quests!

The [Thirteen Year Old Life Game] series began with the desperation of an elementary school teacher who, despite receiving a top grade in economics on the college entrance exam, was only able to understand the real-world financial system after entering society.

Realizing that the economic theories learned in school were of no help in managing real-world assets, he pondered, "Isn't there a way for children to develop financial literacy to the point where they can become 'little rich' slowly, without going through trial and error?" and came up with a financial class called "Retirement Preparation at 13."

This financial class, which allows students to live a microcosm of their lives for a year and encourages them to make wise choices at each turning point in their lives, is receiving enthusiastic responses from both children and parents, sparking a new boom in financial education.

In fact, children and parents who have experienced this class over the past six years unanimously call it a "living financial textbook" and "the best economics introduction to prepare for life."

“If you could live in the future first, what would you change now?”

Advanced financial concepts such as asset management, pensions, and inflation protection

A novel worldview melted down to elementary school level

In an uncertain future where the concept of lifetime employment is disappearing and AI technology is rapidly advancing, what our children really need is not simply "money-making skills," but the ability to make wise economic choices for the future.

To this end, the author designed [The Thirteen-Year-Old Life Game] to help children develop the financial behaviors and attitudes necessary in real life by reconstructing advanced financial concepts such as asset management, retirement planning, and inflation defense, which are the core goals of advanced financial education, at an elementary school level, and allowing them to acquire them naturally.

From a young age, these experiences foster a healthy attitude toward money and life, and develop wise financial judgment.

That is the true goal of financial education and the true meaning of 'retirement planning' that this class talks about.

GOODS SPECIFICS

- Date of issue: October 2, 2025

- Page count, weight, size: 220 pages | 382g | 152*225*20mm

- ISBN13: 9791194451204

- ISBN10: 1194451209

- KC Certification: Certification Type: Conformity Confirmation

You may also like

카테고리

korean

korean

![ELLE 엘르 스페셜 에디션 A형 : 12월 [2025]](http://librairie.coreenne.fr/cdn/shop/files/b8e27a3de6c9538896439686c6b0e8fb.jpg?v=1766436872&width=3840)