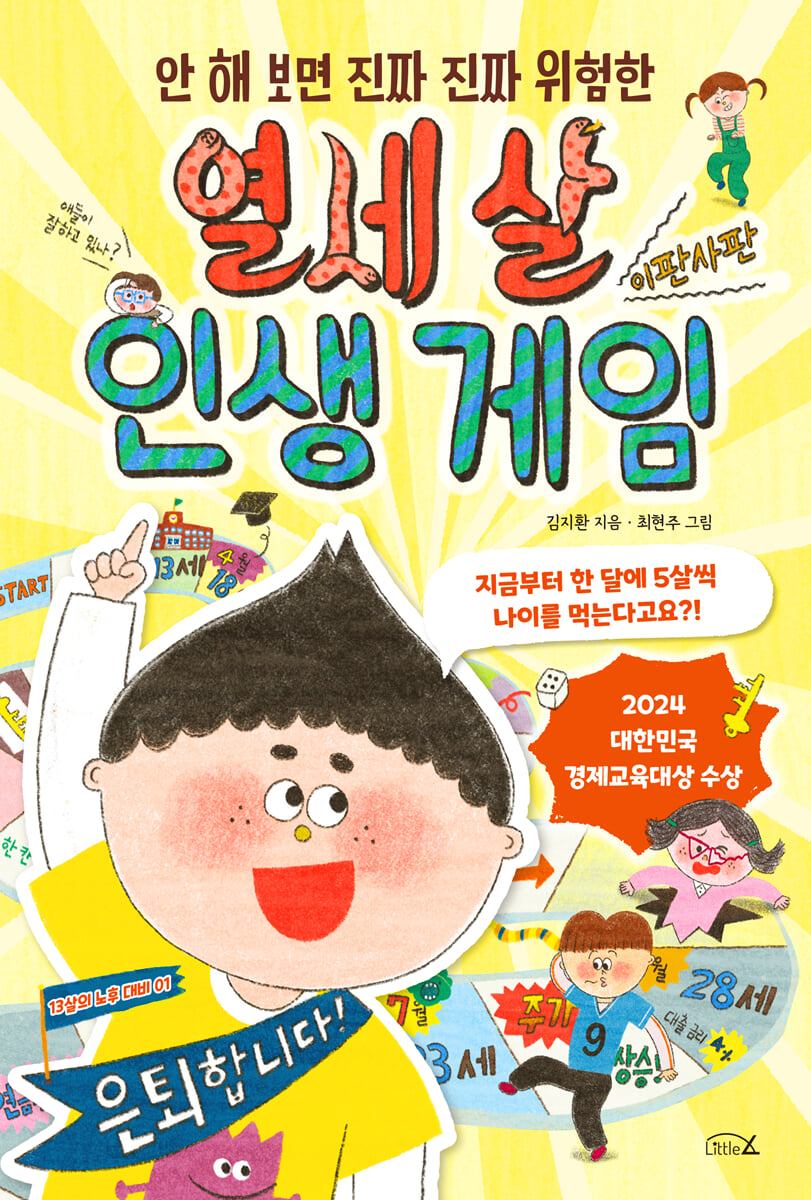

Thirteen-Year-Old Life Game

|

Description

Book Introduction

“I’m getting five years older every month.

“What if there was a classroom where you could live life in advance?”

In just one year, from 13 to 58 years old

Life simulation unfolds in an elementary school classroom! "The Thirteen-Year-Old Life Game" is now available.

The "13-Year-Old's Retirement Preparation" program, which has garnered attention as a new and innovative content in the financial education field, has been published as "The 13-Year-Old's Life Game." This course, which received attention from EBS's In-Depth Planning and major economic media outlets, has already been recognized for its educational value, winning the Republic of Korea Economic Education Award and the Financial Supervisory Service Governor's Award.

"The Thirteen-Year-Old Life Game" is a fun story about a special financial education experiment that takes place in an actual sixth-grade elementary school classroom.

Children experience various financial choices in life in a virtual reality where they age five years each month, and through the consequences of their choices over the course of a year, they naturally come to understand the importance of money, planned spending, and preparing for the future.

“What if there was a classroom where you could live life in advance?”

In just one year, from 13 to 58 years old

Life simulation unfolds in an elementary school classroom! "The Thirteen-Year-Old Life Game" is now available.

The "13-Year-Old's Retirement Preparation" program, which has garnered attention as a new and innovative content in the financial education field, has been published as "The 13-Year-Old's Life Game." This course, which received attention from EBS's In-Depth Planning and major economic media outlets, has already been recognized for its educational value, winning the Republic of Korea Economic Education Award and the Financial Supervisory Service Governor's Award.

"The Thirteen-Year-Old Life Game" is a fun story about a special financial education experiment that takes place in an actual sixth-grade elementary school classroom.

Children experience various financial choices in life in a virtual reality where they age five years each month, and through the consequences of their choices over the course of a year, they naturally come to understand the importance of money, planned spending, and preparing for the future.

- You can preview some of the book's contents.

Preview

index

Enter▷The first half of the game begins!

Introducing the Contestants of "The Game of Life"

Chapter 1.

My class is 13 years old, the game of life begins!

Would you like to live life in advance by growing 5 years older each month?

Life Game Golden Card ▷ What does the bank do?

Chapter 2.

The greatest investment in the world

There's a magic investment notebook that finds the best investments?!

Life Game Golden Card ▷ How do banks make money?

Chapter 3.

Money that goes out just by breathing

Did you take a deep breath last month?

Life Game Golden Card ▷ It's important to reduce fixed expenses!

Chapter 4.

Kang Ho, the Spending Fairy, Splits His Bankbook into Four

As I was splitting my bankbook, a four-tiered waterfall came to mind!

Life Game Golden Card① ▷ You can split your bankbook even further!

Life Game Golden Card② ▷ I want to know more about the 'action device'!

Chapter 5.

My class is 18 years old, and I got drafted into the military!

Oh, there's a country where you have to draw lots to join the military?!

Life Game Golden Card ▷ Which bank should I deposit my money in?

Chapter 6.

My first investment with friends

I'm the investment king. Raise your hand if you want to invest with me!

Life Game Golden Card ▷ Why Should You Care About Investing?

Chapter 7.

My class is 23 years old, let's go to college!

Should I go to college or just become a CEO?

Life Game Golden Card ▷ What is the return?

Chapter 8.

Our classmates who cry and laugh at interest rates

Deposit interest vs.

Loan Interest, Who Wins? ▷ Roll the Interest Rate Dice!

Life Game Golden Card ▷ Are interest rates important to adults too?

Chapter 9.

Midterm review, roller coaster investment

What the hell happened to that company?!

Life Game Golden Card ▷ Can you manipulate performance and stock prices?

Chapter 10.

Our class is 28 years old, and the economic community is born!

From today on, you are on my side!

Life Game Golden Card ▷ Rise and Fall Rates

Chapter 11.

Investing is not easy.

Drumroll, drumroll, drumroll, who is the main character of 'Jjajangmyeon Date'?

Life Game Golden Card ▷ Beware of bias when investing!

Going Out▷ Real Survival Financial Education: "Preparing for Retirement at 13"

Appendix ▷ Curriculum Linkage Table

Introducing the Contestants of "The Game of Life"

Chapter 1.

My class is 13 years old, the game of life begins!

Would you like to live life in advance by growing 5 years older each month?

Life Game Golden Card ▷ What does the bank do?

Chapter 2.

The greatest investment in the world

There's a magic investment notebook that finds the best investments?!

Life Game Golden Card ▷ How do banks make money?

Chapter 3.

Money that goes out just by breathing

Did you take a deep breath last month?

Life Game Golden Card ▷ It's important to reduce fixed expenses!

Chapter 4.

Kang Ho, the Spending Fairy, Splits His Bankbook into Four

As I was splitting my bankbook, a four-tiered waterfall came to mind!

Life Game Golden Card① ▷ You can split your bankbook even further!

Life Game Golden Card② ▷ I want to know more about the 'action device'!

Chapter 5.

My class is 18 years old, and I got drafted into the military!

Oh, there's a country where you have to draw lots to join the military?!

Life Game Golden Card ▷ Which bank should I deposit my money in?

Chapter 6.

My first investment with friends

I'm the investment king. Raise your hand if you want to invest with me!

Life Game Golden Card ▷ Why Should You Care About Investing?

Chapter 7.

My class is 23 years old, let's go to college!

Should I go to college or just become a CEO?

Life Game Golden Card ▷ What is the return?

Chapter 8.

Our classmates who cry and laugh at interest rates

Deposit interest vs.

Loan Interest, Who Wins? ▷ Roll the Interest Rate Dice!

Life Game Golden Card ▷ Are interest rates important to adults too?

Chapter 9.

Midterm review, roller coaster investment

What the hell happened to that company?!

Life Game Golden Card ▷ Can you manipulate performance and stock prices?

Chapter 10.

Our class is 28 years old, and the economic community is born!

From today on, you are on my side!

Life Game Golden Card ▷ Rise and Fall Rates

Chapter 11.

Investing is not easy.

Drumroll, drumroll, drumroll, who is the main character of 'Jjajangmyeon Date'?

Life Game Golden Card ▷ Beware of bias when investing!

Going Out▷ Real Survival Financial Education: "Preparing for Retirement at 13"

Appendix ▷ Curriculum Linkage Table

Detailed image

Into the book

The children held their breath and focused on the teacher's words.

“From the month I retire until I graduate, I will be living in the classroom with the money I have saved.”

“Teacher, what if I don’t have enough money saved?”

Kang-ho asked with a worried look in his eyes.

"Um... the end of elementary school might be a little painful, right? For example, staying with the teacher to clean up after themselves?"

--- p.22

“If you could invest in only one stock among the many in the world, which one would you choose?”

Then Warren Buffett laughed out loud.

“Hahaha! That’s an interesting question.

Are you asking me to recommend which company's stocks to invest in? If you're asking where I should invest, I'd say this.

“The best investment you can make at your age is an investment in yourself.”

--- p.31

The next morning, all the children were diligently writing something down in their investment notebooks.

“I made a presentation yesterday, so I earned ten thousand won. Now all I have to do is read the book!”

“I wrote ‘Pluck out my dad’s gray hair’ as my happiness goal.

“When I told my dad that I could earn money at school if I plucked out my gray hair, he laughed, haha!”

“My growth goal is to get to school by 8 o’clock. I’m always late, so I’m going to try to fix that this time.”

--- p.38

“I remember when I received my first paycheck.

“For the first time, a large sum of money was deposited into my bank account, but I was at a loss as to how to manage it.”

“So what did you do?”

“What should I do… I just wrote it down and ended up going to the military!”

The children laughed out loud.

“But after I learned ‘this method,’ I became better at managing my money.”

Kang-ho was curious about what the 'method' the teacher was talking about.

“Before that, can we all just close our eyes for a moment?”

--- p.53

“Just as computer games and smartphones are so fun that it’s hard to control the time, spending is also so sweet that it’s hard to control.

So, there are people who end up spending more than they earn, and end up ruining their lives because they can't control their spending."

Friends recalled how they had never been able to control their gaming time, and thought that it would be difficult to manage their spending appropriately even as adults.

"So, now let's learn the money management method you've been wondering about. The money management method I'm about to teach you is called 'splitting your bank account.'"

--- p.56

“I get my salary… I subtract fixed expenses… and then I save…

Then when exactly can I consume?”

"You want to spend it quickly, right? It's almost here, so just hold on a little longer, haha."

"There's still more left?" Kang-ho and his fairy friends sighed at their teacher's words.

“What comes to mind when you hear the word ‘investment’?”

“It’s a coin!”

“It’s a once-in-a-lifetime opportunity!”

“No, if you do that, your life could end in ruins!”

Kang-ho was excited by the word investment, but at the same time he was scared.

Because I felt that if I succeeded, I could make a lot of money, but if I did it wrong, I could lose money.

It felt like gambling somehow.

"Those are the words that come to mind when you think of investing. It would be interesting to see how your thoughts on investing change through the game of life."

--- p.61

“From now on, all answers will be unified as ‘evil.’

Do you understand?

Kang-ho and his classmates were so shocked that they couldn't close their mouths.

Although it was only a short 13-year life, I had never even imagined a scene where a teacher would enter the classroom wearing a military uniform throughout my kindergarten and elementary school years.

“It is April now.

“Then how old are our class members?”

“I’m eighteen!”

“'Yo'? In the military, all answers end with 'Danaka.'

Do you understand?

--- p.74

All my friends cheered.

It was partly because I was relieved that I didn't get caught, but for some reason, it was funny that another friend got caught.

“Congratulations, Kangho!”

“Hey, you should have volunteered like me~”

“What should I do, Kang-ho!”

Kang-ho couldn't believe this moment.

‘I was trying to save a lot of money so I could be happy in the classroom…

Of all people, I got drafted in the military first!'

“Okay, next number is 12!”

“Wow! Who is number 12?”

--- p.77

“Obviously, investing can be risky.

But if you live your whole life without investing because it's risky, that too can be risky.

There are cases where people who have never invested in their lives lose all their money after investing without thinking based on someone's advice.

So, I guess it's necessary to invest yourself and develop an eye for discerning what's risky?"

“It’s dangerous to do it, and it’s dangerous not to do it?”

“Then what do you want us to do?”

My friends shouted as if they couldn't understand.

“So, what I mean is, let’s learn how to invest safely by gradually gaining investment experience from a young age.

Don't be so impatient.

Okay? Let me tell you a quick story first.”

“From the month I retire until I graduate, I will be living in the classroom with the money I have saved.”

“Teacher, what if I don’t have enough money saved?”

Kang-ho asked with a worried look in his eyes.

"Um... the end of elementary school might be a little painful, right? For example, staying with the teacher to clean up after themselves?"

--- p.22

“If you could invest in only one stock among the many in the world, which one would you choose?”

Then Warren Buffett laughed out loud.

“Hahaha! That’s an interesting question.

Are you asking me to recommend which company's stocks to invest in? If you're asking where I should invest, I'd say this.

“The best investment you can make at your age is an investment in yourself.”

--- p.31

The next morning, all the children were diligently writing something down in their investment notebooks.

“I made a presentation yesterday, so I earned ten thousand won. Now all I have to do is read the book!”

“I wrote ‘Pluck out my dad’s gray hair’ as my happiness goal.

“When I told my dad that I could earn money at school if I plucked out my gray hair, he laughed, haha!”

“My growth goal is to get to school by 8 o’clock. I’m always late, so I’m going to try to fix that this time.”

--- p.38

“I remember when I received my first paycheck.

“For the first time, a large sum of money was deposited into my bank account, but I was at a loss as to how to manage it.”

“So what did you do?”

“What should I do… I just wrote it down and ended up going to the military!”

The children laughed out loud.

“But after I learned ‘this method,’ I became better at managing my money.”

Kang-ho was curious about what the 'method' the teacher was talking about.

“Before that, can we all just close our eyes for a moment?”

--- p.53

“Just as computer games and smartphones are so fun that it’s hard to control the time, spending is also so sweet that it’s hard to control.

So, there are people who end up spending more than they earn, and end up ruining their lives because they can't control their spending."

Friends recalled how they had never been able to control their gaming time, and thought that it would be difficult to manage their spending appropriately even as adults.

"So, now let's learn the money management method you've been wondering about. The money management method I'm about to teach you is called 'splitting your bank account.'"

--- p.56

“I get my salary… I subtract fixed expenses… and then I save…

Then when exactly can I consume?”

"You want to spend it quickly, right? It's almost here, so just hold on a little longer, haha."

"There's still more left?" Kang-ho and his fairy friends sighed at their teacher's words.

“What comes to mind when you hear the word ‘investment’?”

“It’s a coin!”

“It’s a once-in-a-lifetime opportunity!”

“No, if you do that, your life could end in ruins!”

Kang-ho was excited by the word investment, but at the same time he was scared.

Because I felt that if I succeeded, I could make a lot of money, but if I did it wrong, I could lose money.

It felt like gambling somehow.

"Those are the words that come to mind when you think of investing. It would be interesting to see how your thoughts on investing change through the game of life."

--- p.61

“From now on, all answers will be unified as ‘evil.’

Do you understand?

Kang-ho and his classmates were so shocked that they couldn't close their mouths.

Although it was only a short 13-year life, I had never even imagined a scene where a teacher would enter the classroom wearing a military uniform throughout my kindergarten and elementary school years.

“It is April now.

“Then how old are our class members?”

“I’m eighteen!”

“'Yo'? In the military, all answers end with 'Danaka.'

Do you understand?

--- p.74

All my friends cheered.

It was partly because I was relieved that I didn't get caught, but for some reason, it was funny that another friend got caught.

“Congratulations, Kangho!”

“Hey, you should have volunteered like me~”

“What should I do, Kang-ho!”

Kang-ho couldn't believe this moment.

‘I was trying to save a lot of money so I could be happy in the classroom…

Of all people, I got drafted in the military first!'

“Okay, next number is 12!”

“Wow! Who is number 12?”

--- p.77

“Obviously, investing can be risky.

But if you live your whole life without investing because it's risky, that too can be risky.

There are cases where people who have never invested in their lives lose all their money after investing without thinking based on someone's advice.

So, I guess it's necessary to invest yourself and develop an eye for discerning what's risky?"

“It’s dangerous to do it, and it’s dangerous not to do it?”

“Then what do you want us to do?”

My friends shouted as if they couldn't understand.

“So, what I mean is, let’s learn how to invest safely by gradually gaining investment experience from a young age.

Don't be so impatient.

Okay? Let me tell you a quick story first.”

--- p.88

Publisher's Review

2024 Korea Economic Education Award · Financial Supervisory Service Governor Award

EBS In-Depth Planning · Chosun Biz's Focus

The hottest 'real survival finance' training you've ever seen!

Investment, stocks, real estate, pensions...

How can we teach elementary school students about financial issues that even adults find difficult? This class, which breaks away from rigid, theory-based financial education and allows students to engage directly through hands-on experience, vividly illustrates the process of students growing into economic agents through a unique nine-month journey through time.

The financial class "Preparing for Old Age at Age 13," which has already garnered keen attention from the education community and the media, is being evaluated as an innovative attempt that breaks the mold of existing financial education.

This educational program, which presents a new paradigm of "real survival finance" essential to living, was recognized for its originality and practicality, winning the 2021 Financial Supervisory Service Governor's Award and the 2024 Republic of Korea Economic Education Award. Its effectiveness and buzz were proven through EBS in-depth reporting and Chosun Biz reporting.

From youth, middle age, and retirement

Learn essential financial knowledge through life cycle quests!

Beyond learning with your head, the 'game of life' is felt with your body.

"The Thirteen-Year-Old's Life Game" began with the desperation of an elementary school teacher who, despite receiving a top grade in economics on the college entrance exam, was only able to understand the real-world financial system after entering society.

Realizing that the economic theories learned in school were of no help in managing real-world assets, he pondered, "Isn't there a way for children to develop financial literacy to the point where they can become 'little rich' slowly, without going through trial and error?" and came up with a financial class called "Retirement Preparation at 13."

This financial class, which allows students to live a microcosm of their lives for a year and encourages them to make wise choices at each turning point in their lives, is receiving enthusiastic responses from both children and parents, sparking a new boom in financial education.

"What kind of retirement planning are sixth graders doing?"

Advanced financial concepts such as asset management, pensions, and inflation protection

A novel worldview melted down to elementary school level

In an uncertain future where the concept of lifetime employment is disappearing and AI technology is rapidly advancing, what our children really need is not simply "money-making skills," but the ability to make wise economic choices for the future.

To this end, the author designed "The Thirteen-Year-Old Life Game" to help children develop the financial behaviors and attitudes necessary in real life by reconstructing advanced financial concepts such as asset management, retirement planning, and inflation defense, which are the core goals of advanced financial education, at an elementary school level, and allowing them to acquire them naturally.

From a young age, these experiences foster a healthy attitude toward money and life, and develop wise financial judgment.

That is the true goal of financial education and the true meaning of 'retirement planning' that this class talks about.

This book is an experiential learning book that vividly tells the story of children's most enjoyable experiences and enlightening activities, based on years of accumulated teaching experience.

Even children who cannot experience the game of life firsthand are encouraged to participate by asking various questions and using the lure of a golden card to make them feel like they are playing the game themselves.

EBS In-Depth Planning · Chosun Biz's Focus

The hottest 'real survival finance' training you've ever seen!

Investment, stocks, real estate, pensions...

How can we teach elementary school students about financial issues that even adults find difficult? This class, which breaks away from rigid, theory-based financial education and allows students to engage directly through hands-on experience, vividly illustrates the process of students growing into economic agents through a unique nine-month journey through time.

The financial class "Preparing for Old Age at Age 13," which has already garnered keen attention from the education community and the media, is being evaluated as an innovative attempt that breaks the mold of existing financial education.

This educational program, which presents a new paradigm of "real survival finance" essential to living, was recognized for its originality and practicality, winning the 2021 Financial Supervisory Service Governor's Award and the 2024 Republic of Korea Economic Education Award. Its effectiveness and buzz were proven through EBS in-depth reporting and Chosun Biz reporting.

From youth, middle age, and retirement

Learn essential financial knowledge through life cycle quests!

Beyond learning with your head, the 'game of life' is felt with your body.

"The Thirteen-Year-Old's Life Game" began with the desperation of an elementary school teacher who, despite receiving a top grade in economics on the college entrance exam, was only able to understand the real-world financial system after entering society.

Realizing that the economic theories learned in school were of no help in managing real-world assets, he pondered, "Isn't there a way for children to develop financial literacy to the point where they can become 'little rich' slowly, without going through trial and error?" and came up with a financial class called "Retirement Preparation at 13."

This financial class, which allows students to live a microcosm of their lives for a year and encourages them to make wise choices at each turning point in their lives, is receiving enthusiastic responses from both children and parents, sparking a new boom in financial education.

"What kind of retirement planning are sixth graders doing?"

Advanced financial concepts such as asset management, pensions, and inflation protection

A novel worldview melted down to elementary school level

In an uncertain future where the concept of lifetime employment is disappearing and AI technology is rapidly advancing, what our children really need is not simply "money-making skills," but the ability to make wise economic choices for the future.

To this end, the author designed "The Thirteen-Year-Old Life Game" to help children develop the financial behaviors and attitudes necessary in real life by reconstructing advanced financial concepts such as asset management, retirement planning, and inflation defense, which are the core goals of advanced financial education, at an elementary school level, and allowing them to acquire them naturally.

From a young age, these experiences foster a healthy attitude toward money and life, and develop wise financial judgment.

That is the true goal of financial education and the true meaning of 'retirement planning' that this class talks about.

This book is an experiential learning book that vividly tells the story of children's most enjoyable experiences and enlightening activities, based on years of accumulated teaching experience.

Even children who cannot experience the game of life firsthand are encouraged to participate by asking various questions and using the lure of a golden card to make them feel like they are playing the game themselves.

GOODS SPECIFICS

- Date of issue: March 25, 2025

- Page count, weight, size: 200 pages | 382g | 152*225*12mm

- ISBN13: 9791194451112

- ISBN10: 119445111X

- KC Certification: Certification Type: Conformity Confirmation

You may also like

카테고리

korean

korean

![ELLE 엘르 스페셜 에디션 A형 : 12월 [2025]](http://librairie.coreenne.fr/cdn/shop/files/b8e27a3de6c9538896439686c6b0e8fb.jpg?v=1766436872&width=3840)