A special financial economics class from a high school teacher

|

Description

Book Introduction

This is an era where financial and economic education is essential!

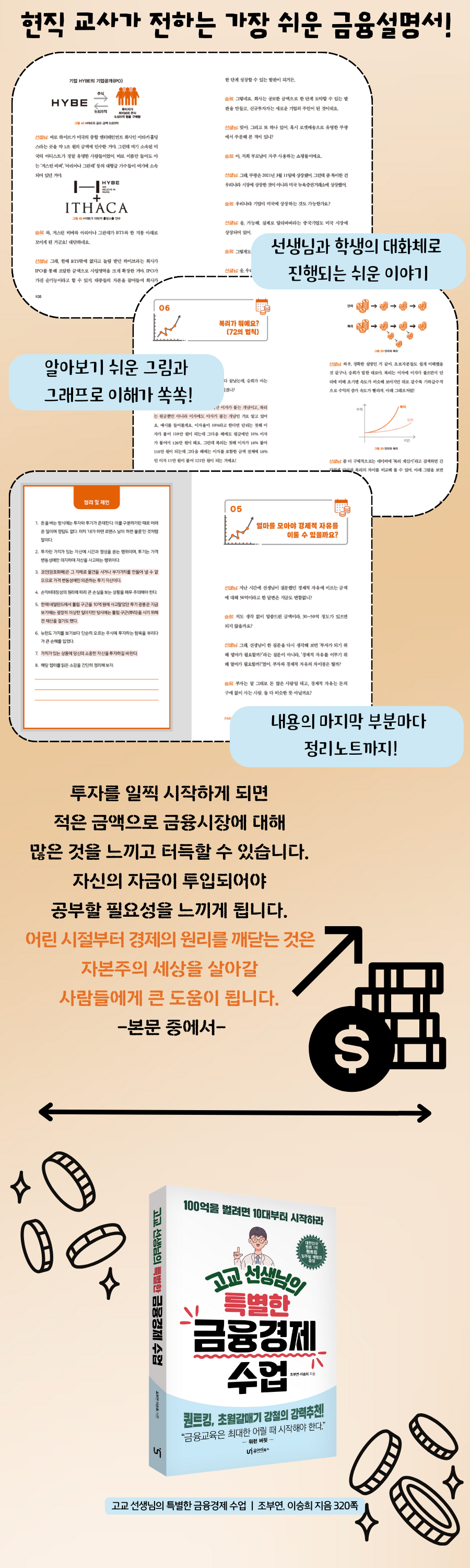

Fundamentals of investment and financial knowledge explained easily by a practicing teacher.

South Korea, one of the world's top 10 economies, ranks 77th in financial literacy.

This is where the consequences of not teaching capitalism are revealed, even though it is a capitalist country.

This is why the need for financial education and asset management is increasing.

As Warren Buffett said, the earlier you start learning about investing, the better. If you gain financial knowledge before you become an adult, you'll be able to navigate capitalist society more wisely.

"A High School Teacher's Special Financial Economics Class" contains the teacher's easy-to-understand explanations of all financial information.

From basic to complex vocabulary, detailed explanations are provided, and the text and chapter summary written as if in a conversation with students help students learn concepts.

The financial knowledge you gain from reading the conversation will help you grow financially and plan a stable life.

Fundamentals of investment and financial knowledge explained easily by a practicing teacher.

South Korea, one of the world's top 10 economies, ranks 77th in financial literacy.

This is where the consequences of not teaching capitalism are revealed, even though it is a capitalist country.

This is why the need for financial education and asset management is increasing.

As Warren Buffett said, the earlier you start learning about investing, the better. If you gain financial knowledge before you become an adult, you'll be able to navigate capitalist society more wisely.

"A High School Teacher's Special Financial Economics Class" contains the teacher's easy-to-understand explanations of all financial information.

From basic to complex vocabulary, detailed explanations are provided, and the text and chapter summary written as if in a conversation with students help students learn concepts.

The financial knowledge you gain from reading the conversation will help you grow financially and plan a stable life.

- You can preview some of the book's contents.

Preview

index

Recommendation 4

Preface 6

PART 1: Should I Invest?

01 Is investing really necessary? 17

02 Adults say you shouldn't invest in stocks? 33

03 Isn't stock investing about making money over the long term? 46

04 Is buying cryptocurrency an investment? 58

05 How much do I need to save to achieve financial freedom? 72

06 What is compound interest? (Rule of 72) 81

PART 2 What on earth are stocks?

01 What on earth are stocks? 93

02 What's good for businesses? 103

03 Why do stock prices rise and fall? 114

PART 3 Which stocks should I buy?

01 Which building would you like to buy? 127

02 How do you know if a stock is cheap or expensive? 134

03 When should I buy and sell stocks? 143

04 How many people make money through stock investing? 153

05 Can I entrust my stock investments to someone else? 157

PART 4: Introduction to the Investment Techniques of Great Stock Investors

01 Warren Buffett of Korea, Sukhyang 175

02 Kang Hwan-guk, who spread the word about quantitative investing, 186

03 Legendary Fund Manager Peter Lynch 205

04 Great Value Investor Warren Buffett 216

05 Benjamin Graham, the Father of Value Investing 226

06 David Dreman, the Master of Contrarian Investing 234

07 Dividend Growth Stock Investment 243

PART 5: A final word of advice

01 Realistic Ways to Create Seed Money 261

02 Words of Advice 266

03 Must-Read Investment Books 269

PART 6 Stock Investment Q&A

01 I'm curious about the teacher's stock investment returns! 277

02 What are some quantitative investment platforms? 279

03 How much does QuantKing cost? 281

04 What elements should be utilized to create good logic in quantitative investing? 282

05 As the number of quantitative investors increases, doesn't excess returns decrease? 285

06 Can quantitative investing always yield excess returns? 287

07 Don't you look at charts when investing? 289

08 Do you also invest in foreign stocks, teacher? 291

09 Do your children also invest in stocks? 292

I'm scared to start investing in stocks. Is there another way? 294

11. Investing in stocks isn't necessary, right? 296

12 How do I invest in bonds? 297

Wouldn't it be better to invest in real estate rather than stocks? 299

14 What if the price of the stock I bought goes down? 301

Should I sell when the stock price hits the upper limit? 303

16 Have you ever regretted investing in stocks? 305

17. Are there any stock investment scenarios for a future recession, interest rate hike, or stagflation?

18 I wonder if I should continue investing in domestic stocks when our country's population is declining.

309

19. If I'm just starting out with stock investing, how much should I invest? 311

I want to open a stock account for a minor. How do I do that? 313

21 Is there a reason you should start investing early? 315

Should I invest in a company with a high current dividend, or a company that raises its dividend every year, even if it's currently low?

Preface 6

PART 1: Should I Invest?

01 Is investing really necessary? 17

02 Adults say you shouldn't invest in stocks? 33

03 Isn't stock investing about making money over the long term? 46

04 Is buying cryptocurrency an investment? 58

05 How much do I need to save to achieve financial freedom? 72

06 What is compound interest? (Rule of 72) 81

PART 2 What on earth are stocks?

01 What on earth are stocks? 93

02 What's good for businesses? 103

03 Why do stock prices rise and fall? 114

PART 3 Which stocks should I buy?

01 Which building would you like to buy? 127

02 How do you know if a stock is cheap or expensive? 134

03 When should I buy and sell stocks? 143

04 How many people make money through stock investing? 153

05 Can I entrust my stock investments to someone else? 157

PART 4: Introduction to the Investment Techniques of Great Stock Investors

01 Warren Buffett of Korea, Sukhyang 175

02 Kang Hwan-guk, who spread the word about quantitative investing, 186

03 Legendary Fund Manager Peter Lynch 205

04 Great Value Investor Warren Buffett 216

05 Benjamin Graham, the Father of Value Investing 226

06 David Dreman, the Master of Contrarian Investing 234

07 Dividend Growth Stock Investment 243

PART 5: A final word of advice

01 Realistic Ways to Create Seed Money 261

02 Words of Advice 266

03 Must-Read Investment Books 269

PART 6 Stock Investment Q&A

01 I'm curious about the teacher's stock investment returns! 277

02 What are some quantitative investment platforms? 279

03 How much does QuantKing cost? 281

04 What elements should be utilized to create good logic in quantitative investing? 282

05 As the number of quantitative investors increases, doesn't excess returns decrease? 285

06 Can quantitative investing always yield excess returns? 287

07 Don't you look at charts when investing? 289

08 Do you also invest in foreign stocks, teacher? 291

09 Do your children also invest in stocks? 292

I'm scared to start investing in stocks. Is there another way? 294

11. Investing in stocks isn't necessary, right? 296

12 How do I invest in bonds? 297

Wouldn't it be better to invest in real estate rather than stocks? 299

14 What if the price of the stock I bought goes down? 301

Should I sell when the stock price hits the upper limit? 303

16 Have you ever regretted investing in stocks? 305

17. Are there any stock investment scenarios for a future recession, interest rate hike, or stagflation?

18 I wonder if I should continue investing in domestic stocks when our country's population is declining.

309

19. If I'm just starting out with stock investing, how much should I invest? 311

I want to open a stock account for a minor. How do I do that? 313

21 Is there a reason you should start investing early? 315

Should I invest in a company with a high current dividend, or a company that raises its dividend every year, even if it's currently low?

Detailed image

Into the book

If a person holds onto cash, the value of his assets will continue to decline.

Anyone who owns a commodity that rises at least as much as inflation can avoid the risk of inflation.

This is called 'hedging' (preventing losses due to price fluctuations) against the risk of inflation.

--- p.21

Bonds guaranteed by the state or local governments, bonds with high credit ratings, etc. can be considered to have almost no risk of principal loss.

Although gold and the dollar are classified as safe assets, there is still a possibility of some loss.

I've organized it like this, but I'm starting to think that even assets that were considered safe could end up in a dangerous situation (black swan).

That's why asset allocation (diversifying assets into various asset classes) is necessary.

--- p.34

When the stock price falls below a certain percentage, the securities company that lent money using the stock as collateral forcibly sells the stocks on the stock market to recover their loan.

This is called a short sale.

--- p.40

What is the KOSPI index? In Korea, there are two markets where stocks are traded: the KOSPI and the KOSDAQ.

The KOSPI market is a market where large, blue-chip stocks such as Samsung Electronics, SK Hynix, Naver, and Kakao are mainly traded.

(Omitted) What is the KOSDAQ index? The KOSDAQ market is modeled after the NASDAQ market, which is centered on advanced technology stocks in the United States.

It is a market that mainly deals with small and medium-sized enterprises and startups.

--- p.47

Investing can be defined as the act of investing capital or time and effort in an asset with the expectation that its value will increase in the future to generate profits.

On the other hand, speculation is a high-frequency risky transaction aimed at making a large profit by selling at a high price when an opportunity arises.

--- p.59

Cryptocurrencies are difficult to measure in value, so they are prone to bubbles. Furthermore, there are no standards for judging value, making them a very difficult area for the general public to access.

So I tend to discourage investment.

And because of the principle of profit and loss asymmetry, once you suffer a big loss, it is often difficult to recover, so you should try to make investments that do not result in losses.

--- p.64

Food is a share of the company.

It's like owning the company.

So, people who own stocks are called shareholders.

The character '주' means 'master'.

So if you own even one share of stock, you are the owner of the company.

--- p.95

It is said that the stock market is generally affected by supply and demand in the short term, by macroeconomics in the medium term, and by the fundamentals of a company in the long term.

Fundamentals refer to a company's performance and growth.

---P.114~115

I opened a chicken restaurant with 200 million won and made 40 million won in profit in a year.

With a total capital of 200 million won, you generated a net profit of 40 million won, which is a 20% return on capital. This is called ROE (Return on Equity). In this case, the ROE is 20%.

---P.135

To measure investment performance, it's crucial to consider not just how much you made or lost in the stock market, but also how much you performed compared to the KOSPI and KOSDAQ indices.

This reference point value is called the benchmark (BM) index.

---P.159

What is an index fund? Also called a "passive fund," it's a product designed to track an index. In Korea, there are ETFs like the KODEX200, which tracks the KOSPI 200 index, and in the US, there are ETFs like the SPY, which tracks the S&P 500 index.

Buying an index fund has the same effect as buying most of the stocks in the index.

---P.162

A fund that is directly managed by a fund manager through an asset management company is called an active fund.

An active fund is a fund where the fund manager buys and sells stocks based on his or her own judgment, and is managed to pursue returns higher than the market rate of return.

---P.166~167

So, to succeed in the stock market, it is very important to have principles and the mindset to persevere until the end.

Without these principles and patience, you'll be easily swayed by the ups and downs of the stock market or swayed by what other people say, making it difficult to maintain your investment principles.

---P.176

Quantitative investing is a quantitative (rules)-based investment.

Tell me how to invest based solely on numbers, excluding subjective judgment.

The ETF we know as KODEX200 is actually a type of quantitative investment.

I'm following certain rules.

---P.186~187

No matter how good a strategy is, there is no strategy with a 100% win rate.

So, it is important to consistently stick to your strategy even if you incur losses.

However, since quants can also suffer from overoptimization, you should evaluate the strategy's win rate to determine whether to continue using it.

--- p.197

Buffett said that one thing he regrets in life is that he started investing in stocks when he was 11.

If you could be born again, you would start when you were 5 or 7. It seems like you were thinking about the compounding effect that would multiply your current assets if you started a few years earlier.

--- p.217

In particular, Benjamin Graham distinguished between investment and speculation, stating that investment is buying stocks with a margin of safety, while speculation is buying stocks without any logical basis, hoping for a rise.

--- p.227

A company that raises its dividend every year like this is called a 'dividend growth stock'.

In the U.S., there are dividend blue-chip companies that have increased their dividends for more than five years, dividend achievers that have increased their dividends for 10 years, dividend aristocrats that have increased their dividends for 25 years, and even dividend kings that have continued to pay dividends for over 50 years without a single cut.

---P.246

REITs are real estate investment companies that pool funds from multiple investors, invest in real estate, and distribute the resulting rental income and real estate sale profits in the form of dividends.

--- p.252

What's the best medicine among medicines? The answer is "savings."

Someone asked this question in a nonsense quiz: Saving is essential to making seed money.

Of course, the pleasure you feel from spending cash now may be sweet, but if you become accustomed to this pleasure, you will never be successful in investing.

--- p.261

In learning, 'hak' means learning from someone, and 'seup' means self-study.

However, our students are so focused on 'learning' by being taught by someone else that they have very little time to acquire knowledge on their own.

By reducing private education and securing time for self-directed study, students will improve their grades as they enter high school, and the money saved on private education can be a great investment.

--- p.263

When investing in stocks, you should never invest with money that you plan to use in the short term.

For example, if the stock market slump is prolonged, things like wedding funds that need to be used in a year or rental deposits that need to be used within two years may not be able to recover and may result in losses.

Therefore, if you invest with spare money that you won't be using for at least 3 to 5 years, you can be less swayed by stock market volatility.

However, if you invest with short-term funds, you may ruin your investment due to impatience and anxiety.

--- p.267

Starting to invest early allows you to gain a greater understanding of the financial markets with a smaller investment.

If you don't invest your own money, you won't study.

You feel the need to study only when you have money invested.

Understanding the principles of economics from a young age is of great help to those who will live in a capitalist world.

Investing can be risky, of course, but not investing is also risky because it can lead to a decline in your assets due to currency devaluation.

--- p.268

Just as we study history to gain insight into the future through the past, investing in the same way can increase your chances of success.

Before investing, I strongly recommend that you go through the process of verifying whether the strategy you have in mind is a good one.

--- p.286

Investing requires an open and flexible mindset.

Because there is no right answer when it comes to investing.

Having an investment philosophy is essential to surviving in the stock market, but that doesn't mean you have to be a stubborn investor.

The most important thing is to survive in the stock market and make money.

--- p.290

Finance is a closely related field of knowledge that is inseparable from our lives, so it is advantageous to learn it early.

You can lose money in stock investing, but with a small initial investment, you can afford to lose some money.

Rather, if you invest in stocks for the first time as an adult and suffer a huge loss, it is very difficult to overcome it.

For the above reasons, I recommend starting your investments early.

Anyone who owns a commodity that rises at least as much as inflation can avoid the risk of inflation.

This is called 'hedging' (preventing losses due to price fluctuations) against the risk of inflation.

--- p.21

Bonds guaranteed by the state or local governments, bonds with high credit ratings, etc. can be considered to have almost no risk of principal loss.

Although gold and the dollar are classified as safe assets, there is still a possibility of some loss.

I've organized it like this, but I'm starting to think that even assets that were considered safe could end up in a dangerous situation (black swan).

That's why asset allocation (diversifying assets into various asset classes) is necessary.

--- p.34

When the stock price falls below a certain percentage, the securities company that lent money using the stock as collateral forcibly sells the stocks on the stock market to recover their loan.

This is called a short sale.

--- p.40

What is the KOSPI index? In Korea, there are two markets where stocks are traded: the KOSPI and the KOSDAQ.

The KOSPI market is a market where large, blue-chip stocks such as Samsung Electronics, SK Hynix, Naver, and Kakao are mainly traded.

(Omitted) What is the KOSDAQ index? The KOSDAQ market is modeled after the NASDAQ market, which is centered on advanced technology stocks in the United States.

It is a market that mainly deals with small and medium-sized enterprises and startups.

--- p.47

Investing can be defined as the act of investing capital or time and effort in an asset with the expectation that its value will increase in the future to generate profits.

On the other hand, speculation is a high-frequency risky transaction aimed at making a large profit by selling at a high price when an opportunity arises.

--- p.59

Cryptocurrencies are difficult to measure in value, so they are prone to bubbles. Furthermore, there are no standards for judging value, making them a very difficult area for the general public to access.

So I tend to discourage investment.

And because of the principle of profit and loss asymmetry, once you suffer a big loss, it is often difficult to recover, so you should try to make investments that do not result in losses.

--- p.64

Food is a share of the company.

It's like owning the company.

So, people who own stocks are called shareholders.

The character '주' means 'master'.

So if you own even one share of stock, you are the owner of the company.

--- p.95

It is said that the stock market is generally affected by supply and demand in the short term, by macroeconomics in the medium term, and by the fundamentals of a company in the long term.

Fundamentals refer to a company's performance and growth.

---P.114~115

I opened a chicken restaurant with 200 million won and made 40 million won in profit in a year.

With a total capital of 200 million won, you generated a net profit of 40 million won, which is a 20% return on capital. This is called ROE (Return on Equity). In this case, the ROE is 20%.

---P.135

To measure investment performance, it's crucial to consider not just how much you made or lost in the stock market, but also how much you performed compared to the KOSPI and KOSDAQ indices.

This reference point value is called the benchmark (BM) index.

---P.159

What is an index fund? Also called a "passive fund," it's a product designed to track an index. In Korea, there are ETFs like the KODEX200, which tracks the KOSPI 200 index, and in the US, there are ETFs like the SPY, which tracks the S&P 500 index.

Buying an index fund has the same effect as buying most of the stocks in the index.

---P.162

A fund that is directly managed by a fund manager through an asset management company is called an active fund.

An active fund is a fund where the fund manager buys and sells stocks based on his or her own judgment, and is managed to pursue returns higher than the market rate of return.

---P.166~167

So, to succeed in the stock market, it is very important to have principles and the mindset to persevere until the end.

Without these principles and patience, you'll be easily swayed by the ups and downs of the stock market or swayed by what other people say, making it difficult to maintain your investment principles.

---P.176

Quantitative investing is a quantitative (rules)-based investment.

Tell me how to invest based solely on numbers, excluding subjective judgment.

The ETF we know as KODEX200 is actually a type of quantitative investment.

I'm following certain rules.

---P.186~187

No matter how good a strategy is, there is no strategy with a 100% win rate.

So, it is important to consistently stick to your strategy even if you incur losses.

However, since quants can also suffer from overoptimization, you should evaluate the strategy's win rate to determine whether to continue using it.

--- p.197

Buffett said that one thing he regrets in life is that he started investing in stocks when he was 11.

If you could be born again, you would start when you were 5 or 7. It seems like you were thinking about the compounding effect that would multiply your current assets if you started a few years earlier.

--- p.217

In particular, Benjamin Graham distinguished between investment and speculation, stating that investment is buying stocks with a margin of safety, while speculation is buying stocks without any logical basis, hoping for a rise.

--- p.227

A company that raises its dividend every year like this is called a 'dividend growth stock'.

In the U.S., there are dividend blue-chip companies that have increased their dividends for more than five years, dividend achievers that have increased their dividends for 10 years, dividend aristocrats that have increased their dividends for 25 years, and even dividend kings that have continued to pay dividends for over 50 years without a single cut.

---P.246

REITs are real estate investment companies that pool funds from multiple investors, invest in real estate, and distribute the resulting rental income and real estate sale profits in the form of dividends.

--- p.252

What's the best medicine among medicines? The answer is "savings."

Someone asked this question in a nonsense quiz: Saving is essential to making seed money.

Of course, the pleasure you feel from spending cash now may be sweet, but if you become accustomed to this pleasure, you will never be successful in investing.

--- p.261

In learning, 'hak' means learning from someone, and 'seup' means self-study.

However, our students are so focused on 'learning' by being taught by someone else that they have very little time to acquire knowledge on their own.

By reducing private education and securing time for self-directed study, students will improve their grades as they enter high school, and the money saved on private education can be a great investment.

--- p.263

When investing in stocks, you should never invest with money that you plan to use in the short term.

For example, if the stock market slump is prolonged, things like wedding funds that need to be used in a year or rental deposits that need to be used within two years may not be able to recover and may result in losses.

Therefore, if you invest with spare money that you won't be using for at least 3 to 5 years, you can be less swayed by stock market volatility.

However, if you invest with short-term funds, you may ruin your investment due to impatience and anxiety.

--- p.267

Starting to invest early allows you to gain a greater understanding of the financial markets with a smaller investment.

If you don't invest your own money, you won't study.

You feel the need to study only when you have money invested.

Understanding the principles of economics from a young age is of great help to those who will live in a capitalist world.

Investing can be risky, of course, but not investing is also risky because it can lead to a decline in your assets due to currency devaluation.

--- p.268

Just as we study history to gain insight into the future through the past, investing in the same way can increase your chances of success.

Before investing, I strongly recommend that you go through the process of verifying whether the strategy you have in mind is a good one.

--- p.286

Investing requires an open and flexible mindset.

Because there is no right answer when it comes to investing.

Having an investment philosophy is essential to surviving in the stock market, but that doesn't mean you have to be a stubborn investor.

The most important thing is to survive in the stock market and make money.

--- p.290

Finance is a closely related field of knowledge that is inseparable from our lives, so it is advantageous to learn it early.

You can lose money in stock investing, but with a small initial investment, you can afford to lose some money.

Rather, if you invest in stocks for the first time as an adult and suffer a huge loss, it is very difficult to overcome it.

For the above reasons, I recommend starting your investments early.

--- p.316

Publisher's Review

Financial education books for parents and children to read together

For a stable retirement and solid assets!

South Korea has the highest elderly poverty rate.

The biggest reason for not having assets in old age is that you can't accumulate assets because you spend a lot of money on your children's education and wedding expenses.

In this reality, people are focusing on investing in assets that will be more helpful in the future than now.

The more you study about investing, the less you'll lose, and the sooner you start, the greater your profits. Therefore, mastering the basics of financial economics from your teens will lead to a stable financial life.

"A High School Teacher's Special Financial and Economics Class" provides easy-to-understand information on everything from investment to stocks, for those unfamiliar with finance.

It's not just a simple argument for investing, but it's also packed with information on risks, things to keep in mind, and accurate information.

It also provides smart ways to identify good investments or pick stocks by assessing the company's prospects.

Rather than continuing to turn away from risky investments, if you learn and leverage your investments, you'll move closer to a future where stable assets are guaranteed.

Part 1 covers the basic definitions of investing.

It covers what investing is, how to do it, what types there are, and even an explanation of the compound interest that comes from investing.

Part 2 covers the basic concepts of what a stock is, and Part 3 follows, discussing the criteria for selecting, understanding, and buying and selling stocks.

Part 4 introduces the investment techniques of great stock investors, from Korea's Sukhyang and Kang Hwan-guk to the world-famous Warren Buffett.

Parts 5 and 6 contain information provided by the author and answers to questions students actually asked.

You can absorb valuable information about economics and finance through rare yet realistic questions and answers.

For a stable retirement and solid assets!

South Korea has the highest elderly poverty rate.

The biggest reason for not having assets in old age is that you can't accumulate assets because you spend a lot of money on your children's education and wedding expenses.

In this reality, people are focusing on investing in assets that will be more helpful in the future than now.

The more you study about investing, the less you'll lose, and the sooner you start, the greater your profits. Therefore, mastering the basics of financial economics from your teens will lead to a stable financial life.

"A High School Teacher's Special Financial and Economics Class" provides easy-to-understand information on everything from investment to stocks, for those unfamiliar with finance.

It's not just a simple argument for investing, but it's also packed with information on risks, things to keep in mind, and accurate information.

It also provides smart ways to identify good investments or pick stocks by assessing the company's prospects.

Rather than continuing to turn away from risky investments, if you learn and leverage your investments, you'll move closer to a future where stable assets are guaranteed.

Part 1 covers the basic definitions of investing.

It covers what investing is, how to do it, what types there are, and even an explanation of the compound interest that comes from investing.

Part 2 covers the basic concepts of what a stock is, and Part 3 follows, discussing the criteria for selecting, understanding, and buying and selling stocks.

Part 4 introduces the investment techniques of great stock investors, from Korea's Sukhyang and Kang Hwan-guk to the world-famous Warren Buffett.

Parts 5 and 6 contain information provided by the author and answers to questions students actually asked.

You can absorb valuable information about economics and finance through rare yet realistic questions and answers.

GOODS SPECIFICS

- Date of issue: November 10, 2023

- Page count, weight, size: 320 pages | 470g | 152*225*16mm

- ISBN13: 9791163221111

- ISBN10: 1163221112

You may also like

카테고리

korean

korean

![ELLE 엘르 스페셜 에디션 A형 : 12월 [2025]](http://librairie.coreenne.fr/cdn/shop/files/b8e27a3de6c9538896439686c6b0e8fb.jpg?v=1766436872&width=3840)