Investment Shift

|

Description

Book Introduction

“Design a ‘wealth scenario’ that will not be shaken by any situation!” The more difficult it is to become rich based on salary alone, the more the market volatility causes sharp ups and downs. We need an investment method that generates consistent profits! The formula for wealth has changed. The saying, 'If you work hard, you will become rich' has become an outdated formula. The impact of COVID-19 has given those with assets the opportunity to see their value increase, while those without have found themselves in a situation where they cannot even guarantee the opportunity to work diligently. The 'K-shaped recovery', which signifies polarization, is becoming a reality. Especially in a shrinking economy where economic growth is slowing due to an aging population and low growth continues for a long time, asset management has become as important as working diligently. We have entered an era where we can enjoy economic freedom by strategically accumulating and growing our assets. In "Investment Shift," economist Kim Gwang-seok, known to the public as YouTube's "The Man Who Reads the Economy," and Kim Young-bin, CEO of Pound, Korea's leading robo-advisor, collaborate to assess the economic outlook and present investment strategies for a time of financial paradigm shift. Now is the time for a systematic strategy that makes money make money. To do so, the first thing we must do is understand the economic trends and financial paradigms we face today, and based on this, examine our previous investment methods. Let's take a look at how the two authors design a "wealth scenario" that will remain unshaken in any situation. |

- You can preview some of the book's contents.

Preview

index

Prologue: Will hard work make you rich? The formula for wealth has changed.

Part 1: Where Will Your Money Go in the Next 10 Years?

Chapter 1: Why Investing with a Long-Term Perspective

Aging Society: Where Are We Heading?

Why It's Difficult to Make Money Through Earned Income Alone

If you don't invest now, you're losing money.

Unpredictable Times, Investor Attitudes

Chapter 2: Shifting the Financial Paradigm: What's Your Choice?

Post-COVID: The Transition from Analog to Digital

Digital finance trends focused on efficiency

The potential of financial platforms that permeate everyday life

Wake up your sleeping money and make it work for you.

Chapter 3: 6 Principles for Growing Your Wealth Every Day

Rule 1: Don't hoard cash.

Principle 2: Build a Portfolio

Rule 3: Manage Volatility

Rule 4: Understand the flow of the game

Principle 5: Invest in Global Markets

Rule 6: Rebalance periodically.

Part 2: Unwavering Investment Strategies in Any Situation

Chapter 4: Creating a Lost Asset Scenario

Turn your salary into an asset

Why You Should Invest Your Entire Fortune

Make investments that you absolutely must protect.

How to Invest Without Being Swayed by Rapid Volatility

Chapter 5: Creating Long-Term Investment Scenarios

Why Investing Requires Faith

Misconceptions about investing

Why You Need to Understand Your Investment Style

Change your mindset about investing

Chapter 6: Creating a Stable Profit Scenario

You can become rich on the price of a cup of coffee a day.

Why are ETFs becoming the trend?

Direct investment vs.

indirect investment

What is an efficient profit scenario for office workers?

References

Part 1: Where Will Your Money Go in the Next 10 Years?

Chapter 1: Why Investing with a Long-Term Perspective

Aging Society: Where Are We Heading?

Why It's Difficult to Make Money Through Earned Income Alone

If you don't invest now, you're losing money.

Unpredictable Times, Investor Attitudes

Chapter 2: Shifting the Financial Paradigm: What's Your Choice?

Post-COVID: The Transition from Analog to Digital

Digital finance trends focused on efficiency

The potential of financial platforms that permeate everyday life

Wake up your sleeping money and make it work for you.

Chapter 3: 6 Principles for Growing Your Wealth Every Day

Rule 1: Don't hoard cash.

Principle 2: Build a Portfolio

Rule 3: Manage Volatility

Rule 4: Understand the flow of the game

Principle 5: Invest in Global Markets

Rule 6: Rebalance periodically.

Part 2: Unwavering Investment Strategies in Any Situation

Chapter 4: Creating a Lost Asset Scenario

Turn your salary into an asset

Why You Should Invest Your Entire Fortune

Make investments that you absolutely must protect.

How to Invest Without Being Swayed by Rapid Volatility

Chapter 5: Creating Long-Term Investment Scenarios

Why Investing Requires Faith

Misconceptions about investing

Why You Need to Understand Your Investment Style

Change your mindset about investing

Chapter 6: Creating a Stable Profit Scenario

You can become rich on the price of a cup of coffee a day.

Why are ETFs becoming the trend?

Direct investment vs.

indirect investment

What is an efficient profit scenario for office workers?

References

Detailed image

Into the book

The implications of Korea's rapid demographic changes and the country's inadequate retirement planning system are clear.

For life after retirement, you need to manage your assets yourself, not through the government.

Now, we must go beyond just living diligently and live strategically.

Rather than aiming to become rich, you should seek out strategies to 'survive' your own retirement.

It's not enough to just work hard and save money.

This is because the rate of increase in earned income is slower than the rate of increase in asset value.

Therefore, you should focus on increasing your assets such as stocks and real estate.

However, blind investment, which involves blindly following the advice, is extremely risky.

After thoroughly studying and understanding how the economy will develop in the future and how the industrial environment will structurally change, you should invest in a way that suits your personality.

You must be able to draw your own direction for the future.

--- From "Aging Society, Where Are We Heading?"

Asset management has long been the exclusive domain of the wealthy.

High net worth individuals have been paying high fees to wealth management professionals with specialized financial knowledge for investment advice.

But now, even ordinary citizens have awakened to the truth that 'money must make money.'

The need for asset management has been recognized.

However, despite recognizing the need for asset management, the general public has not been able to access asset management services.

As mentioned earlier, receiving investment advice from asset management experts required a significant amount of money.

But now the world has changed.

We have entered an era where even small amounts of money can be easily invested in various asset products, regardless of time or location.

This is because robo-advisors are opening the door to this world.

Digital transformation has brought about an era where even salaried workers can consistently invest small amounts and receive asset management without complicated procedures.

Robo-advisors allow us to earn money even while we sleep.

But am I the only one who rejects digital transformation?

--- From "Wake up your sleeping money and make it work for you"

It is true that many people have made a lot of money in the short term as the stock market has been strong for a while since COVID-19.

But if investors who have experienced high returns in a short period of time without any investment principles or strategies later experience a sharp decline in returns due to increased volatility, will they be able to withstand this and continue investing?

If you want to continue investing steadily over the long term, you need to build a portfolio by combining various assets.

We need to define and separate risky and safe assets, and create consistent returns with low volatility through correlation between them.

Of course, this method is unlikely to yield large profits in the short term.

This is because assets with different properties, such as stocks and bonds, are included in one portfolio.

But the important thing is consistency.

It is more important to generate consistent returns while protecting your principal over the long term than to double your assets quickly.

That's what the portfolio is all about.

Managing volatility and avoiding risk in this way is one of the financial investment methods used by the wealthy.

It is also the investment approach pursued by institutions like Goldman Sachs, which manage massive amounts of funds.

--- From "Principle 3: Manage Volatility"

Just like real estate, stocks should be something you can invest your entire life in, risking your entire fortune.

Even if you invest small amounts of spare money in the stock market, it is difficult to actually make a large profit, no matter how high the rate of return is.

Even if you see profits in the short term, it is difficult to consistently generate profits in the long term, so there are many cases where profits eventually become zero.

In short, to make money in the stock market, you need to invest by increasing the principal itself, just like in real estate investment.

Rather than investing with spare funds with the mindset of "if I win, it's good, if I lose, it's okay," I need to be able to risk all of my liquid funds.

This change in thinking can make us rich.

How many investors actually believe they can lose money investing in real estate? So why do we assume they can lose money in the stock market? The simple answer is that it's due to market uncertainty.

This mindset itself acknowledges the speculative element that can lead to losing money.

Rather, since I am investing my entire fortune, I must be determined not to lose it.

--- From "Why You Should Invest with Your Entire Fortune"

Rather than focusing on unconditionally high returns, you should focus on protecting your assets well and generating consistent returns.

Rather than focusing on returns, you should focus on knowing how much risk you can tolerate and diversifying that risk as much as possible.

Focusing your investment perspective on 'risk management'.

This is the investment method of high net worth individuals.

High net worth individuals are fundamentally more focused on not losing money than on making it.

Then, focus on slowly letting it out.

To do that, you allocate your assets.

Rather than investing 100% of your assets in individual companies, you create a portfolio that divides your investment ratios into stocks, bonds, gold, real estate, etc.

Of course, the rate of return is bound to decrease during the asset allocation process.

Because I diversified my investments.

But let's think about when the crash came.

It is important to remember that the purpose of asset allocation itself is to reduce losses in a market crash.

Instead of chasing the dream of a "one-hit wonder," if you invest with the goal of "accumulating assets over the long term," you can generate sufficiently stable returns through diversification.

The problem is investors who are not satisfied with these returns.

--- From "Make an investment you absolutely must protect"

The magic of compound interest is not a difficult economic concept, but in reality, it is less common to put it into practice and reap the benefits.

The reason is simple.

Because the amount is small at first, it is difficult to feel that you have made a large profit even if the interest increases.

In the end, most people end up giving up halfway.

However, if you invest consistently and patiently, at some point your investment will grow into a huge sum.

Let's take a simple example.

Today, too, many people are drinking coffee out of habit.

To shake off the morning fatigue on the way to work, to take a short break after lunch, and to chat with colleagues while drinking coffee.

Coffee has literally become an unconscious part of our daily lives.

Because of this, everyone has probably said this at least once.

“If I had saved money on the coffee I drink every day, wouldn’t I have been able to buy a car?”

The amount of money we spend unconsciously on coffee can add up to a considerable sum, but how much would it actually cost if we accumulated the money we spend on coffee we habitually drink?

According to the International Coffee Association in 2018, Koreans consume 512 cups of coffee per year.

If you assume the price of a cup of coffee is 5,000 won, you are spending 210,000 won a month and a whopping 2.56 million won a year.

It's a pretty big amount of money.

But since you can't completely avoid coffee, why not try cutting back to just one cup a week? That would save you 190,000 won a month.

If you save this money every month for 45 months, you can save about 8.55 million won.

What if you invested in an investment product that yields a 9% annual return? The interest alone would be 1.65 million won, bringing your total savings to 10.2 million won in 45 months.

If you consistently save even a small amount of money, such as the cost of a cup of coffee, you can accumulate interest and save a lot of money.

Because you can enjoy the magic created by time called compound interest.

For life after retirement, you need to manage your assets yourself, not through the government.

Now, we must go beyond just living diligently and live strategically.

Rather than aiming to become rich, you should seek out strategies to 'survive' your own retirement.

It's not enough to just work hard and save money.

This is because the rate of increase in earned income is slower than the rate of increase in asset value.

Therefore, you should focus on increasing your assets such as stocks and real estate.

However, blind investment, which involves blindly following the advice, is extremely risky.

After thoroughly studying and understanding how the economy will develop in the future and how the industrial environment will structurally change, you should invest in a way that suits your personality.

You must be able to draw your own direction for the future.

--- From "Aging Society, Where Are We Heading?"

Asset management has long been the exclusive domain of the wealthy.

High net worth individuals have been paying high fees to wealth management professionals with specialized financial knowledge for investment advice.

But now, even ordinary citizens have awakened to the truth that 'money must make money.'

The need for asset management has been recognized.

However, despite recognizing the need for asset management, the general public has not been able to access asset management services.

As mentioned earlier, receiving investment advice from asset management experts required a significant amount of money.

But now the world has changed.

We have entered an era where even small amounts of money can be easily invested in various asset products, regardless of time or location.

This is because robo-advisors are opening the door to this world.

Digital transformation has brought about an era where even salaried workers can consistently invest small amounts and receive asset management without complicated procedures.

Robo-advisors allow us to earn money even while we sleep.

But am I the only one who rejects digital transformation?

--- From "Wake up your sleeping money and make it work for you"

It is true that many people have made a lot of money in the short term as the stock market has been strong for a while since COVID-19.

But if investors who have experienced high returns in a short period of time without any investment principles or strategies later experience a sharp decline in returns due to increased volatility, will they be able to withstand this and continue investing?

If you want to continue investing steadily over the long term, you need to build a portfolio by combining various assets.

We need to define and separate risky and safe assets, and create consistent returns with low volatility through correlation between them.

Of course, this method is unlikely to yield large profits in the short term.

This is because assets with different properties, such as stocks and bonds, are included in one portfolio.

But the important thing is consistency.

It is more important to generate consistent returns while protecting your principal over the long term than to double your assets quickly.

That's what the portfolio is all about.

Managing volatility and avoiding risk in this way is one of the financial investment methods used by the wealthy.

It is also the investment approach pursued by institutions like Goldman Sachs, which manage massive amounts of funds.

--- From "Principle 3: Manage Volatility"

Just like real estate, stocks should be something you can invest your entire life in, risking your entire fortune.

Even if you invest small amounts of spare money in the stock market, it is difficult to actually make a large profit, no matter how high the rate of return is.

Even if you see profits in the short term, it is difficult to consistently generate profits in the long term, so there are many cases where profits eventually become zero.

In short, to make money in the stock market, you need to invest by increasing the principal itself, just like in real estate investment.

Rather than investing with spare funds with the mindset of "if I win, it's good, if I lose, it's okay," I need to be able to risk all of my liquid funds.

This change in thinking can make us rich.

How many investors actually believe they can lose money investing in real estate? So why do we assume they can lose money in the stock market? The simple answer is that it's due to market uncertainty.

This mindset itself acknowledges the speculative element that can lead to losing money.

Rather, since I am investing my entire fortune, I must be determined not to lose it.

--- From "Why You Should Invest with Your Entire Fortune"

Rather than focusing on unconditionally high returns, you should focus on protecting your assets well and generating consistent returns.

Rather than focusing on returns, you should focus on knowing how much risk you can tolerate and diversifying that risk as much as possible.

Focusing your investment perspective on 'risk management'.

This is the investment method of high net worth individuals.

High net worth individuals are fundamentally more focused on not losing money than on making it.

Then, focus on slowly letting it out.

To do that, you allocate your assets.

Rather than investing 100% of your assets in individual companies, you create a portfolio that divides your investment ratios into stocks, bonds, gold, real estate, etc.

Of course, the rate of return is bound to decrease during the asset allocation process.

Because I diversified my investments.

But let's think about when the crash came.

It is important to remember that the purpose of asset allocation itself is to reduce losses in a market crash.

Instead of chasing the dream of a "one-hit wonder," if you invest with the goal of "accumulating assets over the long term," you can generate sufficiently stable returns through diversification.

The problem is investors who are not satisfied with these returns.

--- From "Make an investment you absolutely must protect"

The magic of compound interest is not a difficult economic concept, but in reality, it is less common to put it into practice and reap the benefits.

The reason is simple.

Because the amount is small at first, it is difficult to feel that you have made a large profit even if the interest increases.

In the end, most people end up giving up halfway.

However, if you invest consistently and patiently, at some point your investment will grow into a huge sum.

Let's take a simple example.

Today, too, many people are drinking coffee out of habit.

To shake off the morning fatigue on the way to work, to take a short break after lunch, and to chat with colleagues while drinking coffee.

Coffee has literally become an unconscious part of our daily lives.

Because of this, everyone has probably said this at least once.

“If I had saved money on the coffee I drink every day, wouldn’t I have been able to buy a car?”

The amount of money we spend unconsciously on coffee can add up to a considerable sum, but how much would it actually cost if we accumulated the money we spend on coffee we habitually drink?

According to the International Coffee Association in 2018, Koreans consume 512 cups of coffee per year.

If you assume the price of a cup of coffee is 5,000 won, you are spending 210,000 won a month and a whopping 2.56 million won a year.

It's a pretty big amount of money.

But since you can't completely avoid coffee, why not try cutting back to just one cup a week? That would save you 190,000 won a month.

If you save this money every month for 45 months, you can save about 8.55 million won.

What if you invested in an investment product that yields a 9% annual return? The interest alone would be 1.65 million won, bringing your total savings to 10.2 million won in 45 months.

If you consistently save even a small amount of money, such as the cost of a cup of coffee, you can accumulate interest and save a lot of money.

Because you can enjoy the magic created by time called compound interest.

--- From "You can become rich for the price of a cup of coffee a day"

Publisher's Review

“A good investment is not the one that produces the highest return,

“It is about continuing to generate decent returns.”

In an era where investing is no longer an option but a necessity, move on to investments that will ensure you never lose money!

The stock investment fever in Korea is still hot.

At the beginning of the year, when the KOSPI broke the 3,000 mark for the first time in 65 years since the domestic stock market opened, even those who had previously had no interest in stock investment joined the market, dreaming of a bright future.

The anxiety that I might be left behind further fueled my investment enthusiasm.

However, those who have jumped into the current bull market are unable to know when the stock market will turn into a bear market, so they are constantly hovering around the 'inflection point of anticipation and anxiety' several times a day.

Each individual stock has its own timing for price rises and falls, but it is not easy for individual investors to time this timing.

Timing is a matter of luck, so if you try to get it right, you run the risk of suffering losses instead of making a profit.

The phrase 'high risk, high return', which means that risk and return are proportional, clearly reveals the riskiness of stock investment.

So, is there no way to invest that generates consistent profits while reducing the risk of loss?

《Investment Shift》 is the answer to people's concerns.

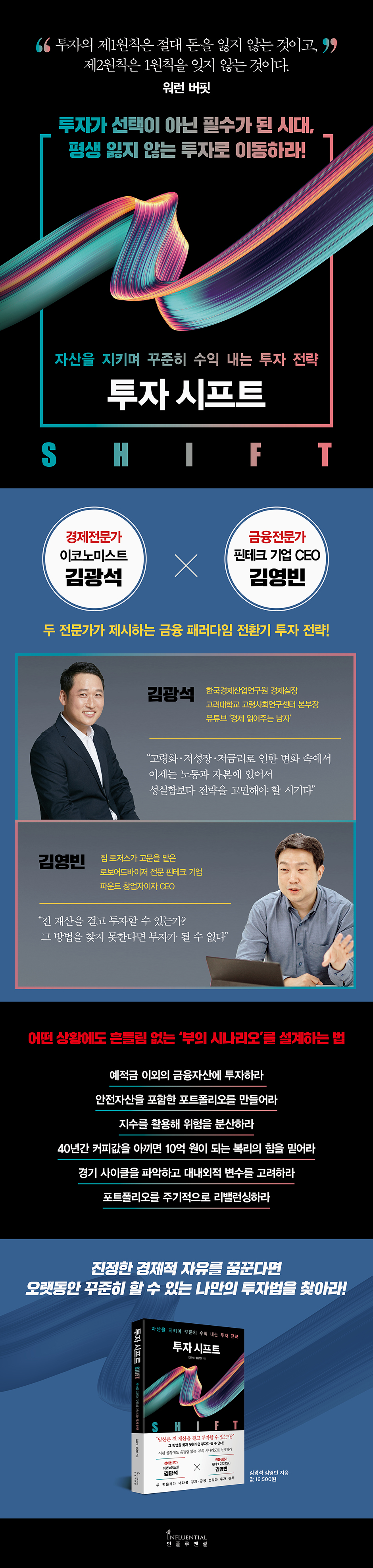

Economist Kim Gwang-seok, who is familiar to the public as the YouTuber “The Man Who Reads the Economy,” and Kim Young-bin, CEO of Pound, Korea’s leading robo-advisor company, have joined hands.

Two experts, each from their respective fields, have developed a book that outlines how to design a wealth scenario that will remain unshaken in any situation.

Author Kim Gwang-seok, an economic expert, provides a comprehensive overview of the economic outlook and financial trends essential to understanding before investing, drawing on a variety of domestic and international data. Financial expert Kim Young-bin presents a concrete methodology, using case studies, on how to achieve financial freedom through investment.

“Can you afford to risk your entire fortune?”

If you don't find a way, you can't get rich!

In his book “Investment Shift,” economic expert Kim Gwang-seok argues that “now is the time to consider strategy rather than sincerity in labor and capital.”

This is because, amidst the inevitable megatrends of aging, low growth, and low interest rates, the economic growth rate is expected to slow down and the employment outlook is also expected to darken.

In this shrinking economy, we need to live strategically, not just work hard.

This is because the rate of increase in earned income is slower than the rate of increase in asset value.

Ultimately, it is time to consider a new way of doing things, different from the past.

Economic freedom can only be achieved through active asset management, not through hard work.

So how should you invest? Financial expert Kim Young-bin recommends, "You should boldly invest your entire assets to build your wealth."

This is because investing with existing spare funds can never guarantee the returns we desire in the long term.

In particular, if the national pension is depleted in 2056, as the Ministry of Strategy and Finance projects, the current 2030 generation may have to take responsibility for their own retirement.

If that happens, the assets needed in the future will inevitably increase.

However, the phrase “invest all your assets” here should not be misunderstood as “investing all your assets” or “investing all your assets”.

Rather, it means keeping in mind that 'investment never guarantees the principal' and building a portfolio with enough stability to be able to roll over all your assets.

To do that, we must focus on the only weapon we have: ‘time.’

The book argues that a good investment is not about achieving the highest return, but about consistently achieving a decent return.

This means that the goal of investment should be to increase the size of assets rather than to achieve high returns.

High returns are difficult to repeat because they are ultimately a matter of luck.

However, consistently maintaining a stable portfolio of 7-8% annual returns for as long as possible is an easy and surefire way to maximize the compounding effect.

The idea is to believe in the power of compound interest, which magically increases returns over time, and invest in a low-risk portfolio to create an asset scenario that looks ahead 10 or 20 years.

“If you dream of true financial freedom,

“Find your own investment method that you can stick with for a long time!”

How to Design a "Wealth Scenario" That Won't Fade in Any Situation

Faced with economic news coming from all over the world, not just South Korea, and the daily fluctuations in the stock market, the reality is that anxiety about the future is greater than anticipation.

Many investors lose sleep over the worry that investing in something they hope will lead to a better life might actually ruin their lives.

However, in "Investment Shift," it is argued that if you are going to invest anyway, if you are going to invest for the rest of your life, you "need to change your perspective on investing."

It means to understand the essence of investment and devise a plan to make efficient investments.

To do this, the most important thing we must do is understand the economic trends and financial paradigms we face.

Part 1 of this book examines macroeconomic trends and examines financial investment trends.

Through this, we explore why long-term investing is important and what investment methods can help you grow your assets every day.

Part 2 provides specific scenarios for those who have decided to invest or are already investing to help them accumulate assets.

We'll explore why your salary alone doesn't guarantee your future, why you should invest your entire savings, and why you should focus on risk management over returns, making "no-loss investments."

It also covers the misconceptions many investors have about investing, the nature of investing, how to understand your investment tendencies, and how to effectively diversify your investments through indirect investments.

I hope this book will serve as an effective compass for those contemplating financial freedom as they live to be 100 years old.

“It is about continuing to generate decent returns.”

In an era where investing is no longer an option but a necessity, move on to investments that will ensure you never lose money!

The stock investment fever in Korea is still hot.

At the beginning of the year, when the KOSPI broke the 3,000 mark for the first time in 65 years since the domestic stock market opened, even those who had previously had no interest in stock investment joined the market, dreaming of a bright future.

The anxiety that I might be left behind further fueled my investment enthusiasm.

However, those who have jumped into the current bull market are unable to know when the stock market will turn into a bear market, so they are constantly hovering around the 'inflection point of anticipation and anxiety' several times a day.

Each individual stock has its own timing for price rises and falls, but it is not easy for individual investors to time this timing.

Timing is a matter of luck, so if you try to get it right, you run the risk of suffering losses instead of making a profit.

The phrase 'high risk, high return', which means that risk and return are proportional, clearly reveals the riskiness of stock investment.

So, is there no way to invest that generates consistent profits while reducing the risk of loss?

《Investment Shift》 is the answer to people's concerns.

Economist Kim Gwang-seok, who is familiar to the public as the YouTuber “The Man Who Reads the Economy,” and Kim Young-bin, CEO of Pound, Korea’s leading robo-advisor company, have joined hands.

Two experts, each from their respective fields, have developed a book that outlines how to design a wealth scenario that will remain unshaken in any situation.

Author Kim Gwang-seok, an economic expert, provides a comprehensive overview of the economic outlook and financial trends essential to understanding before investing, drawing on a variety of domestic and international data. Financial expert Kim Young-bin presents a concrete methodology, using case studies, on how to achieve financial freedom through investment.

“Can you afford to risk your entire fortune?”

If you don't find a way, you can't get rich!

In his book “Investment Shift,” economic expert Kim Gwang-seok argues that “now is the time to consider strategy rather than sincerity in labor and capital.”

This is because, amidst the inevitable megatrends of aging, low growth, and low interest rates, the economic growth rate is expected to slow down and the employment outlook is also expected to darken.

In this shrinking economy, we need to live strategically, not just work hard.

This is because the rate of increase in earned income is slower than the rate of increase in asset value.

Ultimately, it is time to consider a new way of doing things, different from the past.

Economic freedom can only be achieved through active asset management, not through hard work.

So how should you invest? Financial expert Kim Young-bin recommends, "You should boldly invest your entire assets to build your wealth."

This is because investing with existing spare funds can never guarantee the returns we desire in the long term.

In particular, if the national pension is depleted in 2056, as the Ministry of Strategy and Finance projects, the current 2030 generation may have to take responsibility for their own retirement.

If that happens, the assets needed in the future will inevitably increase.

However, the phrase “invest all your assets” here should not be misunderstood as “investing all your assets” or “investing all your assets”.

Rather, it means keeping in mind that 'investment never guarantees the principal' and building a portfolio with enough stability to be able to roll over all your assets.

To do that, we must focus on the only weapon we have: ‘time.’

The book argues that a good investment is not about achieving the highest return, but about consistently achieving a decent return.

This means that the goal of investment should be to increase the size of assets rather than to achieve high returns.

High returns are difficult to repeat because they are ultimately a matter of luck.

However, consistently maintaining a stable portfolio of 7-8% annual returns for as long as possible is an easy and surefire way to maximize the compounding effect.

The idea is to believe in the power of compound interest, which magically increases returns over time, and invest in a low-risk portfolio to create an asset scenario that looks ahead 10 or 20 years.

“If you dream of true financial freedom,

“Find your own investment method that you can stick with for a long time!”

How to Design a "Wealth Scenario" That Won't Fade in Any Situation

Faced with economic news coming from all over the world, not just South Korea, and the daily fluctuations in the stock market, the reality is that anxiety about the future is greater than anticipation.

Many investors lose sleep over the worry that investing in something they hope will lead to a better life might actually ruin their lives.

However, in "Investment Shift," it is argued that if you are going to invest anyway, if you are going to invest for the rest of your life, you "need to change your perspective on investing."

It means to understand the essence of investment and devise a plan to make efficient investments.

To do this, the most important thing we must do is understand the economic trends and financial paradigms we face.

Part 1 of this book examines macroeconomic trends and examines financial investment trends.

Through this, we explore why long-term investing is important and what investment methods can help you grow your assets every day.

Part 2 provides specific scenarios for those who have decided to invest or are already investing to help them accumulate assets.

We'll explore why your salary alone doesn't guarantee your future, why you should invest your entire savings, and why you should focus on risk management over returns, making "no-loss investments."

It also covers the misconceptions many investors have about investing, the nature of investing, how to understand your investment tendencies, and how to effectively diversify your investments through indirect investments.

I hope this book will serve as an effective compass for those contemplating financial freedom as they live to be 100 years old.

GOODS SPECIFICS

- Publication date: April 19, 2021

- Page count, weight, size: 260 pages | 460g | 148*220*16mm

- ISBN13: 9791191056532

- ISBN10: 1191056538

You may also like

카테고리

korean

korean

![ELLE 엘르 스페셜 에디션 A형 : 12월 [2025]](http://librairie.coreenne.fr/cdn/shop/files/b8e27a3de6c9538896439686c6b0e8fb.jpg?v=1766436872&width=3840)