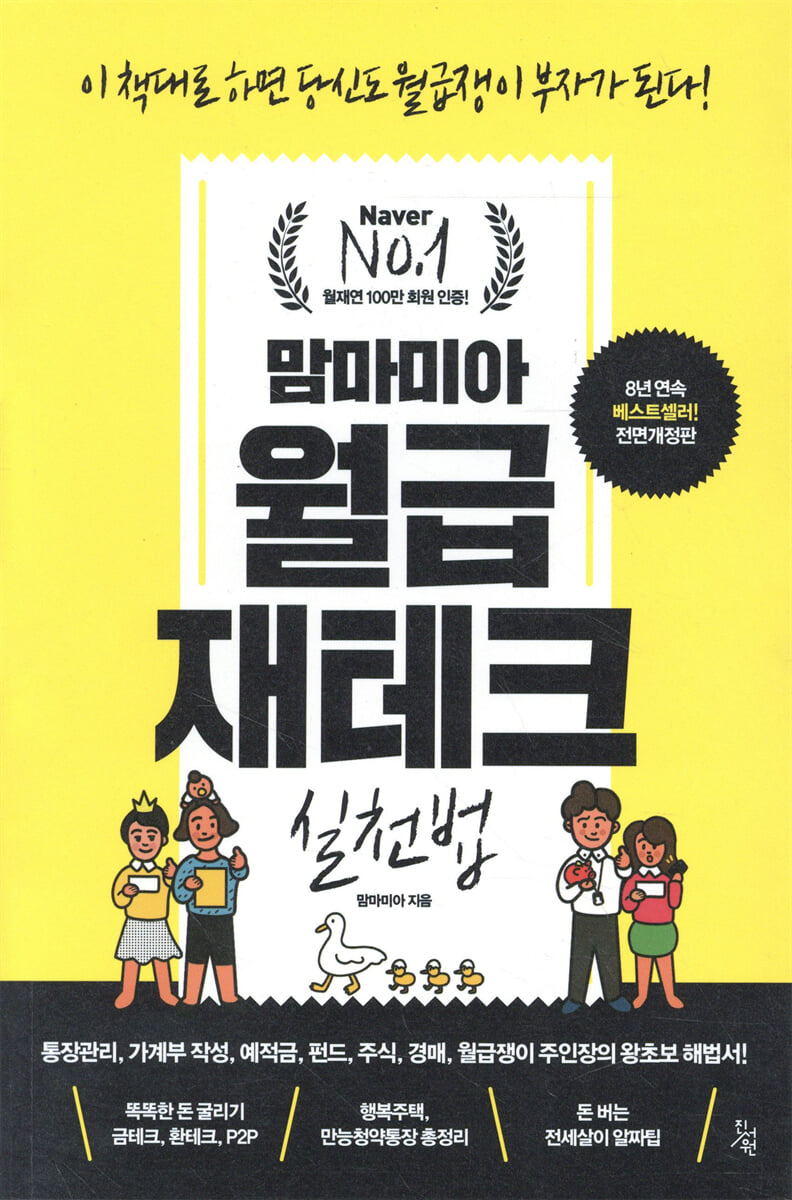

Mamma Mia's Salary Investment Practices

|

Description

Book Introduction

If you follow this book, you too can become a rich salaried worker!

Written by a real salaried worker, so it's 200% trustworthy

"Mamma Mia Salary Investment Practices," which has consistently been a bestseller for the past four years and has received the sympathy and support of countless salaried workers, has returned with a powerful, completely revised edition.

The author of this book, Mammamia, who started out as a poor salaryman but is now financially independent through consistent financial management, created the 'Salaried Worker Financial Management Research' cafe to share the financial management know-how she personally experienced.

Four years after publishing my first book, I am still a salaried worker and am working alongside the cafe.

As word of mouth spread that even a complete beginner in finance could become rich, 500,000 members gathered, and it became the undisputed No. 1 finance cafe on Naver. It upgraded the "Mamma Mia Salary Finance Practice Method" by arming it with the latest information and even Altolan's secrets.

In this revised edition, we've supplemented the latest financial technology issues and new practices, including gold technology, currency technology, P2P investment, and subscription, to create a more robust financial technology practice.

Written by a real salaried worker, so it's 200% trustworthy

"Mamma Mia Salary Investment Practices," which has consistently been a bestseller for the past four years and has received the sympathy and support of countless salaried workers, has returned with a powerful, completely revised edition.

The author of this book, Mammamia, who started out as a poor salaryman but is now financially independent through consistent financial management, created the 'Salaried Worker Financial Management Research' cafe to share the financial management know-how she personally experienced.

Four years after publishing my first book, I am still a salaried worker and am working alongside the cafe.

As word of mouth spread that even a complete beginner in finance could become rich, 500,000 members gathered, and it became the undisputed No. 1 finance cafe on Naver. It upgraded the "Mamma Mia Salary Finance Practice Method" by arming it with the latest information and even Altolan's secrets.

In this revised edition, we've supplemented the latest financial technology issues and new practices, including gold technology, currency technology, P2P investment, and subscription, to create a more robust financial technology practice.

- You can preview some of the book's contents.

Preview

index

preface

[Preparation] Determination! I can't let my hard-earned salary just stray from my bank account!

01 If you manage your paycheck well, you'll be different in 10 years/Change your mindset

02 Tracking 30 days, thoroughly reviewing/investigating paycheck statements

03 Transfer/execute monthly salary account details to household account book

04 Just understanding your spending habits will boost your will to save!/Reflection

05 Let's Block Easy-to-Reduce Expenses First/Solution 1

06 Just master your paycheck and you'll be on track for a profitable life!/Solution 2

07 50% Savings/Investments? Rich Dad, Rich Mom Guaranteed Check!/Solution 3

[First Yard] Practice! Splitting Your Paycheck Account/Money Flow Looks Like a Ghost!

08 Open your paycheck account properly! Stop being a swindler!

09 CMA into a paycheck account? No, absolutely not!

10. Set up automatic payments for fixed expenses (utility bills, etc.)! / Prepare for an exit strategy.

Splitting the November salary account 1.

Expense Account (Living Expenses)/Exit Strategy Step 1

Splitting the December salary account 2.

Emergency Fund Account (Sudden Expenses)/Exit Strategy Step 2

13 Splitting the salary account 3.

Financial Investment Account (Savings/Investment)/3-Step Exit Strategy

14. Create a check card for your spending account and emergency fund account/Complete your exit strategy

[Second Yard] Practice! Save! / Beginners, start with the fun of saving small amounts!

15. “A little bit of money becomes a lot of money!” Repeat this to yourself once a day.

16 Happy Investments! Create a Bucket List in January

17 Cut up your credit cards and only use check cards!

18 The habit of keeping a household account book is the first step to becoming rich!

19-21 days of forced savings! Developing the habit of saving first and spending later

20 Economic News in 3 Lines! Study Habits That Will Make You Rich

21 Self-development is the most reliable way to make money!

[Third Yard] Practice! Savings 2/A Master's Money-Saving Challenge!

22 Even though the salary is the same, the amount of savings varies greatly!

23 Great Challenges! Living on 100,000 Won a Month

24 Save 200,000 Won on Summer Vacation

25. Save 100,000 won on car gas

26 Secret Calendar to Turn 500 Won of Pocket Money into Cash Every Day

27 Maximize your check card discount benefits with selection and focus!

28 Earn a little extra cash with AppTech

29. Gold is the leading safe asset! Gold tech methods

When the $30 level is strong, it's time to invest! How to invest

31 Crowdfunding! Conquering P2P Investment

32 More Powerful 21-Day Savings Plan! Quit Smoking, Cancer Savings Plan

33 Spinning 12 accounts, one account per month

52-week savings plan with weekly increases of 1,000 won

35 18-month savings challenge that will dramatically increase your savings!

[Fourth Step] Practice! Open a savings account/Easy money saving for salaried workers

36. Avoid high-interest savings accounts and bank tricks.

37 Find a safer savings bank with higher interest rates!

How to Use Your CMA Account 200% as a Salaried Worker

39 Personal Pension for Retirement - Pension Savings, Pension Insurance

[Fifth Yard] Practice! Fund Investing/Recommendations for Salaried Workers in Their First Year of Financial Management

Understanding the Reality of 40 Funds/Fund Investment Step 1

41 Identifying the Mysterious Fund Types/Fund Investment Step 2

42 Understanding Fund Management Structure/3 Steps to Fund Investment

43. Researching Low Fund Fees and Fees/Four Steps to Fund Investment

44 Fund Investment Principles! / 5 Steps to Fund Investment

45 Hot Products in the Low-Interest Era 1. ELS

46 Hot Products in the Low-Interest-Rate Era 2: ETFs

[Sixth Yard] Practice! The best way to study stock investment and economics!

47 Stock Investment: At the Crossroads of Jackpot and Fail

48 Stock Investments! Start by Opening an Account

Buying and selling stocks on 49 HTS

Finding Undervalued Stocks Using 50 Investment Metrics/Step 1: Fundamental Analysis

51 Stocks: Finding the Optimal Trading Point/Step 2: Technical Analysis

52 Stock Savings! Long-Term Stock Investment for Salaried Workers

[Seventh Yard] Putting It into Practice! Real Estate Auctions/Achieving the Salaried Worker's Dream of Homeownership

53 Homeownership Preparation for Salaried Workers

54 Ways Salaried Workers Can Buy a Home

Can a salaried worker study auctions while working?

56 I need to study compressed auctions for salaried workers!

57 How to Find Auction Items for a Beginner Auctioneer

58 Auction Study for Beginners 1.

Rights Analysis

59 Auction Study for Beginners 2.

Dividend Analysis

60 Real Estate Auction Site Investigation Tips

61 Don't forget, the auction bidding order

62 It's really over when the balance is paid and the title is confirmed!

[Appendix] It's possible! Financial planning expert/Financing to become rich by saving up your salary.

Appendix 1: Top 3 Financial Products for Investment

Appendix 2: Money-Making Year-End Tax Settlement

Appendix 3: The dream of owning a home, apply!

Appendix 4 Living Smartly in a Rental Home!

Appendix 5: The Last Bastion, Insurance!

[Preparation] Determination! I can't let my hard-earned salary just stray from my bank account!

01 If you manage your paycheck well, you'll be different in 10 years/Change your mindset

02 Tracking 30 days, thoroughly reviewing/investigating paycheck statements

03 Transfer/execute monthly salary account details to household account book

04 Just understanding your spending habits will boost your will to save!/Reflection

05 Let's Block Easy-to-Reduce Expenses First/Solution 1

06 Just master your paycheck and you'll be on track for a profitable life!/Solution 2

07 50% Savings/Investments? Rich Dad, Rich Mom Guaranteed Check!/Solution 3

[First Yard] Practice! Splitting Your Paycheck Account/Money Flow Looks Like a Ghost!

08 Open your paycheck account properly! Stop being a swindler!

09 CMA into a paycheck account? No, absolutely not!

10. Set up automatic payments for fixed expenses (utility bills, etc.)! / Prepare for an exit strategy.

Splitting the November salary account 1.

Expense Account (Living Expenses)/Exit Strategy Step 1

Splitting the December salary account 2.

Emergency Fund Account (Sudden Expenses)/Exit Strategy Step 2

13 Splitting the salary account 3.

Financial Investment Account (Savings/Investment)/3-Step Exit Strategy

14. Create a check card for your spending account and emergency fund account/Complete your exit strategy

[Second Yard] Practice! Save! / Beginners, start with the fun of saving small amounts!

15. “A little bit of money becomes a lot of money!” Repeat this to yourself once a day.

16 Happy Investments! Create a Bucket List in January

17 Cut up your credit cards and only use check cards!

18 The habit of keeping a household account book is the first step to becoming rich!

19-21 days of forced savings! Developing the habit of saving first and spending later

20 Economic News in 3 Lines! Study Habits That Will Make You Rich

21 Self-development is the most reliable way to make money!

[Third Yard] Practice! Savings 2/A Master's Money-Saving Challenge!

22 Even though the salary is the same, the amount of savings varies greatly!

23 Great Challenges! Living on 100,000 Won a Month

24 Save 200,000 Won on Summer Vacation

25. Save 100,000 won on car gas

26 Secret Calendar to Turn 500 Won of Pocket Money into Cash Every Day

27 Maximize your check card discount benefits with selection and focus!

28 Earn a little extra cash with AppTech

29. Gold is the leading safe asset! Gold tech methods

When the $30 level is strong, it's time to invest! How to invest

31 Crowdfunding! Conquering P2P Investment

32 More Powerful 21-Day Savings Plan! Quit Smoking, Cancer Savings Plan

33 Spinning 12 accounts, one account per month

52-week savings plan with weekly increases of 1,000 won

35 18-month savings challenge that will dramatically increase your savings!

[Fourth Step] Practice! Open a savings account/Easy money saving for salaried workers

36. Avoid high-interest savings accounts and bank tricks.

37 Find a safer savings bank with higher interest rates!

How to Use Your CMA Account 200% as a Salaried Worker

39 Personal Pension for Retirement - Pension Savings, Pension Insurance

[Fifth Yard] Practice! Fund Investing/Recommendations for Salaried Workers in Their First Year of Financial Management

Understanding the Reality of 40 Funds/Fund Investment Step 1

41 Identifying the Mysterious Fund Types/Fund Investment Step 2

42 Understanding Fund Management Structure/3 Steps to Fund Investment

43. Researching Low Fund Fees and Fees/Four Steps to Fund Investment

44 Fund Investment Principles! / 5 Steps to Fund Investment

45 Hot Products in the Low-Interest Era 1. ELS

46 Hot Products in the Low-Interest-Rate Era 2: ETFs

[Sixth Yard] Practice! The best way to study stock investment and economics!

47 Stock Investment: At the Crossroads of Jackpot and Fail

48 Stock Investments! Start by Opening an Account

Buying and selling stocks on 49 HTS

Finding Undervalued Stocks Using 50 Investment Metrics/Step 1: Fundamental Analysis

51 Stocks: Finding the Optimal Trading Point/Step 2: Technical Analysis

52 Stock Savings! Long-Term Stock Investment for Salaried Workers

[Seventh Yard] Putting It into Practice! Real Estate Auctions/Achieving the Salaried Worker's Dream of Homeownership

53 Homeownership Preparation for Salaried Workers

54 Ways Salaried Workers Can Buy a Home

Can a salaried worker study auctions while working?

56 I need to study compressed auctions for salaried workers!

57 How to Find Auction Items for a Beginner Auctioneer

58 Auction Study for Beginners 1.

Rights Analysis

59 Auction Study for Beginners 2.

Dividend Analysis

60 Real Estate Auction Site Investigation Tips

61 Don't forget, the auction bidding order

62 It's really over when the balance is paid and the title is confirmed!

[Appendix] It's possible! Financial planning expert/Financing to become rich by saving up your salary.

Appendix 1: Top 3 Financial Products for Investment

Appendix 2: Money-Making Year-End Tax Settlement

Appendix 3: The dream of owning a home, apply!

Appendix 4 Living Smartly in a Rental Home!

Appendix 5: The Last Bastion, Insurance!

Detailed image

Publisher's Review

Don't give up your paycheck for sustainable investing!

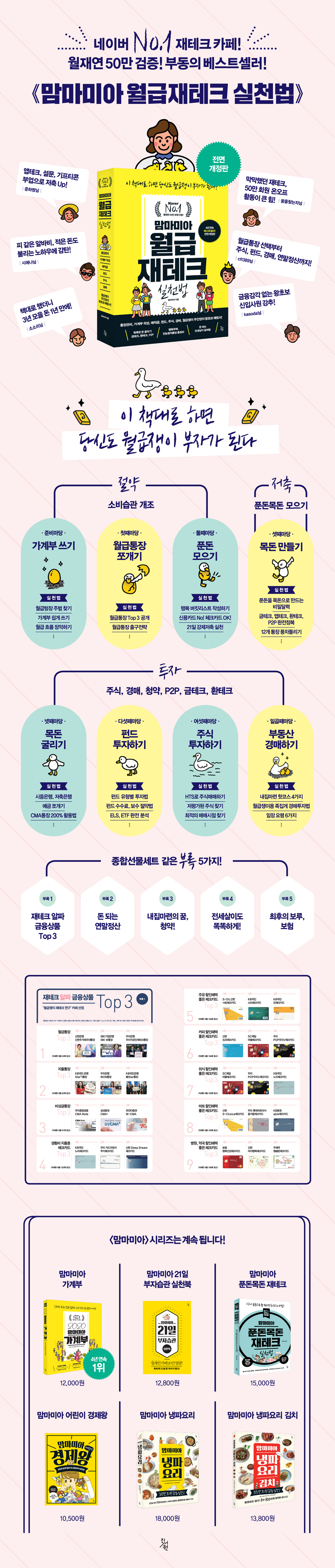

The fundamentals of financial management: saving → saving → investing.

Salaried workers can't become rich? Should they invest in stocks, real estate, or their own business? Author Mammamia says even salaried workers can retire wealthy.

A salaried worker's greatest weapon is his or her salary.

How you manage your monthly salary will determine what you will be like after retirement.

People who make a lot of money through real estate and stocks often quit their jobs, but I tell them that if they want to make sustainable investments, they should maintain their salaried job.

Investment returns are just a lucky bonus, and it is difficult to cover monthly living expenses.

Here's how the author explains how to retire rich.

-Step 1: Realize the importance of small change through saving.

-Step 2: Turn small amounts into large sums of money through savings.

-Step 3: Roll your money through investments.

Step 1 of saving involves not only saving money, but also preventing unnecessary spending.

For this purpose, we introduce methods for writing a household account book, managing a salary account, and 21-day mandatory savings to reduce living expenses, and you can enjoyably achieve the second stage of saving money through secret calendars that turn small amounts into large sums of money, app tech, gold tech, currency tech, P2P investment, bankbook windmilling, and 52-week savings.

Finally, you can master everything about financial management from A to Z in one book, including safe investments for your savings, funds, stocks, and auctions.

Comprehensive Gift Set [Appendix] 5 Items

① Top 3 financial products ② Year-end tax settlement ③ Subscription ④ Leasehold living ⑤ Insurance

In addition, the appendix contains everything that a true financial expert cannot miss, including ① Top 3 financial products recommended by 500,000 members, ② Creating a 13th month salary through year-end tax settlement, ③ Subscription, ④ Smart jeonse living, and ⑤ Insurance.

Are you swayed by the words "I hit the jackpot with stocks" or "I got rich with real estate" as you stare at your empty paycheck every month? Salaried workers aren't professional investors.

Salaried workers who are always pressed for time and work can ruin both their money and their careers by rashly venturing into stocks and real estate, which require sufficient study.

The ultimate goal of a salaried worker's financial planning is happiness.

Don't lose precious happiness while chasing money.

Investing for happiness, not blindly saving! "Mamma Mia's Salary Investment Practices" and the 500,000 members of "Woljaeyeon" support your efforts.

[Recommendation]

If you follow the book, you can save 3 years' worth of money in just 1 year!

After reading the book, I realized the importance of small change.

I saved in one year the money that would take three years to save.

If you follow the book, small amounts of money really become a lot of money!

- Sosori

Save up with app tech, surveys, and gift certificate side jobs!

A basic financial management book I found after suffering losses from hasty investments.

From side hustles like app tech, surveys, and gift cards to various financial know-hows, saving money little by little is a breeze!

- Junha-chan

Highly recommended for new employees with no financial sense!

From the mindset you need to start investing to practical implementation methods! This isn't just a fantasy drama; it's a real guide to investing for salaried workers!

- kasoda

Financial planning was a daunting task, but the on- and off-line activities of 500,000 members were a huge help!

A book filled with real-life stories from our members, inspiring them! A book shared by 500,000 cafe members!

- Dream Seeker

Albabee, who is like blood, is amazed by the know-how of making even small amounts of money!

I was wondering how to manage the money I saved from my part-time job.

It's perfect for small-scale investment strategies like splitting your bank account or spinning a windmill!

- Siena

From your paycheck to stocks, funds, auctions, and year-end tax settlement!

If you've saved money by keeping a household account book, this book will teach you how to manage it! This financial management textbook is worth owning!

- cft389

The fundamentals of financial management: saving → saving → investing.

Salaried workers can't become rich? Should they invest in stocks, real estate, or their own business? Author Mammamia says even salaried workers can retire wealthy.

A salaried worker's greatest weapon is his or her salary.

How you manage your monthly salary will determine what you will be like after retirement.

People who make a lot of money through real estate and stocks often quit their jobs, but I tell them that if they want to make sustainable investments, they should maintain their salaried job.

Investment returns are just a lucky bonus, and it is difficult to cover monthly living expenses.

Here's how the author explains how to retire rich.

-Step 1: Realize the importance of small change through saving.

-Step 2: Turn small amounts into large sums of money through savings.

-Step 3: Roll your money through investments.

Step 1 of saving involves not only saving money, but also preventing unnecessary spending.

For this purpose, we introduce methods for writing a household account book, managing a salary account, and 21-day mandatory savings to reduce living expenses, and you can enjoyably achieve the second stage of saving money through secret calendars that turn small amounts into large sums of money, app tech, gold tech, currency tech, P2P investment, bankbook windmilling, and 52-week savings.

Finally, you can master everything about financial management from A to Z in one book, including safe investments for your savings, funds, stocks, and auctions.

Comprehensive Gift Set [Appendix] 5 Items

① Top 3 financial products ② Year-end tax settlement ③ Subscription ④ Leasehold living ⑤ Insurance

In addition, the appendix contains everything that a true financial expert cannot miss, including ① Top 3 financial products recommended by 500,000 members, ② Creating a 13th month salary through year-end tax settlement, ③ Subscription, ④ Smart jeonse living, and ⑤ Insurance.

Are you swayed by the words "I hit the jackpot with stocks" or "I got rich with real estate" as you stare at your empty paycheck every month? Salaried workers aren't professional investors.

Salaried workers who are always pressed for time and work can ruin both their money and their careers by rashly venturing into stocks and real estate, which require sufficient study.

The ultimate goal of a salaried worker's financial planning is happiness.

Don't lose precious happiness while chasing money.

Investing for happiness, not blindly saving! "Mamma Mia's Salary Investment Practices" and the 500,000 members of "Woljaeyeon" support your efforts.

[Recommendation]

If you follow the book, you can save 3 years' worth of money in just 1 year!

After reading the book, I realized the importance of small change.

I saved in one year the money that would take three years to save.

If you follow the book, small amounts of money really become a lot of money!

- Sosori

Save up with app tech, surveys, and gift certificate side jobs!

A basic financial management book I found after suffering losses from hasty investments.

From side hustles like app tech, surveys, and gift cards to various financial know-hows, saving money little by little is a breeze!

- Junha-chan

Highly recommended for new employees with no financial sense!

From the mindset you need to start investing to practical implementation methods! This isn't just a fantasy drama; it's a real guide to investing for salaried workers!

- kasoda

Financial planning was a daunting task, but the on- and off-line activities of 500,000 members were a huge help!

A book filled with real-life stories from our members, inspiring them! A book shared by 500,000 cafe members!

- Dream Seeker

Albabee, who is like blood, is amazed by the know-how of making even small amounts of money!

I was wondering how to manage the money I saved from my part-time job.

It's perfect for small-scale investment strategies like splitting your bank account or spinning a windmill!

- Siena

From your paycheck to stocks, funds, auctions, and year-end tax settlement!

If you've saved money by keeping a household account book, this book will teach you how to manage it! This financial management textbook is worth owning!

- cft389

GOODS SPECIFICS

- Date of publication: December 6, 2019

- Page count, weight, size: 588 pages | 784g | 145*220*28mm

- ISBN13: 9791186647349

- ISBN10: 1186647345

You may also like

카테고리

korean

korean

![ELLE 엘르 스페셜 에디션 A형 : 12월 [2025]](http://librairie.coreenne.fr/cdn/shop/files/b8e27a3de6c9538896439686c6b0e8fb.jpg?v=1766436872&width=3840)