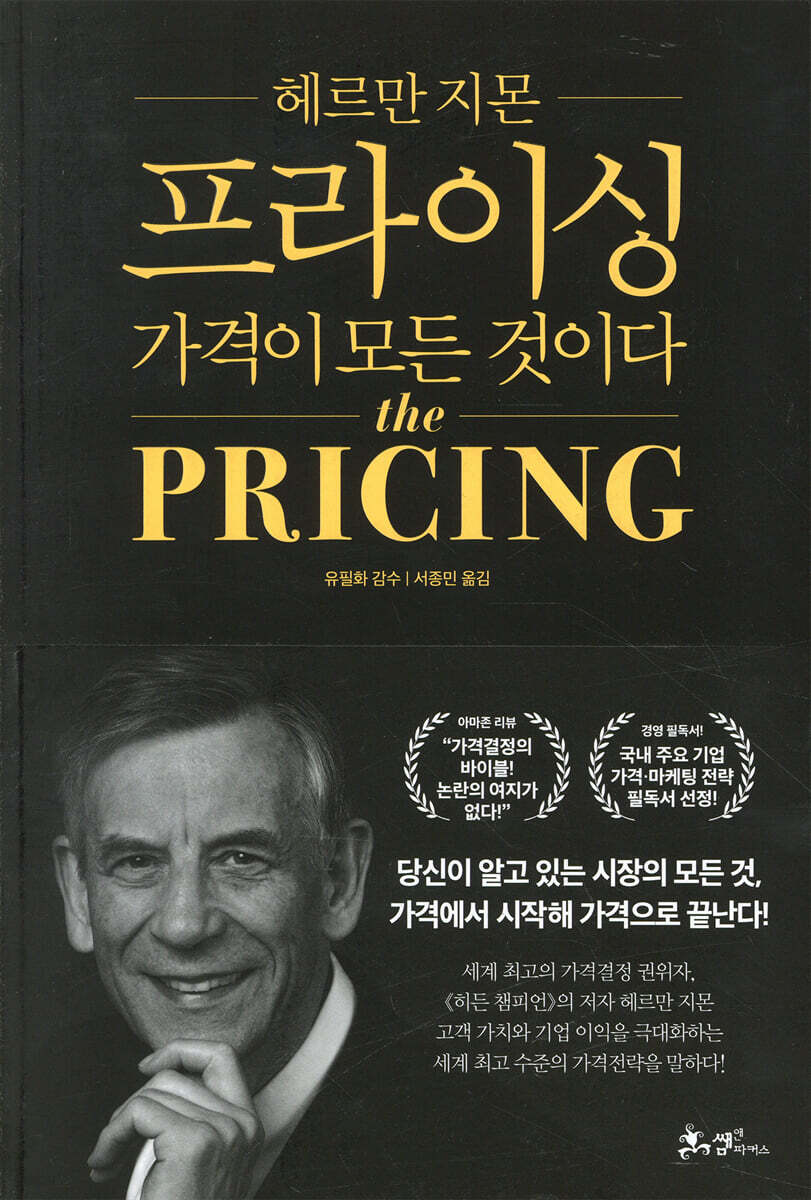

Hermann Simon's Pricing

|

Description

Book Introduction

A new book by Hermann Simon, a world-renowned management scholar born in Germany, Europe's Peter Drucker, chairman of Simon-Kucher & Partners, a world-class pricing consulting firm, and author of the best-selling book "Hidden Champions."

It covers everything about 'pricing'.

It was selected as one of the best business books to read in 2017 by Fortune, an American business magazine, and Amazon.com called it “the bible of pricing.”

In this book, the author guides us through a treasure trove of wisdom regarding 'pricing decisions.'

He presents autobiographical stories of his dramatic encounters with luminaries like Philip Kotler and Peter Drucker, a rich and diverse range of cases he has encountered over the past 40 years, and new, surprising, and innovative pricing methods.

These cases are even more valuable because they are based on vivid, up-to-date data produced by Simon-Kuher & Partners.

This is a must-read for managers, and it is also a must-read for professionals in each field involved in processes such as product conception and planning, post-launch marketing, and sales.

It also provides a very useful standard for consumers who are evaluating the value of numerous products or services and searching for the right price.

It covers everything about 'pricing'.

It was selected as one of the best business books to read in 2017 by Fortune, an American business magazine, and Amazon.com called it “the bible of pricing.”

In this book, the author guides us through a treasure trove of wisdom regarding 'pricing decisions.'

He presents autobiographical stories of his dramatic encounters with luminaries like Philip Kotler and Peter Drucker, a rich and diverse range of cases he has encountered over the past 40 years, and new, surprising, and innovative pricing methods.

These cases are even more valuable because they are based on vivid, up-to-date data produced by Simon-Kuher & Partners.

This is a must-read for managers, and it is also a must-read for professionals in each field involved in processes such as product conception and planning, post-launch marketing, and sales.

It also provides a very useful standard for consumers who are evaluating the value of numerous products or services and searching for the right price.

- You can preview some of the book's contents.

Preview

index

Reviewer's note

Introduction_ 'Confession'

1 A painful first encounter with price

Learning Pricing: The Journey Begins

Teaching Pricing: New Questions, Expanding Horizons

Becoming a Pricing Consultant: From Theory to Reality

2 Everything revolves around price

What does 'price' really mean?

Various pseudonyms applied to 'price'

Pricing: Value is paramount

Value Creation and Value Communication

What Smart Pricing Can Do for You: The 2012 London Olympics

What Smart Pricing Can Do for You: Germany's Rail Card

supply and demand

Scarcity and Cycles

Prices and Government

Pricing power

Pricing expands its own scope.

3 The Mysterious Psychology of Pricing

Price-quality effect

Price as a Quality Indicator

The placebo effect of price

What if prices become obsolete?

Price anchor effect

The Magic of the Middle, or the Lock Story

Neither the lowest price nor the highest price can win.

A filial piety product that no one buys

Create scarcity

Increasing side options increases sales.

Price thresholds and odd prices

prospect theory

Prospect Theory and Prices

Business class or economy class?

Free or Paid: The Big Difference

It's better to pay in cash

The temptation of credit cards

Cash Back and Other Strange Forms

price of the moon

Price structure

Mental Accounting

neural pricing

Conclusion: Beware!

4 Optimal Price Positioning

A successful strategy leveraging low prices

Aldi

IKEA

H&M and Zara

Ryanair

Dell

low-cost alternatives

Amazon and Zalando: Profit vs.

profit

Success Factors of a Low-Price Strategy

Ultra-low prices: Can you go lower than low?

Renault's Dacia Logan and Tata's Nano

Honda Wave

Ultra-low-price positioning of other consumer goods and industrial goods

Ultra-low-priced products for sale in developed countries?

Success factors of ultra-low price policy

Success Strategies for High-Price Policies

Premium pricing

Apple vs.

samsung

Gillette

millet

Porsche

Enercon

Bugs Burger Killer (BBBK)

Premium strategies also have their drawbacks.

Success Factors of a Premium Pricing Strategy

Successful Strategies for Luxury Product Pricing

How much do luxury watches cost?

Swiss watches

LVMH and Richemont

Obstacles in the luxury goods market

Maybach

Is there a limit to the price of luxury goods?

The challenge of creating continuous value

Adhere to limited production quantities

Success Factors of Luxury Product Pricing Strategy

What is the most promising pricing strategy?

5 Profitable price

Are you pursuing the wrong goals?

What effect does a 2% price increase have on profits?

Price is the most effective profit driver.

Back to the Future: General Motors Employee Discount Program

Price, Margin, and Profit

Price is a unique marketing tool.

6. Pricing and Decision-Making

Who, when, where, what, why… and how?

The effect of pricing decisions

Price and quantity

Setting prices based on cost

Follow your competitors

Market-based pricing

Split the value 50:50

How do we find the demand curve and price elasticity?

Expert Judgment: Estimating Price Elasticity Directly

Direct customer surveys on pricing

Indirect customer surveys on price

Price field experiment

Big Data Myths: Using Market Data to Deduce Demand Curves and Price Elasticities

So what about the competitors' prices?

Prisoner's Dilemma: Let's Play

Price leadership

Send a signal

Competitor Reactions and Pricing

What is inflation, and why does it matter when determining prices?

Prices and Inflation: Lessons from Brazil

7 The Essence of Pricing: Price Discrimination

From profit rectangle to profit triangle

How much does a can of Coca-Cola cost?

The difference two prices can make

Why the first beer should be more expensive

Nonlinear pricing in movie theaters

Bundle price

Bundle price consisting of optional items

Unbundle pricing

Multiple customer pricing

The more you buy, the cheaper it gets? Beware!

Price discrimination and price differentials

Price and location

Price and time

Products that are damaged

Patent for dynamic pricing

Equipment utilization rate and price

Price and scarcity

High-Low Strategy vs. EDLP Strategy

Advance booking discount and reservation discount

Market Penetration Strategy: Toyota Lexus

Skimming Strategy: Apple's iPhone

Information and profit cliff

Fence

Pay attention to the cost

8 Innovative Pricing Methods

A groundbreaking improvement in price transparency

Pay as you go

New price unit

Introduction of a new pricing variable: Sanifair

Amazon Prime

industrial gases

ARM

premium

Flat rate

Prepaid plan

Customer-Driven Pricing

Pay the desired amount

profit-oriented incentive system

Price prediction

Intelligent additional pricing plan

A pricing system that allows you to select and purchase only the items you want.

Harvard Business Review Publishing

auction

9 Pricing and Price Wars in an Economic Crisis

What is an economic crisis?

Declining sales or lower prices?

Smart Ways to Lower Prices

Instead of lowering the price, offer cash or goods!

Stay off the consumer's radar

Worst Nightmare: Overcapacity

Price increases during recessions

price war

10 Things a CEO Should Do

Price and shareholder value

Increasing market capitalization through price

An additional $120 million through pricing decisions

Price and market capitalization

The day the Marlboro Man fell off his horse

20% off all items: Practicer Case

The Fatal Impact of a Price War: The Potassium Carbonate Oligopoly

In his own words: Netflix

J.C. Penney's strategy to convert consumers to luxury goods has failed.

Discounts and Promotions: Abercrombie & Fitch

Increasing Market Share by Adhering to Pricing Guidelines: The Case of a Telecom Company

Pricing and Financial Analysts

Prices and private equity investors

Key Roles of Top Management

main

Search

Introduction_ 'Confession'

1 A painful first encounter with price

Learning Pricing: The Journey Begins

Teaching Pricing: New Questions, Expanding Horizons

Becoming a Pricing Consultant: From Theory to Reality

2 Everything revolves around price

What does 'price' really mean?

Various pseudonyms applied to 'price'

Pricing: Value is paramount

Value Creation and Value Communication

What Smart Pricing Can Do for You: The 2012 London Olympics

What Smart Pricing Can Do for You: Germany's Rail Card

supply and demand

Scarcity and Cycles

Prices and Government

Pricing power

Pricing expands its own scope.

3 The Mysterious Psychology of Pricing

Price-quality effect

Price as a Quality Indicator

The placebo effect of price

What if prices become obsolete?

Price anchor effect

The Magic of the Middle, or the Lock Story

Neither the lowest price nor the highest price can win.

A filial piety product that no one buys

Create scarcity

Increasing side options increases sales.

Price thresholds and odd prices

prospect theory

Prospect Theory and Prices

Business class or economy class?

Free or Paid: The Big Difference

It's better to pay in cash

The temptation of credit cards

Cash Back and Other Strange Forms

price of the moon

Price structure

Mental Accounting

neural pricing

Conclusion: Beware!

4 Optimal Price Positioning

A successful strategy leveraging low prices

Aldi

IKEA

H&M and Zara

Ryanair

Dell

low-cost alternatives

Amazon and Zalando: Profit vs.

profit

Success Factors of a Low-Price Strategy

Ultra-low prices: Can you go lower than low?

Renault's Dacia Logan and Tata's Nano

Honda Wave

Ultra-low-price positioning of other consumer goods and industrial goods

Ultra-low-priced products for sale in developed countries?

Success factors of ultra-low price policy

Success Strategies for High-Price Policies

Premium pricing

Apple vs.

samsung

Gillette

millet

Porsche

Enercon

Bugs Burger Killer (BBBK)

Premium strategies also have their drawbacks.

Success Factors of a Premium Pricing Strategy

Successful Strategies for Luxury Product Pricing

How much do luxury watches cost?

Swiss watches

LVMH and Richemont

Obstacles in the luxury goods market

Maybach

Is there a limit to the price of luxury goods?

The challenge of creating continuous value

Adhere to limited production quantities

Success Factors of Luxury Product Pricing Strategy

What is the most promising pricing strategy?

5 Profitable price

Are you pursuing the wrong goals?

What effect does a 2% price increase have on profits?

Price is the most effective profit driver.

Back to the Future: General Motors Employee Discount Program

Price, Margin, and Profit

Price is a unique marketing tool.

6. Pricing and Decision-Making

Who, when, where, what, why… and how?

The effect of pricing decisions

Price and quantity

Setting prices based on cost

Follow your competitors

Market-based pricing

Split the value 50:50

How do we find the demand curve and price elasticity?

Expert Judgment: Estimating Price Elasticity Directly

Direct customer surveys on pricing

Indirect customer surveys on price

Price field experiment

Big Data Myths: Using Market Data to Deduce Demand Curves and Price Elasticities

So what about the competitors' prices?

Prisoner's Dilemma: Let's Play

Price leadership

Send a signal

Competitor Reactions and Pricing

What is inflation, and why does it matter when determining prices?

Prices and Inflation: Lessons from Brazil

7 The Essence of Pricing: Price Discrimination

From profit rectangle to profit triangle

How much does a can of Coca-Cola cost?

The difference two prices can make

Why the first beer should be more expensive

Nonlinear pricing in movie theaters

Bundle price

Bundle price consisting of optional items

Unbundle pricing

Multiple customer pricing

The more you buy, the cheaper it gets? Beware!

Price discrimination and price differentials

Price and location

Price and time

Products that are damaged

Patent for dynamic pricing

Equipment utilization rate and price

Price and scarcity

High-Low Strategy vs. EDLP Strategy

Advance booking discount and reservation discount

Market Penetration Strategy: Toyota Lexus

Skimming Strategy: Apple's iPhone

Information and profit cliff

Fence

Pay attention to the cost

8 Innovative Pricing Methods

A groundbreaking improvement in price transparency

Pay as you go

New price unit

Introduction of a new pricing variable: Sanifair

Amazon Prime

industrial gases

ARM

premium

Flat rate

Prepaid plan

Customer-Driven Pricing

Pay the desired amount

profit-oriented incentive system

Price prediction

Intelligent additional pricing plan

A pricing system that allows you to select and purchase only the items you want.

Harvard Business Review Publishing

auction

9 Pricing and Price Wars in an Economic Crisis

What is an economic crisis?

Declining sales or lower prices?

Smart Ways to Lower Prices

Instead of lowering the price, offer cash or goods!

Stay off the consumer's radar

Worst Nightmare: Overcapacity

Price increases during recessions

price war

10 Things a CEO Should Do

Price and shareholder value

Increasing market capitalization through price

An additional $120 million through pricing decisions

Price and market capitalization

The day the Marlboro Man fell off his horse

20% off all items: Practicer Case

The Fatal Impact of a Price War: The Potassium Carbonate Oligopoly

In his own words: Netflix

J.C. Penney's strategy to convert consumers to luxury goods has failed.

Discounts and Promotions: Abercrombie & Fitch

Increasing Market Share by Adhering to Pricing Guidelines: The Case of a Telecom Company

Pricing and Financial Analysts

Prices and private equity investors

Key Roles of Top Management

main

Search

Into the book

The pricing process begins at the product concept stage.

Companies should think about pricing as early and as often as possible during product development, not just after a product is ready to launch.

Customers and consumers also have a lot to do.

Old adages like "beware of the peddler" and "cheap things are expensive" serve as apt warnings.

As a customer, you need to understand the value that the product or service provides to you and then decide how much you are willing to pay.

Knowing your values is the best protection you can have before making a purchase to avoid regretting your decision.

I must confess that I learned this lesson the hard way.

The farms in my hometown were so small that two or three households had to share one piece of farm equipment.

So when harvest time came, everyone had to help each other.

At the age of 16, frustrated with the time wasting on housework, I decided to take steps to make my family independent.

I bought a used farm machine for $600 without consulting my father.

The price seemed reasonable, and I was proud of myself for finding something worth it.

But we soon despaired when we tried this machine the next harvest season.

The farm machinery was so new and unfamiliar in its construction that it was practically inconvenient to use.

That damn machine kept breaking down.

It broke down way too often for the money I paid for it.

We struggled with the machine for about two years, but it kept failing, so we sold it for scrap.

Here I learned a valuable lesson.

As the French say, “Price is forgotten, quality remains.” This means that the quality of something you buy will be remembered long after you forget the price.

(Pages 45-46)

Pricing was instrumental in the fantastic success of the 2012 Olympic Games in London.

Paul Williamson, who was the general manager of the ticket program, used price not only as an effective incentive to generate revenue and profits, but also as a powerful communication tool.

The price numbers themselves are designed to convey a message without requiring further explanation.

The lowest basic price was £20.12, and the most expensive ticket was £20.12.

The number '2012' appeared repeatedly on the price tag, and everyone immediately knew that this amount meant the Olympic Games.

For youth under 18, a 'pay as you go' system was applied.

A six-year-old child would pay six pounds, and a sixteen-year-old would pay sixteen pounds.

This pricing system was met with great acclaim, and was reported thousands of times in the media.

Even the Queen and Prime Minister of England have publicly praised the 'pay-as-you-go' system.

These prices were considered to be an effective means of communication and, furthermore, were considered very fair.

Seniors were also able to purchase tickets at a discounted price.

Another key point about the London Olympics pricing system is that there was no discount policy at all.

This principle was strictly adhered to throughout the London Olympics, even for events where tickets were not sold.

This immediately sent a strong signal of value: 'The game and its tickets are worth the price.'

Management also decided not to bundle tickets.

It was common practice at sporting events to bundle tickets for popular and unpopular games, but we decided not to do that.

However, public transportation passes for the London area could be purchased as a set with match tickets.

London Olympic management relied heavily on the Internet for both communications and sales.

About 99% of tickets were sold online.

The target for ticket sales before the Olympics was £376 million ($625 million).

But Williamson and his team, with their ingenious pricing and promotional campaigns, managed to generate £660 million ($1.1 billion) in ticket sales, well above their target.

This was 75% more than expected and more than the combined ticket revenue from the three previous Olympics (Beijing, Athens and Sydney) before London.

(pages 52-53)

Unfortunately, many people take the word “profit” as a red flag.

For the past 30 years, Hollywood films have portrayed profit-making activities as debauchery or excess.

We cannot deny that such a thing actually happens.

After all, most of these films are based on real people.

However, I do not think that defending 'profit' means defending greed or excess.

Rather, it is closer to advocating for the survival and growth of companies.

Let's reflect on the words of Peter Drucker, one of the most respected and admired management experts of our time.

“Profit is a condition for survival.

“It is the cost of the future, the cost of maintaining the business.” As the renowned German economist Erich Gutenberg once said, “No business ever went bankrupt while making a profit.”

Profit is a device that guarantees the survival of a company, so it takes priority over all other business goals.

Companies cannot afford to treat profits as a 'nice-to-have' or a 'surprise gift' at the end of the year.

In other words, if the company you work for is not making any profits or takes actions that pose a significant threat to its profits, your job is also at risk.

It's only a matter of time before layoffs arrive.

A prime example of this is what happened to Motorola in late 2006.

Motorola, a mobile communications device maker, reported its highest-ever sales in the fourth quarter of 2006, shortly after it slashed the price of its Razr model.

But this good news was of no use in the face of the enormous disaster they faced.

Profits fell 48% in the quarter.

Billions of dollars were wiped from the company's market capitalization.

Just weeks after these news broke, Motorola announced it would lay off 3,500 employees.

Profit is essential for survival, and therefore good pricing is a means of survival.

Companies should calculate prices with the same rigor they apply to costs.

This book explores many stories of failure due to poor pricing decisions, but it also contains many stories of success from those who took a completely different path.

They created valuable goods and services and then priced them at a level that ensured healthy sales and a healthy profit.

(pages 177-178)

If a manager were to ask me point-blank how to best leverage pricing in their company, what would I say? This isn't a rhetorical question; it's actually a question I hear often.

I know CEOs don't want answers like, "It depends" or "It's very complicated."

They already know that much.

Management wants more than that.

I recently met with the new CEO of a global company with annual revenues exceeding $50 billion.

He explained that the company has historically placed a strong emphasis on market share, an attitude that has become almost an obsession deeply ingrained in the corporate culture.

He said that while it might have been acceptable a few decades ago, the industry the company operates in today has become too mature.

“What should I do?” he asked.

“Do you have any tips for me?”

Of course I said there was no secret plan.

No one can do magic.

But I could give you an answer.

“Make sure you run the company with strict profit-oriented goals,” I said.

“Also, don’t forget that price is the most effective profit generator.”

“That’s easy to say,” he replied, reminding me that his predecessor would publicly rebuke his own reports of market share declines.

“It’s actually incredibly difficult.”

I advised him to recite the mantra 'Price' every day, as often as possible.

You'll be able to remind yourself of the price every time you mention it, and others will hear it just enough to keep it from getting boring.

He also asked them to practice their words consistently and appropriately.

When providing incentives to branch managers, it is also very important to base them on profit, not revenue, quantity, or market share.

Companies should think about pricing as early and as often as possible during product development, not just after a product is ready to launch.

Customers and consumers also have a lot to do.

Old adages like "beware of the peddler" and "cheap things are expensive" serve as apt warnings.

As a customer, you need to understand the value that the product or service provides to you and then decide how much you are willing to pay.

Knowing your values is the best protection you can have before making a purchase to avoid regretting your decision.

I must confess that I learned this lesson the hard way.

The farms in my hometown were so small that two or three households had to share one piece of farm equipment.

So when harvest time came, everyone had to help each other.

At the age of 16, frustrated with the time wasting on housework, I decided to take steps to make my family independent.

I bought a used farm machine for $600 without consulting my father.

The price seemed reasonable, and I was proud of myself for finding something worth it.

But we soon despaired when we tried this machine the next harvest season.

The farm machinery was so new and unfamiliar in its construction that it was practically inconvenient to use.

That damn machine kept breaking down.

It broke down way too often for the money I paid for it.

We struggled with the machine for about two years, but it kept failing, so we sold it for scrap.

Here I learned a valuable lesson.

As the French say, “Price is forgotten, quality remains.” This means that the quality of something you buy will be remembered long after you forget the price.

(Pages 45-46)

Pricing was instrumental in the fantastic success of the 2012 Olympic Games in London.

Paul Williamson, who was the general manager of the ticket program, used price not only as an effective incentive to generate revenue and profits, but also as a powerful communication tool.

The price numbers themselves are designed to convey a message without requiring further explanation.

The lowest basic price was £20.12, and the most expensive ticket was £20.12.

The number '2012' appeared repeatedly on the price tag, and everyone immediately knew that this amount meant the Olympic Games.

For youth under 18, a 'pay as you go' system was applied.

A six-year-old child would pay six pounds, and a sixteen-year-old would pay sixteen pounds.

This pricing system was met with great acclaim, and was reported thousands of times in the media.

Even the Queen and Prime Minister of England have publicly praised the 'pay-as-you-go' system.

These prices were considered to be an effective means of communication and, furthermore, were considered very fair.

Seniors were also able to purchase tickets at a discounted price.

Another key point about the London Olympics pricing system is that there was no discount policy at all.

This principle was strictly adhered to throughout the London Olympics, even for events where tickets were not sold.

This immediately sent a strong signal of value: 'The game and its tickets are worth the price.'

Management also decided not to bundle tickets.

It was common practice at sporting events to bundle tickets for popular and unpopular games, but we decided not to do that.

However, public transportation passes for the London area could be purchased as a set with match tickets.

London Olympic management relied heavily on the Internet for both communications and sales.

About 99% of tickets were sold online.

The target for ticket sales before the Olympics was £376 million ($625 million).

But Williamson and his team, with their ingenious pricing and promotional campaigns, managed to generate £660 million ($1.1 billion) in ticket sales, well above their target.

This was 75% more than expected and more than the combined ticket revenue from the three previous Olympics (Beijing, Athens and Sydney) before London.

(pages 52-53)

Unfortunately, many people take the word “profit” as a red flag.

For the past 30 years, Hollywood films have portrayed profit-making activities as debauchery or excess.

We cannot deny that such a thing actually happens.

After all, most of these films are based on real people.

However, I do not think that defending 'profit' means defending greed or excess.

Rather, it is closer to advocating for the survival and growth of companies.

Let's reflect on the words of Peter Drucker, one of the most respected and admired management experts of our time.

“Profit is a condition for survival.

“It is the cost of the future, the cost of maintaining the business.” As the renowned German economist Erich Gutenberg once said, “No business ever went bankrupt while making a profit.”

Profit is a device that guarantees the survival of a company, so it takes priority over all other business goals.

Companies cannot afford to treat profits as a 'nice-to-have' or a 'surprise gift' at the end of the year.

In other words, if the company you work for is not making any profits or takes actions that pose a significant threat to its profits, your job is also at risk.

It's only a matter of time before layoffs arrive.

A prime example of this is what happened to Motorola in late 2006.

Motorola, a mobile communications device maker, reported its highest-ever sales in the fourth quarter of 2006, shortly after it slashed the price of its Razr model.

But this good news was of no use in the face of the enormous disaster they faced.

Profits fell 48% in the quarter.

Billions of dollars were wiped from the company's market capitalization.

Just weeks after these news broke, Motorola announced it would lay off 3,500 employees.

Profit is essential for survival, and therefore good pricing is a means of survival.

Companies should calculate prices with the same rigor they apply to costs.

This book explores many stories of failure due to poor pricing decisions, but it also contains many stories of success from those who took a completely different path.

They created valuable goods and services and then priced them at a level that ensured healthy sales and a healthy profit.

(pages 177-178)

If a manager were to ask me point-blank how to best leverage pricing in their company, what would I say? This isn't a rhetorical question; it's actually a question I hear often.

I know CEOs don't want answers like, "It depends" or "It's very complicated."

They already know that much.

Management wants more than that.

I recently met with the new CEO of a global company with annual revenues exceeding $50 billion.

He explained that the company has historically placed a strong emphasis on market share, an attitude that has become almost an obsession deeply ingrained in the corporate culture.

He said that while it might have been acceptable a few decades ago, the industry the company operates in today has become too mature.

“What should I do?” he asked.

“Do you have any tips for me?”

Of course I said there was no secret plan.

No one can do magic.

But I could give you an answer.

“Make sure you run the company with strict profit-oriented goals,” I said.

“Also, don’t forget that price is the most effective profit generator.”

“That’s easy to say,” he replied, reminding me that his predecessor would publicly rebuke his own reports of market share declines.

“It’s actually incredibly difficult.”

I advised him to recite the mantra 'Price' every day, as often as possible.

You'll be able to remind yourself of the price every time you mention it, and others will hear it just enough to keep it from getting boring.

He also asked them to practice their words consistently and appropriately.

When providing incentives to branch managers, it is also very important to base them on profit, not revenue, quantity, or market share.

---pp.383~384

Publisher's Review

Bigger profits, stronger competitiveness!

At the center of everything is ‘price’!

Hermann Simon, a global pricing authority and author of "Hidden Champions"

Talking about the best pricing strategy that maximizes 'customer value' and 'corporate profit'!

★ Fortune's "Best Business Books to Read in 2017"

★ "The Bible of Pricing! No Controversy!" _Amazon.com

★ Selected as a must-read for pricing and marketing strategies for major domestic companies!

Hermann Simon, widely known to domestic readers as the author of the best-selling book Hidden Champions, has published a new book, Pricing by Hermann Simon.

As the title suggests, this book covers everything about ‘pricing.’

This book was ranked at the top of the list of the top 5 must-read business books of 2017 selected by the American business magazine Fortune, and its word of mouth was already so widespread that some large domestic companies, recognizing the importance of its contents early on, selected it as a textbook for teaching pricing and marketing strategies.

This Korean edition was reviewed by Professor Pil-Hwa Yoo of Sungkyunkwan University's Graduate School of Business, an authority in the field of domestic pricing, thereby enhancing the rigor and reliability of the terminology and overall content.

Hermann Simon, the world-renowned management scholar born in Germany, the Peter Drucker of Europe, and the chairman of Simon-Kucher & Partners, a firm that boasts the world's best consulting on pricing, guides us through this book with a treasure trove of wisdom on 'pricing' that he has accumulated over the past 40 years (from just after World War II, when he first became curious about 'price' as a child, to the present).

“I confess that this book comprehensively captures my pricing struggles, adventures, triumphs and failures.

“I am still amazed every day by the atypical and creative new pricing ideas that pop up.” As seen in the author’s ‘confession,’ this book presents the author’s autobiographical stories of his first encounter with pricing while working on a livestock farm as a child, his dramatic encounters with masters such as Philip Kotler and Peter Drucker, the rich and diverse cases he has encountered over the past 40 years, and new, surprising, innovative pricing methods.

These cases are even more valuable because they are based on vivid, up-to-date data produced by Simon-Kuher & Partners.

Amazon.com has described Hermann Simon's Pricing as "the bible of pricing."

The Essence of Corporate Management: Pricing and Price Management

A book that perfectly showcases its influence and innovative methods!

This book is the key to the treasure trove of wisdom on 'pricing' that author Hermann Simon has amassed over 40 years.

“Everything you need to know about pricing is in this book.

This story is deeply relevant not only to consumers, but also to managers, executives, sales professionals, and marketing experts.

As your trusted guide, I'll walk you through pricing techniques and strategies, the best and worst pricing practices.

“I hope you enjoy exploring the vast world of price, and that you will encounter a moment that makes you slap your knee at least once along the way.” (From the introduction, “Confession”)

The vast world of pricing remains shrouded in uncertainty and mystery, despite numerous studies, case studies, and countless successes and failures.

As with any field of science, the deeper you delve into the world of "price" and "pricing," the more you learn and the more questions you become.

Price as a point of balance between supply and demand, price as the best marketing weapon to increase sales in a highly competitive market, price as a medium to convey the value of a product, and even price, which is the thing that CEOs should devote the most time and energy to, but which they end up deciding 'carelessly' (or sometimes 'moderately')...

The author unravels all of this in an orderly manner with excellent writing skills and detailed explanations.

A brief overview of the contents of this book, which consists of 10 chapters, is as follows.

Chapter 1 is a fascinating autobiographical account of Hermann Simon's rise to become the world's greatest pricing expert (The Pricing Man).

Even readers unfamiliar with Hermann Simon will quickly feel a sense of familiarity and be immersed in the narrative of pricing that follows.

Chapters 2-4 examine all the elements of our economy that revolve around price, the central role of the mysterious psychology of price, new and surprising discoveries, and how different price positioning can lead to sustained "profits."

This book presents cases of corporate damage caused by price uncertainty, various dimensions of price such as price and value, standard price, discount, bonus, special price, bundled price, wholesale price, retail price, producer's recommended price, special services, and additional services, examples of smart pricing decisions, and the psychological drivers of pricing used as a marketing technique. These are presented in an easy-to-read and engaging manner, with a variety of case studies.

The author emphasizes that among the many aspects of pricing, the most important is 'value'.

To be more specific, it can be said to be ‘value perceived by customers.’

The Latin word 'pretium' has two meanings: 'price' and 'value'.

Literally speaking, price and value are one and the same.

'Value' is mentioned frequently in various ways throughout this book as the basis for understanding the nature of pricing.

Chapters 5 and 6 examine more internal pricing dynamics based on the bird's-eye view covered in Chapters 2 to 4.

In particular, in Chapter 5, the author emphasizes that “profit pursuit is both an incentive for and a consequence of good pricing decisions, and the two cannot be considered separately.”

“Profit is ultimately the only valid criterion that will guide your business.

The reason is simple.

Because profit is the only criterion that allows a company to consider both the revenue and cost aspects simultaneously.

Companies that want to maximize sales tend to ignore the cost aspect.

Companies seeking to maximize market share can distort their operations in numerous ways.

After all, the easiest way to maximize market share is to bring the price down to zero.” Based on this explanation, Chapters 5 and 6 explain the basic economics related to price.

In other words, it presents specific and practical methods for “how to determine prices in a way that will make your company profitable.”

Chapter 7 is 'The Essence of Pricing: Price Discrimination'.

We suggest various pricing strategies to get closer to maximum profit by setting prices at various levels.

We have compiled and organized various strategies that many companies have tried so far, including nonlinear pricing, bundling and unbundling, price discrimination and price differentials, price and time, high-low strategy, EDLP (Every Day Low Price) strategy, and skimming strategy.

Based on this, you will be able to develop and implement a strategy that is suitable for your company.

Chapter 8 examines some of the innovations that have occurred in the field of pricing.

Some of the presented examples are already established concepts, while others are still only potential.

Depending on the type of product and service, and customer preferences and needs, you can encounter innovative pricing strategies that change and emerge constantly.

Chapter 9 introduces pricing strategies that can be utilized in economic crisis situations.

In a situation where the consumer market is shrinking and costs are rising, what is the wisest pricing strategy? Should we cut prices outright? What are the alternatives? What strategies are necessary to ensure profitability when raising prices during a recession? This book will provide answers to the concerns of many domestic mid-sized and small businesses.

Chapter 10 reiterates the profound impact that price has on profits, arguing that this is why CEOs should pay even greater attention to pricing issues.

We offer valuable advice to help you become a market leader, including guidance on long-term profit orientation and tips for short-term success.

The author says he always tells this to countless entrepreneurs.

“Good pricing decisions require three prerequisites:

It's about creating value, quantifying value, and communicating value.

If you do that, you will be able to get the price you deserve, the price that will bring profit to the business.

One more thing, above all else, keep in mind that you must avoid price wars.”

The work of making people spend money will continue without end.

The process of determining prices will also be repeated continuously.

Prices have a history as old as humanity.

Prices existed before money was invented.

Also, everyone produces and consumes value.

There is a constant cycle of spending money and thinking it is worth it, or convincing others that it is worth it.

But many companies still seem to think of value, profit, and price as separate things.

Even companies are unable to properly assign value or price to the act of 'pricing'.

There is a proverb in Russia:

“There are two kinds of fools in every market.

“One is a fool who bids too high, and the other is a fool who bids too low.” Can you say that you don’t fall into either of these two categories?

Hermann Simon's Pricing is a classic, full of insights and guidance that every manager must read, learn, and put into practice.

It is also a must-read for professionals in each field involved in processes such as product conception and planning, post-launch marketing and sales.

Moreover, as the author mentions several times in the book, this book provides very useful criteria for consumers who are constantly evaluating the value of products or services they need and searching for the right price.

In the mid-1970s, Peter Drucker was "impressed" by Hermann Simon's emphasis on pricing, saying it was "the most neglected area of marketing."

Drucker realized that profit was the cost of survival and that price would determine a company's survival.

If we recall Drucker's remarks, based on the premise of fair market practices and price transparency, we will be able to understand the ultimate message of this book, "Hermann Simon's Pricing," namely, why "greater profits" and "stronger competitiveness" begin with pricing.

“Companies that ‘eat’ society are not companies that earn profits commensurate with their true cost of capital, the risks of tomorrow, and the needs of tomorrow’s workers and pensioners.

“Companies that fail at these things are the ones that are eating away at society.”

At the center of everything is ‘price’!

Hermann Simon, a global pricing authority and author of "Hidden Champions"

Talking about the best pricing strategy that maximizes 'customer value' and 'corporate profit'!

★ Fortune's "Best Business Books to Read in 2017"

★ "The Bible of Pricing! No Controversy!" _Amazon.com

★ Selected as a must-read for pricing and marketing strategies for major domestic companies!

Hermann Simon, widely known to domestic readers as the author of the best-selling book Hidden Champions, has published a new book, Pricing by Hermann Simon.

As the title suggests, this book covers everything about ‘pricing.’

This book was ranked at the top of the list of the top 5 must-read business books of 2017 selected by the American business magazine Fortune, and its word of mouth was already so widespread that some large domestic companies, recognizing the importance of its contents early on, selected it as a textbook for teaching pricing and marketing strategies.

This Korean edition was reviewed by Professor Pil-Hwa Yoo of Sungkyunkwan University's Graduate School of Business, an authority in the field of domestic pricing, thereby enhancing the rigor and reliability of the terminology and overall content.

Hermann Simon, the world-renowned management scholar born in Germany, the Peter Drucker of Europe, and the chairman of Simon-Kucher & Partners, a firm that boasts the world's best consulting on pricing, guides us through this book with a treasure trove of wisdom on 'pricing' that he has accumulated over the past 40 years (from just after World War II, when he first became curious about 'price' as a child, to the present).

“I confess that this book comprehensively captures my pricing struggles, adventures, triumphs and failures.

“I am still amazed every day by the atypical and creative new pricing ideas that pop up.” As seen in the author’s ‘confession,’ this book presents the author’s autobiographical stories of his first encounter with pricing while working on a livestock farm as a child, his dramatic encounters with masters such as Philip Kotler and Peter Drucker, the rich and diverse cases he has encountered over the past 40 years, and new, surprising, innovative pricing methods.

These cases are even more valuable because they are based on vivid, up-to-date data produced by Simon-Kuher & Partners.

Amazon.com has described Hermann Simon's Pricing as "the bible of pricing."

The Essence of Corporate Management: Pricing and Price Management

A book that perfectly showcases its influence and innovative methods!

This book is the key to the treasure trove of wisdom on 'pricing' that author Hermann Simon has amassed over 40 years.

“Everything you need to know about pricing is in this book.

This story is deeply relevant not only to consumers, but also to managers, executives, sales professionals, and marketing experts.

As your trusted guide, I'll walk you through pricing techniques and strategies, the best and worst pricing practices.

“I hope you enjoy exploring the vast world of price, and that you will encounter a moment that makes you slap your knee at least once along the way.” (From the introduction, “Confession”)

The vast world of pricing remains shrouded in uncertainty and mystery, despite numerous studies, case studies, and countless successes and failures.

As with any field of science, the deeper you delve into the world of "price" and "pricing," the more you learn and the more questions you become.

Price as a point of balance between supply and demand, price as the best marketing weapon to increase sales in a highly competitive market, price as a medium to convey the value of a product, and even price, which is the thing that CEOs should devote the most time and energy to, but which they end up deciding 'carelessly' (or sometimes 'moderately')...

The author unravels all of this in an orderly manner with excellent writing skills and detailed explanations.

A brief overview of the contents of this book, which consists of 10 chapters, is as follows.

Chapter 1 is a fascinating autobiographical account of Hermann Simon's rise to become the world's greatest pricing expert (The Pricing Man).

Even readers unfamiliar with Hermann Simon will quickly feel a sense of familiarity and be immersed in the narrative of pricing that follows.

Chapters 2-4 examine all the elements of our economy that revolve around price, the central role of the mysterious psychology of price, new and surprising discoveries, and how different price positioning can lead to sustained "profits."

This book presents cases of corporate damage caused by price uncertainty, various dimensions of price such as price and value, standard price, discount, bonus, special price, bundled price, wholesale price, retail price, producer's recommended price, special services, and additional services, examples of smart pricing decisions, and the psychological drivers of pricing used as a marketing technique. These are presented in an easy-to-read and engaging manner, with a variety of case studies.

The author emphasizes that among the many aspects of pricing, the most important is 'value'.

To be more specific, it can be said to be ‘value perceived by customers.’

The Latin word 'pretium' has two meanings: 'price' and 'value'.

Literally speaking, price and value are one and the same.

'Value' is mentioned frequently in various ways throughout this book as the basis for understanding the nature of pricing.

Chapters 5 and 6 examine more internal pricing dynamics based on the bird's-eye view covered in Chapters 2 to 4.

In particular, in Chapter 5, the author emphasizes that “profit pursuit is both an incentive for and a consequence of good pricing decisions, and the two cannot be considered separately.”

“Profit is ultimately the only valid criterion that will guide your business.

The reason is simple.

Because profit is the only criterion that allows a company to consider both the revenue and cost aspects simultaneously.

Companies that want to maximize sales tend to ignore the cost aspect.

Companies seeking to maximize market share can distort their operations in numerous ways.

After all, the easiest way to maximize market share is to bring the price down to zero.” Based on this explanation, Chapters 5 and 6 explain the basic economics related to price.

In other words, it presents specific and practical methods for “how to determine prices in a way that will make your company profitable.”

Chapter 7 is 'The Essence of Pricing: Price Discrimination'.

We suggest various pricing strategies to get closer to maximum profit by setting prices at various levels.

We have compiled and organized various strategies that many companies have tried so far, including nonlinear pricing, bundling and unbundling, price discrimination and price differentials, price and time, high-low strategy, EDLP (Every Day Low Price) strategy, and skimming strategy.

Based on this, you will be able to develop and implement a strategy that is suitable for your company.

Chapter 8 examines some of the innovations that have occurred in the field of pricing.

Some of the presented examples are already established concepts, while others are still only potential.

Depending on the type of product and service, and customer preferences and needs, you can encounter innovative pricing strategies that change and emerge constantly.

Chapter 9 introduces pricing strategies that can be utilized in economic crisis situations.

In a situation where the consumer market is shrinking and costs are rising, what is the wisest pricing strategy? Should we cut prices outright? What are the alternatives? What strategies are necessary to ensure profitability when raising prices during a recession? This book will provide answers to the concerns of many domestic mid-sized and small businesses.

Chapter 10 reiterates the profound impact that price has on profits, arguing that this is why CEOs should pay even greater attention to pricing issues.

We offer valuable advice to help you become a market leader, including guidance on long-term profit orientation and tips for short-term success.

The author says he always tells this to countless entrepreneurs.

“Good pricing decisions require three prerequisites:

It's about creating value, quantifying value, and communicating value.

If you do that, you will be able to get the price you deserve, the price that will bring profit to the business.

One more thing, above all else, keep in mind that you must avoid price wars.”

The work of making people spend money will continue without end.

The process of determining prices will also be repeated continuously.

Prices have a history as old as humanity.

Prices existed before money was invented.

Also, everyone produces and consumes value.

There is a constant cycle of spending money and thinking it is worth it, or convincing others that it is worth it.

But many companies still seem to think of value, profit, and price as separate things.

Even companies are unable to properly assign value or price to the act of 'pricing'.

There is a proverb in Russia:

“There are two kinds of fools in every market.

“One is a fool who bids too high, and the other is a fool who bids too low.” Can you say that you don’t fall into either of these two categories?

Hermann Simon's Pricing is a classic, full of insights and guidance that every manager must read, learn, and put into practice.

It is also a must-read for professionals in each field involved in processes such as product conception and planning, post-launch marketing and sales.

Moreover, as the author mentions several times in the book, this book provides very useful criteria for consumers who are constantly evaluating the value of products or services they need and searching for the right price.

In the mid-1970s, Peter Drucker was "impressed" by Hermann Simon's emphasis on pricing, saying it was "the most neglected area of marketing."

Drucker realized that profit was the cost of survival and that price would determine a company's survival.

If we recall Drucker's remarks, based on the premise of fair market practices and price transparency, we will be able to understand the ultimate message of this book, "Hermann Simon's Pricing," namely, why "greater profits" and "stronger competitiveness" begin with pricing.

“Companies that ‘eat’ society are not companies that earn profits commensurate with their true cost of capital, the risks of tomorrow, and the needs of tomorrow’s workers and pensioners.

“Companies that fail at these things are the ones that are eating away at society.”

GOODS SPECIFICS

- Date of publication: October 13, 2017

- Page count, weight, size: 440 pages | 645g | 152*224*21mm

- ISBN13: 9788965705246

- ISBN10: 896570524X

You may also like

카테고리

korean

korean

![ELLE 엘르 스페셜 에디션 A형 : 12월 [2025]](http://librairie.coreenne.fr/cdn/shop/files/b8e27a3de6c9538896439686c6b0e8fb.jpg?v=1766436872&width=3840)