Hackers IFRS Jeong Yun-don Multiple Choice Financial Accounting

|

Description

Book Introduction

Analysis and reflection of the latest exam trends

A practice book of multiple-choice financial accounting questions to prepare you for the Certified Public Accountant/Certified Tax Accountant exam!

1.

Reflecting all the latest international accounting standards! We've carefully selected questions highly likely to appear on the CPA/CPA first-round exams.

2.

The problems are structured so that you can learn step by step according to your ability level.

3.

You can conveniently study by separating the [Problem] part and the [Answer and Explanation] part into separate volumes.

4.

Strategic exam preparation is possible through [Analysis of CPA/CTA 1st Exam Questions], which thoroughly analyzes past exam questions from the past 10 years (2025-2016).

5.

[Self Study] and [Reference] are included in the commentary to help you organize the key theories and additional explanations necessary for problem solving.

A practice book of multiple-choice financial accounting questions to prepare you for the Certified Public Accountant/Certified Tax Accountant exam!

1.

Reflecting all the latest international accounting standards! We've carefully selected questions highly likely to appear on the CPA/CPA first-round exams.

2.

The problems are structured so that you can learn step by step according to your ability level.

3.

You can conveniently study by separating the [Problem] part and the [Answer and Explanation] part into separate volumes.

4.

Strategic exam preparation is possible through [Analysis of CPA/CTA 1st Exam Questions], which thoroughly analyzes past exam questions from the past 10 years (2025-2016).

5.

[Self Study] and [Reference] are included in the commentary to help you organize the key theories and additional explanations necessary for problem solving.

- You can preview some of the book's contents.

Preview

index

Analysis of the CPA and CTA 1st Exam Questions

PART 1 Intermediate Accounting

Chapter 1 Financial Statements and Conceptual Framework

Check the basic type

Summary of past question types

Related Type Practice

Skill Test Quiz

Chapter 2 Inventory Assets and Agriculture, Forestry and Fisheries

Check the basic type

Summary of past question types

Related Type Practice

Skill Test Quiz

Preview of the second problem

Chapter 3 Tangible Assets

Check the basic type

Summary of past question types

Related Type Practice

Skill Test Quiz

Preview of the second problem

Chapter 4 Capitalization of Borrowing Costs

Check the basic type

Summary of past question types

Related Type Practice

Skill Test Quiz

Preview of the second problem

Chapter 5 Other Assets

Check the basic type

Summary of past question types

Related Type Practice

Skill Test Quiz

Preview of the second problem

Chapter 6 Financial Debt

Check the basic type

Summary of past question types

Related Type Practice

Skill Test Quiz

Preview of the second problem

Chapter 7 Provisions, Interim Financial Reporting, and Disclosure of Special Related Parties

Check the basic type

Summary of past question types

Related Type Practice

Skill Test Quiz

Preview of the second problem

Chapter 8 Capital

Check the basic type

Summary of past question types

Related Type Practice

Skill Test Quiz

Preview of the second problem

Chapter 9 Financial Assets (1)

Check the basic type

Summary of past question types

Related Type Practice

Skill Test Quiz

Preview of the second problem

Chapter 10 Financial Assets (2)

Check the basic type

Summary of past question types

Related Type Practice

Skill Test Quiz

Preview of the second problem

Chapter 11 Complex Financial Products

Check the basic type

Summary of past question types

Related Type Practice

Skill Test Quiz

Preview of the second problem

Chapter 12 Revenue from Contracts with Customers

Check the basic type

Summary of past question types

Related Type Practice

Skill Test Quiz

Preview of the second problem

Chapter 13 Leases

Check the basic type

Summary of past question types

Related Type Practice

Skill Test Quiz

Preview of the second problem

Chapter 14 Employee Compensation and Stock-Based Compensation Transactions

Check the basic type

Summary of past question types

Related Type Practice

Skill Test Quiz

Preview of the second problem

Chapter 15 Corporate Tax Accounting

Check the basic type

Summary of past question types

Related Type Practice

Skill Test Quiz

Preview of the second problem

Chapter 16 Accounting Changes and Error Corrections

Check the basic type

Summary of past question types

Related Type Practice

Skill Test Quiz

Preview of the second problem

Chapter 17 Earnings per Share

Check the basic type

Summary of past question types

Related Type Practice

Skill Test Quiz

Preview of the second problem

Chapter 18 Statement of Cash Flows

Check the basic type

Summary of past question types

Related Type Practice

Skill Test Quiz

Preview of the second problem

PART 2 ADVANCED ACCOUNTING

Chapter 19 Business Combinations

Check the basic type

Summary of past question types

Related Type Practice

Skill Test Quiz

Preview of the second problem

Chapter 20 Consolidated Financial Statements

Check the basic type

Summary of past question types

Related Type Practice

Skill Test Quiz

Preview of the second problem

Chapter 21 Investment in Affiliated Companies and Joint Arrangements

Check the basic type

Summary of past question types

Related Type Practice

Skill Test Quiz

Preview of the second problem

Chapter 22: Effects of Exchange Rate Fluctuations

Summary of past question types

Related Type Practice

Chapter 23 Derivatives and Hedging Accounting

Summary of past question types

Related Type Practice

[Special Edition] Answers and Explanations

PART 1 Intermediate Accounting

Chapter 1 Financial Statements and Conceptual Framework

Check the basic type

Summary of past question types

Related Type Practice

Skill Test Quiz

Chapter 2 Inventory Assets and Agriculture, Forestry and Fisheries

Check the basic type

Summary of past question types

Related Type Practice

Skill Test Quiz

Preview of the second problem

Chapter 3 Tangible Assets

Check the basic type

Summary of past question types

Related Type Practice

Skill Test Quiz

Preview of the second problem

Chapter 4 Capitalization of Borrowing Costs

Check the basic type

Summary of past question types

Related Type Practice

Skill Test Quiz

Preview of the second problem

Chapter 5 Other Assets

Check the basic type

Summary of past question types

Related Type Practice

Skill Test Quiz

Preview of the second problem

Chapter 6 Financial Debt

Check the basic type

Summary of past question types

Related Type Practice

Skill Test Quiz

Preview of the second problem

Chapter 7 Provisions, Interim Financial Reporting, and Disclosure of Special Related Parties

Check the basic type

Summary of past question types

Related Type Practice

Skill Test Quiz

Preview of the second problem

Chapter 8 Capital

Check the basic type

Summary of past question types

Related Type Practice

Skill Test Quiz

Preview of the second problem

Chapter 9 Financial Assets (1)

Check the basic type

Summary of past question types

Related Type Practice

Skill Test Quiz

Preview of the second problem

Chapter 10 Financial Assets (2)

Check the basic type

Summary of past question types

Related Type Practice

Skill Test Quiz

Preview of the second problem

Chapter 11 Complex Financial Products

Check the basic type

Summary of past question types

Related Type Practice

Skill Test Quiz

Preview of the second problem

Chapter 12 Revenue from Contracts with Customers

Check the basic type

Summary of past question types

Related Type Practice

Skill Test Quiz

Preview of the second problem

Chapter 13 Leases

Check the basic type

Summary of past question types

Related Type Practice

Skill Test Quiz

Preview of the second problem

Chapter 14 Employee Compensation and Stock-Based Compensation Transactions

Check the basic type

Summary of past question types

Related Type Practice

Skill Test Quiz

Preview of the second problem

Chapter 15 Corporate Tax Accounting

Check the basic type

Summary of past question types

Related Type Practice

Skill Test Quiz

Preview of the second problem

Chapter 16 Accounting Changes and Error Corrections

Check the basic type

Summary of past question types

Related Type Practice

Skill Test Quiz

Preview of the second problem

Chapter 17 Earnings per Share

Check the basic type

Summary of past question types

Related Type Practice

Skill Test Quiz

Preview of the second problem

Chapter 18 Statement of Cash Flows

Check the basic type

Summary of past question types

Related Type Practice

Skill Test Quiz

Preview of the second problem

PART 2 ADVANCED ACCOUNTING

Chapter 19 Business Combinations

Check the basic type

Summary of past question types

Related Type Practice

Skill Test Quiz

Preview of the second problem

Chapter 20 Consolidated Financial Statements

Check the basic type

Summary of past question types

Related Type Practice

Skill Test Quiz

Preview of the second problem

Chapter 21 Investment in Affiliated Companies and Joint Arrangements

Check the basic type

Summary of past question types

Related Type Practice

Skill Test Quiz

Preview of the second problem

Chapter 22: Effects of Exchange Rate Fluctuations

Summary of past question types

Related Type Practice

Chapter 23 Derivatives and Hedging Accounting

Summary of past question types

Related Type Practice

[Special Edition] Answers and Explanations

Detailed image

Publisher's Review

Hackers Management Academy, the #1 Certified Public Accountant/Tax Accountant Training Institute

Ranked #1 in the Accounting category of the 2023 Korea Brand Satisfaction Index Education (Online/Offline) by Weekly Donga

Analysis and reflection of the latest exam trends

A practice book of multiple-choice financial accounting questions to prepare you for the Certified Public Accountant/Certified Tax Accountant exam!

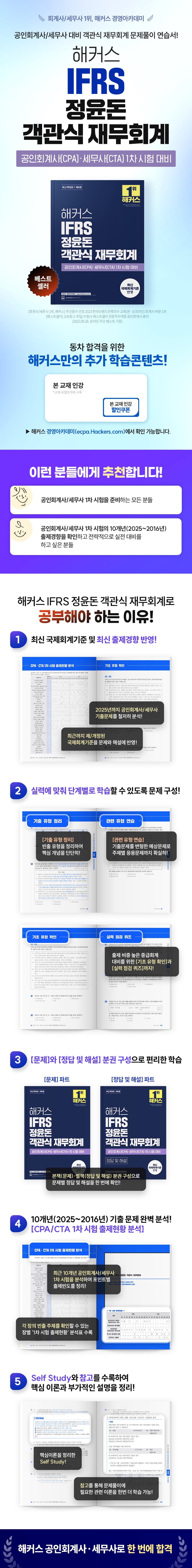

[Recommended for these people]

1.

Everyone preparing for the first CPA/Tax Accountant exam

2.

Those who want to check the 10-year (2025-2016) exam trends for the Certified Public Accountant/Tax Accountant 1st Exam and strategically prepare for the actual exam.

[Hacker's Textbook's Unique Features]

1.

Reflecting all the latest international accounting standards! We've carefully selected questions highly likely to appear on the CPA/CPA first-round exams.

1) The recently established/revised international accounting standards have been faithfully reflected in the questions and explanations.

2) We have thoroughly analyzed past CPA/Tax Accountant exam questions up to 2025 and included only those questions with a high probability of appearing on the exam.

2.

The problems are structured so that you can learn step by step according to your ability level.

1) You can solidify your fundamentals by reviewing key concepts once again through the 'Summary of Past Questions', which organizes frequently appearing types of questions.

2) You can prepare for topic-specific application problems with 'Related Type Practice', which consists of expected questions modified from previous exam questions.

3) For intermediate accounting, which has a high proportion of questions, you can prepare more thoroughly by adding learning stages such as 'Checking Basic Types' and 'Quiz to Check Skills'.

3.

You can conveniently study by separating the [Problem] part and the [Answer and Explanation] part into separate volumes.

The textbook is divided into a main book containing the 'Problems' section and a separate book containing the 'Answers and Explanations' section, so that when solving problems, you can focus only on the problems and check the answers and explanations for each problem at once.

4.

Strategic exam preparation is possible through [Analysis of CPA/CTA 1st Exam Questions], which thoroughly analyzes past exam questions from the past 10 years (2025-2016).

1) You can prepare for the exam efficiently by identifying important topics through the 'Analysis of CPA/CTA 1st Exam Questions', which analyzes the 1st CPA/CTA exams over the past 10 years and organizes the frequency of questions by point.

2) By including a 'First Exam Questions Status' analysis table for each chapter, you can check frequently appearing topics in each chapter and study strategically before starting full-scale study.

5.

[Self Study] and [Reference] are included in the commentary to help you organize the key theories and additional explanations necessary for problem solving.

You can study the relevant theories needed to solve problems once more by including 'Self Study', which summarizes the core theories, and 'Reference', which provides additional explanations, in the commentary.

Hackers' Additional Learning Content for Passing the CPA Exam - Hackers Management Academy (cpa.Hackers.com)

1.

This textbook lecture (discount coupon included in the textbook)

Ranked #1 in the Accounting category of the 2023 Korea Brand Satisfaction Index Education (Online/Offline) by Weekly Donga

Analysis and reflection of the latest exam trends

A practice book of multiple-choice financial accounting questions to prepare you for the Certified Public Accountant/Certified Tax Accountant exam!

[Recommended for these people]

1.

Everyone preparing for the first CPA/Tax Accountant exam

2.

Those who want to check the 10-year (2025-2016) exam trends for the Certified Public Accountant/Tax Accountant 1st Exam and strategically prepare for the actual exam.

[Hacker's Textbook's Unique Features]

1.

Reflecting all the latest international accounting standards! We've carefully selected questions highly likely to appear on the CPA/CPA first-round exams.

1) The recently established/revised international accounting standards have been faithfully reflected in the questions and explanations.

2) We have thoroughly analyzed past CPA/Tax Accountant exam questions up to 2025 and included only those questions with a high probability of appearing on the exam.

2.

The problems are structured so that you can learn step by step according to your ability level.

1) You can solidify your fundamentals by reviewing key concepts once again through the 'Summary of Past Questions', which organizes frequently appearing types of questions.

2) You can prepare for topic-specific application problems with 'Related Type Practice', which consists of expected questions modified from previous exam questions.

3) For intermediate accounting, which has a high proportion of questions, you can prepare more thoroughly by adding learning stages such as 'Checking Basic Types' and 'Quiz to Check Skills'.

3.

You can conveniently study by separating the [Problem] part and the [Answer and Explanation] part into separate volumes.

The textbook is divided into a main book containing the 'Problems' section and a separate book containing the 'Answers and Explanations' section, so that when solving problems, you can focus only on the problems and check the answers and explanations for each problem at once.

4.

Strategic exam preparation is possible through [Analysis of CPA/CTA 1st Exam Questions], which thoroughly analyzes past exam questions from the past 10 years (2025-2016).

1) You can prepare for the exam efficiently by identifying important topics through the 'Analysis of CPA/CTA 1st Exam Questions', which analyzes the 1st CPA/CTA exams over the past 10 years and organizes the frequency of questions by point.

2) By including a 'First Exam Questions Status' analysis table for each chapter, you can check frequently appearing topics in each chapter and study strategically before starting full-scale study.

5.

[Self Study] and [Reference] are included in the commentary to help you organize the key theories and additional explanations necessary for problem solving.

You can study the relevant theories needed to solve problems once more by including 'Self Study', which summarizes the core theories, and 'Reference', which provides additional explanations, in the commentary.

Hackers' Additional Learning Content for Passing the CPA Exam - Hackers Management Academy (cpa.Hackers.com)

1.

This textbook lecture (discount coupon included in the textbook)

GOODS SPECIFICS

- Date of issue: September 16, 2025

- Page count, weight, size: 1,124 pages | 188*257*60mm

- ISBN13: 9791174043535

- ISBN10: 1174043539

You may also like

카테고리

korean

korean

![ELLE 엘르 스페셜 에디션 A형 : 12월 [2025]](http://librairie.coreenne.fr/cdn/shop/files/b8e27a3de6c9538896439686c6b0e8fb.jpg?v=1766436872&width=3840)