Soros Investment Special Lecture

|

Description

Book Introduction

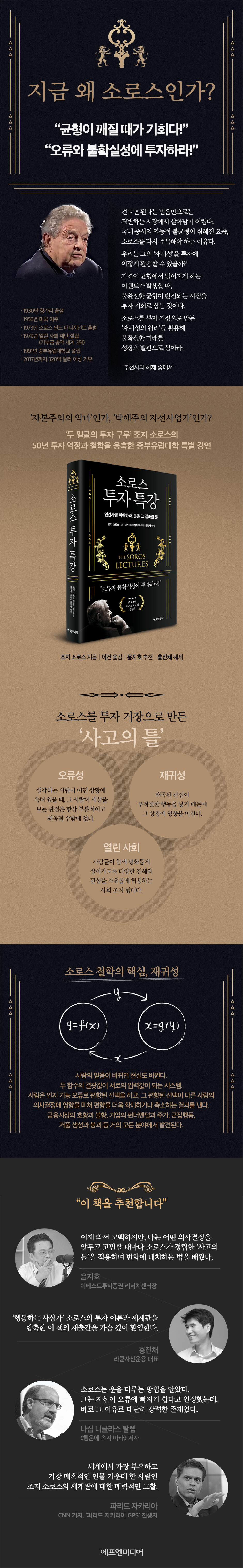

When the balance is broken, that's the opportunity!

Invest in errors and uncertainty!

If you want to make money, understand 'humans'!

A book that encapsulates the investment theories and worldview of George Soros, considered "the greatest fund manager alive."

This book compiles lectures Soros gave over five days in October 2009 at the Central European University, which he founded.

For him, who is now in his 90s, this was practically his 'last lecture'.

In his lecture, Soros emphasized that the "principle of human uncertainty," which is characterized by fallibility and reflexivity, is a core characteristic of human history, and that the scope of uncertainty is also uncertain and can sometimes grow infinitely.

Therefore, it is meaningless to accurately predict what happens in the market or in society when people are involved.

The explanation is that we have no choice but to respond faithfully depending on the situation.

While people tried to predict market conditions, Soros took advantage of uncertainty.

In Lectures 1 and 2, we explained the concepts of fallibility and reflexivity, which are the basis of the "Soros-style thinking framework," and applied them to analyze financial markets and financial crises.

In addition, in the third and fourth lectures, after expressing his beliefs about an open society, he addressed the conflict and moral issues that arise between market values and social values.

In the final five lectures, we examine financial markets as a product of history, delve into the past and present of international politics and economics, and look to the future. We also offer our views on China, whose status is rising day by day.

In Korea, too, Soros's message is receiving renewed attention as more and more investors are exposed to "dynamic imbalances" thanks to the recent stock investment boom.

Yoon Ji-ho, head of the research center at IBK Investment & Securities, said, “Whenever I was faced with a decision, I applied the ‘framework of thought’ established by Soros to cope with change.”

Hong Jin-chae, CEO of Raccoon Asset Management, added, “Soros’ simple proposition that ‘when people’s beliefs change, reality changes’ has the potential to be an antidote not only to capital market problems but also to social issues.”

Invest in errors and uncertainty!

If you want to make money, understand 'humans'!

A book that encapsulates the investment theories and worldview of George Soros, considered "the greatest fund manager alive."

This book compiles lectures Soros gave over five days in October 2009 at the Central European University, which he founded.

For him, who is now in his 90s, this was practically his 'last lecture'.

In his lecture, Soros emphasized that the "principle of human uncertainty," which is characterized by fallibility and reflexivity, is a core characteristic of human history, and that the scope of uncertainty is also uncertain and can sometimes grow infinitely.

Therefore, it is meaningless to accurately predict what happens in the market or in society when people are involved.

The explanation is that we have no choice but to respond faithfully depending on the situation.

While people tried to predict market conditions, Soros took advantage of uncertainty.

In Lectures 1 and 2, we explained the concepts of fallibility and reflexivity, which are the basis of the "Soros-style thinking framework," and applied them to analyze financial markets and financial crises.

In addition, in the third and fourth lectures, after expressing his beliefs about an open society, he addressed the conflict and moral issues that arise between market values and social values.

In the final five lectures, we examine financial markets as a product of history, delve into the past and present of international politics and economics, and look to the future. We also offer our views on China, whose status is rising day by day.

In Korea, too, Soros's message is receiving renewed attention as more and more investors are exposed to "dynamic imbalances" thanks to the recent stock investment boom.

Yoon Ji-ho, head of the research center at IBK Investment & Securities, said, “Whenever I was faced with a decision, I applied the ‘framework of thought’ established by Soros to cope with change.”

Hong Jin-chae, CEO of Raccoon Asset Management, added, “Soros’ simple proposition that ‘when people’s beliefs change, reality changes’ has the potential to be an antidote not only to capital market problems but also to social issues.”

- You can preview some of the book's contents.

Preview

index

Recommendation: The Two-Faced Investment Guru | Jiho Yoon

preface

First lecture.

Principle of Uncertainty

Understand human history, money is just a consequence.

Second lecture.

financial markets

Invest in errors and uncertainty

Third lecture.

open society

Beyond the era of 'abundant errors'

Fourth lecture.

Capitalism or Open Society?

Who ignores the truth and manipulates public opinion?

Fifth lecture.

The way forward

The market needs global regulation.

Translator's Note _ A Man Who Knows How to Handle Luck | This is

Release _ A Passion for an "Open Society" Overshadowed by "Speculator" Prejudice | Hong Jin-chae

preface

First lecture.

Principle of Uncertainty

Understand human history, money is just a consequence.

Second lecture.

financial markets

Invest in errors and uncertainty

Third lecture.

open society

Beyond the era of 'abundant errors'

Fourth lecture.

Capitalism or Open Society?

Who ignores the truth and manipulates public opinion?

Fifth lecture.

The way forward

The market needs global regulation.

Translator's Note _ A Man Who Knows How to Handle Luck | This is

Release _ A Passion for an "Open Society" Overshadowed by "Speculator" Prejudice | Hong Jin-chae

Detailed image

Into the book

Soros drew his approach to finance from philosophy, and added his own ideas to Popper's philosophy to create the concept of "reflexivity."

The catchphrase of this book, “Invest in errors and uncertainty,” means taking advantage of the interrelationship between the market and investors, and this is precisely the investment use of reflexivity.

--- p.10

In economics, we first assume complete knowledge, and when this assumption becomes difficult to sustain, we make more distorted assumptions.

Economics finally developed the theory of rational expectations.

According to this theory, there is only one optimal view of the future, and the views of all market participants will eventually converge on this view.

It's absolutely absurd, but if economic theory is to be like Newtonian physics, it has to make claims like this.

--- p.59~60

When I see a bubble forming, I immediately buy the asset and pour oil on the fire.

This is not unusual behavior.

Therefore, if there is a risk that the bubble will grow too large, regulators must respond to the market.

No matter how knowledgeable and rational market participants may be, they should not be trusted.

--- p.81

Just as others are devoted to religion, I am devoted to the objective aspect of reality.

In situations where there is no perfect knowledge, faith is necessary.

Other people believe in God, but I have come to believe in harsh reality.

Even so, if society ignores the objective aspects of reality, it is in danger.

If we try to avoid unpleasant realities by deceiving ourselves or the voters, we will be punished by reality and will not be able to meet our expectations.

--- p.130

Market fundamentalism has given morality to the originally amoral function of the market and transformed the pursuit of self-interest into a civic consciousness similar to the pursuit of truth.

Market fundamentalism has become widespread not through the power of reason but through the power of manipulation.

A powerful, well-funded propaganda machine supports market fundamentalism while distorting the public's perception of profit.

--- p.164

The point I'm trying to make is that the scope of regulation must be global.

Otherwise, financial markets cannot be maintained at a global level.

It will collapse because of deals that take advantage of regulatory differences.

Companies will migrate to countries with the least regulations, taking on risks that other countries would find difficult to handle.

--- p.196

As an investor, he seems aptly described as a 'successful white hat hacker'.

A 'white hat hacker' is someone who hacks to analyze and warn of vulnerabilities in security systems.

He describes his investment activities as a way to make money legally by discovering flaws in the system and as an act of sounding the alarm by informing policymakers of the system's flaws.

--- p.222

The core of Soros's investment is that he views the market not from an equilibrium perspective but from a recursive perspective, which fundamentally changes the market dominated by equilibrium theory.

(Omitted) Soros' concept of reflexivity provides a new and very useful perspective for me and all other investors.

When people's beliefs change, reality changes too.

This simple proposition, which can be summarized in one sentence, has placed one man among the world's greatest investors.

This one sentence has the potential to be an antidote to the fundamental problems not only of the capital market but of this society as well.

The catchphrase of this book, “Invest in errors and uncertainty,” means taking advantage of the interrelationship between the market and investors, and this is precisely the investment use of reflexivity.

--- p.10

In economics, we first assume complete knowledge, and when this assumption becomes difficult to sustain, we make more distorted assumptions.

Economics finally developed the theory of rational expectations.

According to this theory, there is only one optimal view of the future, and the views of all market participants will eventually converge on this view.

It's absolutely absurd, but if economic theory is to be like Newtonian physics, it has to make claims like this.

--- p.59~60

When I see a bubble forming, I immediately buy the asset and pour oil on the fire.

This is not unusual behavior.

Therefore, if there is a risk that the bubble will grow too large, regulators must respond to the market.

No matter how knowledgeable and rational market participants may be, they should not be trusted.

--- p.81

Just as others are devoted to religion, I am devoted to the objective aspect of reality.

In situations where there is no perfect knowledge, faith is necessary.

Other people believe in God, but I have come to believe in harsh reality.

Even so, if society ignores the objective aspects of reality, it is in danger.

If we try to avoid unpleasant realities by deceiving ourselves or the voters, we will be punished by reality and will not be able to meet our expectations.

--- p.130

Market fundamentalism has given morality to the originally amoral function of the market and transformed the pursuit of self-interest into a civic consciousness similar to the pursuit of truth.

Market fundamentalism has become widespread not through the power of reason but through the power of manipulation.

A powerful, well-funded propaganda machine supports market fundamentalism while distorting the public's perception of profit.

--- p.164

The point I'm trying to make is that the scope of regulation must be global.

Otherwise, financial markets cannot be maintained at a global level.

It will collapse because of deals that take advantage of regulatory differences.

Companies will migrate to countries with the least regulations, taking on risks that other countries would find difficult to handle.

--- p.196

As an investor, he seems aptly described as a 'successful white hat hacker'.

A 'white hat hacker' is someone who hacks to analyze and warn of vulnerabilities in security systems.

He describes his investment activities as a way to make money legally by discovering flaws in the system and as an act of sounding the alarm by informing policymakers of the system's flaws.

--- p.222

The core of Soros's investment is that he views the market not from an equilibrium perspective but from a recursive perspective, which fundamentally changes the market dominated by equilibrium theory.

(Omitted) Soros' concept of reflexivity provides a new and very useful perspective for me and all other investors.

When people's beliefs change, reality changes too.

This simple proposition, which can be summarized in one sentence, has placed one man among the world's greatest investors.

This one sentence has the potential to be an antidote to the fundamental problems not only of the capital market but of this society as well.

--- p.238

Publisher's Review

The definitive Sorosian "winning thinking" and "human ecology"

50 years of investment experience, wisdom, and dreams unfold in 5 lectures over 5 days.

"Soros Investment Special Lecture" is the definitive edition of Soros's "winning thinking" and "human ecology," in which George Soros, "the greatest fund manager alive," candidly shares his life's experiences, wisdom, and dreams.

In the introduction to the book, Soros stated that he was able to make money by developing his own 'framework of thought,' and that the goal of this book was to provide a framework of thought that could help us better understand human affairs.

People listen to Soros because they want to know "how to make money," but he says that to be successful in investing, business, and even life itself, you need to be able to see through "human error and uncertainty."

This book is a compilation of lectures given by Soros over five days at the University of Central Europe. It has been republished with commentary by domestic investment experts at the request of readers who were disappointed that the first edition of "The Winning Paradigm" (2010) and the revised edition of "Confessions of a Billionaire" (2014) were out of print.

In Lectures 1 and 2, we explained the concepts of fallibility and reflexivity, which are the basis of the "Soros-style thinking framework," and applied them to analyze financial markets and financial crises.

In the third and fourth lectures, after expressing his convictions about an open society, he addressed the conflicts and moral issues that arise between market and social values, and also presented his views on political power.

The final five lectures examine financial markets as a product of history, providing insight into the past and present of international politics and economics, and looking ahead to the future. They also provide a perspective on China, whose status is rising day by day.

If you want to make money, understand 'humans'.

The basis of Soros's 'frame of thought' is 'fallibility'.

This concept assumes that when a thinking person is in a certain situation, his or her perspective on the world is always partial and distorted.

Because the world is too complex for humans to understand, and it requires us to understand ourselves as well.

People often make mistakes in the process of simplifying complex reality, and these mistakes influence not only the market but also the flow of history.

Fallibility leads to 'reflexivity', which is the core of Soros's thinking.

This concept comes from the two-way relationship between human thought and reality.

A feedback loop continues, with people's distorted thoughts influencing reality, and the flow of reality in turn influencing people's perspectives.

This creates a gap between people's intentions and actions, and actions and outcomes, making it uncertain how reality will unfold.

Soros emphasizes that the "principle of human uncertainty," based on fallibility and reflexivity, is a core characteristic of human history, and that the scope of uncertainty is also uncertain and can sometimes grow infinitely.

According to this, it is meaningless to accurately predict what happens in the market or in society when people are involved.

It seems that we have no choice but to respond faithfully depending on the situation.

Ultimately, while people were trying to predict market conditions, Soros was taking advantage of the uncertainty.

Around the age of 50, Soros also experienced a slump.

Even though I was earning enough money for my family to live comfortably, I began to doubt whether running a costly and stressful hedge fund was worth it.

At this time, Soros overcame his midlife crisis by deciding to contribute to promoting an "open society," which led to his global philanthropic efforts.

The concept of an “open society,” taken from the philosophy of Karl Popper, Soros’ lifelong mentor, is based on the recognition that no one can know the ultimate truth.

An open society is one in which people's diverse opinions and free criticism are accepted, and through this, mistakes can be corrected.

The goal is to move toward a better world where the values of democracy based on individual freedom function properly.

The enemy of open society: market fundamentalism

“Don’t you feel guilty about making so much money in the stock market?” Soros responded to an audience member’s question, saying that until he became a prominent figure influencing the markets, he never considered morality in his decision-making.

This is a statement that emphasizes the super-morality of market functions, which is distinct from immorality.

Rather, he argues that the problem is that market fundamentalism has transformed the pursuit of self-interest into civic consciousness, such as the pursuit of truth, by imbuing the amoral function of the market with morality.

Soros says that while he was a fund manager, he tried to maximize his own profits within the law, but now he supports improving the law, such as regulating hedge funds, even if it harms his personal interests.

Unlike the market, politics cannot function properly without morality.

He explains that the concept of morality that arises from this difference between market value and social value is a key concept that forms his thinking, and that he feels a moral obligation to make good use of the privileged position he currently holds.

I believe that if more people can distinguish between the functions of participating in politics and the functions of participating in the market, the function of democracy will improve.

A "thinker of action" with the world's second-largest donation total

Reviews of Soros range from "the ruthless demon of capitalism" to "philanthropist."

All the media is interested in is where the 'King of Speculation' will attack next.

The 1992 pound sell-off that catapulted him to the ranks of the big shots was a plan devised by his right-hand man, Stanley Druckenmiller.

At that point, Soros had already withdrawn from his day-to-day fund management and was focusing on democratization in Eastern Europe.

In Korea, the label of 'IMF's main culprit' follows him around.

In January 1998, Soros visited Korea at the invitation of President-elect Kim Dae-jung, promised to invest in Korea, and then actually took over Seoul Securities, showing his willingness to inject funds into the troubled nation. However, this fact has long been forgotten.

Even those who remember the incident describe him as extending his 'hand of speculation' to Korea and 'swindling' hundreds of billions of won.

However, experts say that “there are few people as famous yet undervalued as Soros.”

The fact that the Open Society Foundations he founded are the world's second-largest foundation in terms of total donations after the Bill & Melinda Gates Foundation, that he devoted all his energy to establishing democracy in Eastern Europe after the fall of the Soviet Union, and that he supports environmental issues and strengthening regulations, etc., do not receive much attention.

It is up to the readers to evaluate Soros's life and philosophy.

However, at least through this book, Soros is an extraordinary person who has lived his entire life steadfastly sticking to his convictions.

"A person who lives more like Popper than Popper"

It is also noteworthy that Nicholas Taleb, famous for his caustic remarks, evaluated Soros in his book Fooled by Randomness.

Taleb disparaged Soros, saying he was simply trying to make money and gain a superior position because he was not recognized by other intellectuals.

However, the criticism was limited to this 'light' level, and he even praised Soros, saying that thanks to Soros, he had rediscovered the only philosopher he truly respects, Karl Popper.

(It is very rare for someone to be praised by Taleb.)

“Soros knew how to manipulate luck.

He always maintained an extremely open mind and changed his views without any hesitation.

He always admitted that he was prone to error, which is why he was so powerful.

He understood Popper.

You shouldn't judge Soros just by reading his writing.

He lived a life like Popper.

“George Soros, who is extremely self-critical, lives more like Popper than Popper himself.”

Soros's concepts of fallibility and reflexivity are not widely accepted in academia, nor are they easy to understand.

However, if after reading this book you realize how prone you are to error and find yourself reflecting on every decision, including investing, then this book was worth the price.

What made Soros truly powerful was his humility to admit that he could be wrong at any time.

50 years of investment experience, wisdom, and dreams unfold in 5 lectures over 5 days.

"Soros Investment Special Lecture" is the definitive edition of Soros's "winning thinking" and "human ecology," in which George Soros, "the greatest fund manager alive," candidly shares his life's experiences, wisdom, and dreams.

In the introduction to the book, Soros stated that he was able to make money by developing his own 'framework of thought,' and that the goal of this book was to provide a framework of thought that could help us better understand human affairs.

People listen to Soros because they want to know "how to make money," but he says that to be successful in investing, business, and even life itself, you need to be able to see through "human error and uncertainty."

This book is a compilation of lectures given by Soros over five days at the University of Central Europe. It has been republished with commentary by domestic investment experts at the request of readers who were disappointed that the first edition of "The Winning Paradigm" (2010) and the revised edition of "Confessions of a Billionaire" (2014) were out of print.

In Lectures 1 and 2, we explained the concepts of fallibility and reflexivity, which are the basis of the "Soros-style thinking framework," and applied them to analyze financial markets and financial crises.

In the third and fourth lectures, after expressing his convictions about an open society, he addressed the conflicts and moral issues that arise between market and social values, and also presented his views on political power.

The final five lectures examine financial markets as a product of history, providing insight into the past and present of international politics and economics, and looking ahead to the future. They also provide a perspective on China, whose status is rising day by day.

If you want to make money, understand 'humans'.

The basis of Soros's 'frame of thought' is 'fallibility'.

This concept assumes that when a thinking person is in a certain situation, his or her perspective on the world is always partial and distorted.

Because the world is too complex for humans to understand, and it requires us to understand ourselves as well.

People often make mistakes in the process of simplifying complex reality, and these mistakes influence not only the market but also the flow of history.

Fallibility leads to 'reflexivity', which is the core of Soros's thinking.

This concept comes from the two-way relationship between human thought and reality.

A feedback loop continues, with people's distorted thoughts influencing reality, and the flow of reality in turn influencing people's perspectives.

This creates a gap between people's intentions and actions, and actions and outcomes, making it uncertain how reality will unfold.

Soros emphasizes that the "principle of human uncertainty," based on fallibility and reflexivity, is a core characteristic of human history, and that the scope of uncertainty is also uncertain and can sometimes grow infinitely.

According to this, it is meaningless to accurately predict what happens in the market or in society when people are involved.

It seems that we have no choice but to respond faithfully depending on the situation.

Ultimately, while people were trying to predict market conditions, Soros was taking advantage of the uncertainty.

Around the age of 50, Soros also experienced a slump.

Even though I was earning enough money for my family to live comfortably, I began to doubt whether running a costly and stressful hedge fund was worth it.

At this time, Soros overcame his midlife crisis by deciding to contribute to promoting an "open society," which led to his global philanthropic efforts.

The concept of an “open society,” taken from the philosophy of Karl Popper, Soros’ lifelong mentor, is based on the recognition that no one can know the ultimate truth.

An open society is one in which people's diverse opinions and free criticism are accepted, and through this, mistakes can be corrected.

The goal is to move toward a better world where the values of democracy based on individual freedom function properly.

The enemy of open society: market fundamentalism

“Don’t you feel guilty about making so much money in the stock market?” Soros responded to an audience member’s question, saying that until he became a prominent figure influencing the markets, he never considered morality in his decision-making.

This is a statement that emphasizes the super-morality of market functions, which is distinct from immorality.

Rather, he argues that the problem is that market fundamentalism has transformed the pursuit of self-interest into civic consciousness, such as the pursuit of truth, by imbuing the amoral function of the market with morality.

Soros says that while he was a fund manager, he tried to maximize his own profits within the law, but now he supports improving the law, such as regulating hedge funds, even if it harms his personal interests.

Unlike the market, politics cannot function properly without morality.

He explains that the concept of morality that arises from this difference between market value and social value is a key concept that forms his thinking, and that he feels a moral obligation to make good use of the privileged position he currently holds.

I believe that if more people can distinguish between the functions of participating in politics and the functions of participating in the market, the function of democracy will improve.

A "thinker of action" with the world's second-largest donation total

Reviews of Soros range from "the ruthless demon of capitalism" to "philanthropist."

All the media is interested in is where the 'King of Speculation' will attack next.

The 1992 pound sell-off that catapulted him to the ranks of the big shots was a plan devised by his right-hand man, Stanley Druckenmiller.

At that point, Soros had already withdrawn from his day-to-day fund management and was focusing on democratization in Eastern Europe.

In Korea, the label of 'IMF's main culprit' follows him around.

In January 1998, Soros visited Korea at the invitation of President-elect Kim Dae-jung, promised to invest in Korea, and then actually took over Seoul Securities, showing his willingness to inject funds into the troubled nation. However, this fact has long been forgotten.

Even those who remember the incident describe him as extending his 'hand of speculation' to Korea and 'swindling' hundreds of billions of won.

However, experts say that “there are few people as famous yet undervalued as Soros.”

The fact that the Open Society Foundations he founded are the world's second-largest foundation in terms of total donations after the Bill & Melinda Gates Foundation, that he devoted all his energy to establishing democracy in Eastern Europe after the fall of the Soviet Union, and that he supports environmental issues and strengthening regulations, etc., do not receive much attention.

It is up to the readers to evaluate Soros's life and philosophy.

However, at least through this book, Soros is an extraordinary person who has lived his entire life steadfastly sticking to his convictions.

"A person who lives more like Popper than Popper"

It is also noteworthy that Nicholas Taleb, famous for his caustic remarks, evaluated Soros in his book Fooled by Randomness.

Taleb disparaged Soros, saying he was simply trying to make money and gain a superior position because he was not recognized by other intellectuals.

However, the criticism was limited to this 'light' level, and he even praised Soros, saying that thanks to Soros, he had rediscovered the only philosopher he truly respects, Karl Popper.

(It is very rare for someone to be praised by Taleb.)

“Soros knew how to manipulate luck.

He always maintained an extremely open mind and changed his views without any hesitation.

He always admitted that he was prone to error, which is why he was so powerful.

He understood Popper.

You shouldn't judge Soros just by reading his writing.

He lived a life like Popper.

“George Soros, who is extremely self-critical, lives more like Popper than Popper himself.”

Soros's concepts of fallibility and reflexivity are not widely accepted in academia, nor are they easy to understand.

However, if after reading this book you realize how prone you are to error and find yourself reflecting on every decision, including investing, then this book was worth the price.

What made Soros truly powerful was his humility to admit that he could be wrong at any time.

GOODS SPECIFICS

- Publication date: October 20, 2021

- Format: Hardcover book binding method guide

- Page count, weight, size: 248 pages | 404g | 130*190*20mm

- ISBN13: 9791188754502

- ISBN10: 1188754505

You may also like

카테고리

korean

korean

![ELLE 엘르 스페셜 에디션 A형 : 12월 [2025]](http://librairie.coreenne.fr/cdn/shop/files/b8e27a3de6c9538896439686c6b0e8fb.jpg?v=1766436872&width=3840)