Wizards of the New Market

|

Description

Book Introduction

Stocks, futures options, commodities, and foreign exchange markets Investing Secrets from 17 of the World's Best Investors Are great traders born with talent, or are they developed through learning and mastering trading techniques? Could ordinary investors achieve success by learning and mastering the unique investment strategies of Wall Street's greatest investors? However, as Ed Seykota's introduction mentioned earlier suggests, becoming a true jeweler, a true investor, isn't something you can achieve simply by learning investment methods. The secret to success of powerful traders who have weathered and overcome crises in unpredictable markets and made a fortune is, in a way, simple. It is about gaining insight into what investing is, establishing clear investment principles, and sticking to them thoroughly. "The New Market Wizards" offers a fun way to answer the question, "How do I become a true investor?" rather than "How do I become a successful investor?" The current stock market situation, where it is impossible to see even an inch ahead, is the optimal time to return to basics and principles. The answer to returning to the basics and principles is in this book. |

- You can preview some of the book's contents.

Preview

index

preface

Acknowledgements

Prologue_The Jeweler (by Ed Seykota)

PART 1_Perspectives on Trading

01.

Trading without principles only results in failure.

02.

Why Hussein's Trade Failed

PART 2_The World's Largest Market

03.

The Sultan of the Forex Market_Bill Lipschutz

PART 3_Variety Pack Market

04.

Understanding the Gift Market from the Basics

05.

Veteran Trader_Randy McKay

06.

The Turtle Trading System_William Eckhardt

Appendix to the book: The Silence of the Turtles

07.

The Best Returns from Small Risks_Monroe Trout

08.

The Human Chart Encyclopedia_Al Weiss

PART 4_Fund Managers and Market Timers

09.

The Art of Top-Down Investing_Stanley Druckenmiller

10.

The Art of Bottom-Up Investing_Richard Driehaus

11.

Master of Consistency_Gil Blake

12.

Even Markets Age_Victor Sperandeo

PART 5_Multimarket Player

13.

The epitome of composure: Tom Basso

14.

Tapping into the Market's Song_Linda Bradford Raschke

PART 6_People who make money by printing money

15.

Computerized trading system, CRT (Chicago Research and Trading)

16.

Mark Ritchie, the God of Exchanges

17.

Joe Ritchie, an analyst with exceptional intuition

18.

Have a Winning Strategy_Blair Hull

19.

A Trading Strategy as Sophisticated as Math_Jess Yass

PART 7_Trading Psychology

20.

The Art of Trading: A Trader Who Made Hundreds of Millions

21.

The Mindset of Successful People_Charles Faulkner

22.

The Functions of the Subconscious_Robert Krausz

PART 8_The bell that signals the end of the day

23.

Wisdom from the Market Wizards

Epilogue: Reflections on Trading

Appendix_Options | Understanding the Basics

Glossary of Terms

Acknowledgements

Prologue_The Jeweler (by Ed Seykota)

PART 1_Perspectives on Trading

01.

Trading without principles only results in failure.

02.

Why Hussein's Trade Failed

PART 2_The World's Largest Market

03.

The Sultan of the Forex Market_Bill Lipschutz

PART 3_Variety Pack Market

04.

Understanding the Gift Market from the Basics

05.

Veteran Trader_Randy McKay

06.

The Turtle Trading System_William Eckhardt

Appendix to the book: The Silence of the Turtles

07.

The Best Returns from Small Risks_Monroe Trout

08.

The Human Chart Encyclopedia_Al Weiss

PART 4_Fund Managers and Market Timers

09.

The Art of Top-Down Investing_Stanley Druckenmiller

10.

The Art of Bottom-Up Investing_Richard Driehaus

11.

Master of Consistency_Gil Blake

12.

Even Markets Age_Victor Sperandeo

PART 5_Multimarket Player

13.

The epitome of composure: Tom Basso

14.

Tapping into the Market's Song_Linda Bradford Raschke

PART 6_People who make money by printing money

15.

Computerized trading system, CRT (Chicago Research and Trading)

16.

Mark Ritchie, the God of Exchanges

17.

Joe Ritchie, an analyst with exceptional intuition

18.

Have a Winning Strategy_Blair Hull

19.

A Trading Strategy as Sophisticated as Math_Jess Yass

PART 7_Trading Psychology

20.

The Art of Trading: A Trader Who Made Hundreds of Millions

21.

The Mindset of Successful People_Charles Faulkner

22.

The Functions of the Subconscious_Robert Krausz

PART 8_The bell that signals the end of the day

23.

Wisdom from the Market Wizards

Epilogue: Reflections on Trading

Appendix_Options | Understanding the Basics

Glossary of Terms

Publisher's Review

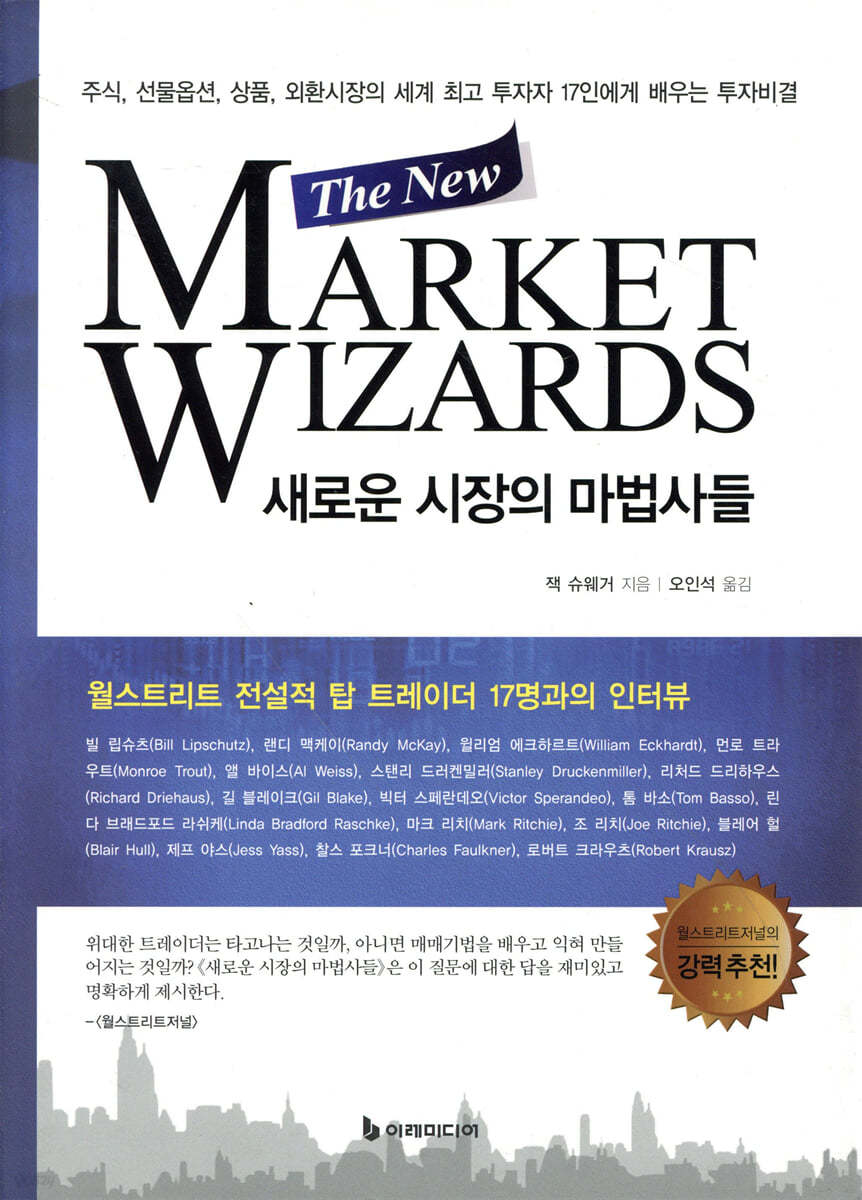

Contains interviews with 17 legendary top traders on Wall Street.

Complete translation of The New Market Wizards

One cold winter day, a young man came to learn jewellery cutting.

The jeweler placed a jade stone in the young man's hand and began to tell him about the three frogs.

Then the young man interrupted him, saying that he had come to learn jewellery cutting.

The jeweler sends the young man away, telling him to return in a week after receiving the jade.

When the young man came back a week later, the jeweler gave him another jade stone and continued the story about the frog.

At this, the young man cut off the jeweler again and was sent back home.

After several weeks of doing this, and repeating the same thing over and over again, the young man became less and less interested in the jeweler's stories, and learned to cut and clean the car.

And then one spring day, the young man said:

“The stone I have is not real jade.”

This story is the question and answer that Wall Street sage Ed Seykota poses to readers: “What is investing?” and is the introduction to “The New Market Wizards.”

Bestselling author and hedge fund expert Jack Schwager's "Market Wizards" series features in-depth interviews with prominent traders across various financial sectors, providing a detailed introduction to their investments and strategies.

This book, "The New Market Wizards," is one of Jack Schwager's "Market Wizards" series.

This is the third book published by Iremedia, following Market Wizards, which interviewed Richard Dennis, Ed Seykota, and others, and Hedge Fund Market Wizards, which contains the insights and strategies of 15 hedge fund experts.

A faithful and complete translation of The New Market Wizards, The New Market Wizards features interviews with 17 of the world's top investors in the stock, futures, options, commodities, and foreign exchange markets.

In this book, you will discover the investment secrets of great investors such as William Eckhart, Monroe Trout, and Mark Rich.

Iremedia Publishing will also soon publish the final book in the "Market Wizards" series, "Stock Market Wizards."

Stocks, futures options, commodities, and foreign exchange markets

Investing Secrets from 17 of the World's Best Investors

Are great traders born with talent, or are they developed through learning and mastering trading techniques? Could ordinary investors achieve success by learning and mastering the unique investment strategies of Wall Street's greatest investors? However, as Ed Seykota's introduction mentioned earlier suggests, becoming a true jeweler, a true investor, isn't something you can achieve simply by learning investment methods.

The secret to success of powerful traders who have weathered and overcome crises in unpredictable markets and made a fortune is, in a way, simple.

It is about gaining insight into what investing is, establishing clear investment principles, and sticking to them thoroughly.

"The New Market Wizards" offers a fun way to answer the question, "How do I become a true investor?" rather than "How do I become a successful investor?"

The current stock market situation, where it is impossible to see even an inch ahead, is the optimal time to return to basics and principles.

The answer to returning to the basics and principles is in this book.

What is the world's largest financial market? The foreign exchange market.

Bill Lipschutz, who controls the huge foreign exchange market, started and grew with Salomon Brothers.

He manages a staggering $2 billion in investment funds, but his investment principles are simple.

'Don't fall into the temptation to perfectly predict the market direction.'

William Eckhardt, a legendary figure in the investment industry, experimented with the "Turtle Trading System" alongside Richard Dennis, the most famous futures trader.

He was also a mathematician, had excellent analytical skills, and was far superior to anyone in designing trading systems.

He developed his own trading system for trading and has been generating an average annual return of over 60 percent since 1978.

Eckhart, who says, "Most things that make you feel good are things you shouldn't do," consistently generates profits through thorough analysis and considers risk management to be of utmost importance.

He emphasizes that one should not trade instinctively and follow comfort, but rather develop habits that will enable one to trade correctly.

Stanley Druckenmiller, one of the world's leading fund managers managing billions of dollars and a top-down investor who learned how to predict market direction from George Soros, and Richard Driehaus, who earned more than twice the return of the S&P index.

Victor Sperandeo consistently generates profits with a trading strategy that adjusts investment size according to market conditions.

Linda Raschke, a passionate female trader.

Computer trading system masters Marc Rich, Joe Rich, Blair Hull, and Jeff Yass.

Charles Faulkner, who applied neurolinguistic programming to investing, and Robert Krautz, who led successful investments by hypnotizing the human subconscious.

The traders featured in this book are people whose names alone make your heart flutter.

What makes them worthy of being called the best traders is their consistently profitable trading strategies.

By establishing their own investment principles and investing without going against them, they were able to create their own iron fortress in the investment world.

And they continue to make profits today.

Author of the Wall Street investment bible series [Market Wizards]

Jack Schwager's Key Elements for Trading Success

◇ The market does not move randomly.

Even if the line of scholars who believe in the efficient market hypothesis were as long as the distance to the moon and back, I still think they are wrong.

◇ The market moves according to human behavior, and since human behavior, especially the behavior of the public, is not random, the market does not move randomly either.

The market has never been random, and never will be.

◇ There is no magic wand in the market.

But there are many patterns that can help you make money.

◇ There are tens of thousands of ways to make money in the market.

But, ironically, these methods are very difficult to find.

◇ The market is always changing, but it is also always the same.

◇ The secret to success in the market lies not in discovering great indicators or great theories, but in your own mind.

◇ To be far ahead of others in trading, you need talent, but surprisingly, it also requires a tremendous amount of effort.

This is the same in any field.

Anyone who tries to succeed in investing by buying the latest system costing $300 or even $3,000 or by using the latest information will never achieve the results they want.

Because we still don't understand the essence of the problem.

◇ While it's great to have the goal of success in the trading world, it becomes even more meaningful when paired with a successful life (here, "successful life" doesn't mean making a lot of money).

Praise poured in from all walks of life

There are some very outstanding traders who are different from the crowd.

How do these winners, who have achieved outstanding performance in various financial markets, invest? What sets them apart from the average person? And what can they teach ordinary traders and investors? In "The New Market Wizards," these incredibly successful traders (some of whom are lesser-known) share the investment strategies that quickly led them to success.

Jack Schwager asks readers who work in or are interested in the financial markets the questions they would like to ask the financial market's superstars, and the market wizards share their secrets.

Not only is the content engaging and useful, but it is also very valuable, and "The New Market Wizards" will be another masterpiece from Jack Schwager.

Are great traders born with it, or are they made through learning and mastering trading techniques? "The New Market Wizards" offers a compelling and clear answer to this question.

- The Wall Street Journal

“It offers unique insights into the mysterious world of currency markets, as well as fast-moving markets like options and commodities.”

- U.S. News and World Report

“It’s incredibly fun.”

- John Train, author of "The Masters of Stock Investing"

“Simply put, Jack Schwager’s book is the best trading book I’ve ever read.”

- Richard Dennis, founder of Turtle Trading and president of Dennis Trading Group

Complete translation of The New Market Wizards

One cold winter day, a young man came to learn jewellery cutting.

The jeweler placed a jade stone in the young man's hand and began to tell him about the three frogs.

Then the young man interrupted him, saying that he had come to learn jewellery cutting.

The jeweler sends the young man away, telling him to return in a week after receiving the jade.

When the young man came back a week later, the jeweler gave him another jade stone and continued the story about the frog.

At this, the young man cut off the jeweler again and was sent back home.

After several weeks of doing this, and repeating the same thing over and over again, the young man became less and less interested in the jeweler's stories, and learned to cut and clean the car.

And then one spring day, the young man said:

“The stone I have is not real jade.”

This story is the question and answer that Wall Street sage Ed Seykota poses to readers: “What is investing?” and is the introduction to “The New Market Wizards.”

Bestselling author and hedge fund expert Jack Schwager's "Market Wizards" series features in-depth interviews with prominent traders across various financial sectors, providing a detailed introduction to their investments and strategies.

This book, "The New Market Wizards," is one of Jack Schwager's "Market Wizards" series.

This is the third book published by Iremedia, following Market Wizards, which interviewed Richard Dennis, Ed Seykota, and others, and Hedge Fund Market Wizards, which contains the insights and strategies of 15 hedge fund experts.

A faithful and complete translation of The New Market Wizards, The New Market Wizards features interviews with 17 of the world's top investors in the stock, futures, options, commodities, and foreign exchange markets.

In this book, you will discover the investment secrets of great investors such as William Eckhart, Monroe Trout, and Mark Rich.

Iremedia Publishing will also soon publish the final book in the "Market Wizards" series, "Stock Market Wizards."

Stocks, futures options, commodities, and foreign exchange markets

Investing Secrets from 17 of the World's Best Investors

Are great traders born with talent, or are they developed through learning and mastering trading techniques? Could ordinary investors achieve success by learning and mastering the unique investment strategies of Wall Street's greatest investors? However, as Ed Seykota's introduction mentioned earlier suggests, becoming a true jeweler, a true investor, isn't something you can achieve simply by learning investment methods.

The secret to success of powerful traders who have weathered and overcome crises in unpredictable markets and made a fortune is, in a way, simple.

It is about gaining insight into what investing is, establishing clear investment principles, and sticking to them thoroughly.

"The New Market Wizards" offers a fun way to answer the question, "How do I become a true investor?" rather than "How do I become a successful investor?"

The current stock market situation, where it is impossible to see even an inch ahead, is the optimal time to return to basics and principles.

The answer to returning to the basics and principles is in this book.

What is the world's largest financial market? The foreign exchange market.

Bill Lipschutz, who controls the huge foreign exchange market, started and grew with Salomon Brothers.

He manages a staggering $2 billion in investment funds, but his investment principles are simple.

'Don't fall into the temptation to perfectly predict the market direction.'

William Eckhardt, a legendary figure in the investment industry, experimented with the "Turtle Trading System" alongside Richard Dennis, the most famous futures trader.

He was also a mathematician, had excellent analytical skills, and was far superior to anyone in designing trading systems.

He developed his own trading system for trading and has been generating an average annual return of over 60 percent since 1978.

Eckhart, who says, "Most things that make you feel good are things you shouldn't do," consistently generates profits through thorough analysis and considers risk management to be of utmost importance.

He emphasizes that one should not trade instinctively and follow comfort, but rather develop habits that will enable one to trade correctly.

Stanley Druckenmiller, one of the world's leading fund managers managing billions of dollars and a top-down investor who learned how to predict market direction from George Soros, and Richard Driehaus, who earned more than twice the return of the S&P index.

Victor Sperandeo consistently generates profits with a trading strategy that adjusts investment size according to market conditions.

Linda Raschke, a passionate female trader.

Computer trading system masters Marc Rich, Joe Rich, Blair Hull, and Jeff Yass.

Charles Faulkner, who applied neurolinguistic programming to investing, and Robert Krautz, who led successful investments by hypnotizing the human subconscious.

The traders featured in this book are people whose names alone make your heart flutter.

What makes them worthy of being called the best traders is their consistently profitable trading strategies.

By establishing their own investment principles and investing without going against them, they were able to create their own iron fortress in the investment world.

And they continue to make profits today.

Author of the Wall Street investment bible series [Market Wizards]

Jack Schwager's Key Elements for Trading Success

◇ The market does not move randomly.

Even if the line of scholars who believe in the efficient market hypothesis were as long as the distance to the moon and back, I still think they are wrong.

◇ The market moves according to human behavior, and since human behavior, especially the behavior of the public, is not random, the market does not move randomly either.

The market has never been random, and never will be.

◇ There is no magic wand in the market.

But there are many patterns that can help you make money.

◇ There are tens of thousands of ways to make money in the market.

But, ironically, these methods are very difficult to find.

◇ The market is always changing, but it is also always the same.

◇ The secret to success in the market lies not in discovering great indicators or great theories, but in your own mind.

◇ To be far ahead of others in trading, you need talent, but surprisingly, it also requires a tremendous amount of effort.

This is the same in any field.

Anyone who tries to succeed in investing by buying the latest system costing $300 or even $3,000 or by using the latest information will never achieve the results they want.

Because we still don't understand the essence of the problem.

◇ While it's great to have the goal of success in the trading world, it becomes even more meaningful when paired with a successful life (here, "successful life" doesn't mean making a lot of money).

Praise poured in from all walks of life

There are some very outstanding traders who are different from the crowd.

How do these winners, who have achieved outstanding performance in various financial markets, invest? What sets them apart from the average person? And what can they teach ordinary traders and investors? In "The New Market Wizards," these incredibly successful traders (some of whom are lesser-known) share the investment strategies that quickly led them to success.

Jack Schwager asks readers who work in or are interested in the financial markets the questions they would like to ask the financial market's superstars, and the market wizards share their secrets.

Not only is the content engaging and useful, but it is also very valuable, and "The New Market Wizards" will be another masterpiece from Jack Schwager.

Are great traders born with it, or are they made through learning and mastering trading techniques? "The New Market Wizards" offers a compelling and clear answer to this question.

- The Wall Street Journal

“It offers unique insights into the mysterious world of currency markets, as well as fast-moving markets like options and commodities.”

- U.S. News and World Report

“It’s incredibly fun.”

- John Train, author of "The Masters of Stock Investing"

“Simply put, Jack Schwager’s book is the best trading book I’ve ever read.”

- Richard Dennis, founder of Turtle Trading and president of Dennis Trading Group

GOODS SPECIFICS

- Date of issue: September 25, 2015

- Format: Hardcover book binding method guide

- Page count, weight, size: 572 pages | 1,138g | 170*235*35mm

- ISBN13: 9791186588314

- ISBN10: 1186588314

You may also like

카테고리

korean

korean

![ELLE 엘르 스페셜 에디션 A형 : 12월 [2025]](http://librairie.coreenne.fr/cdn/shop/files/b8e27a3de6c9538896439686c6b0e8fb.jpg?v=1766436872&width=3840)