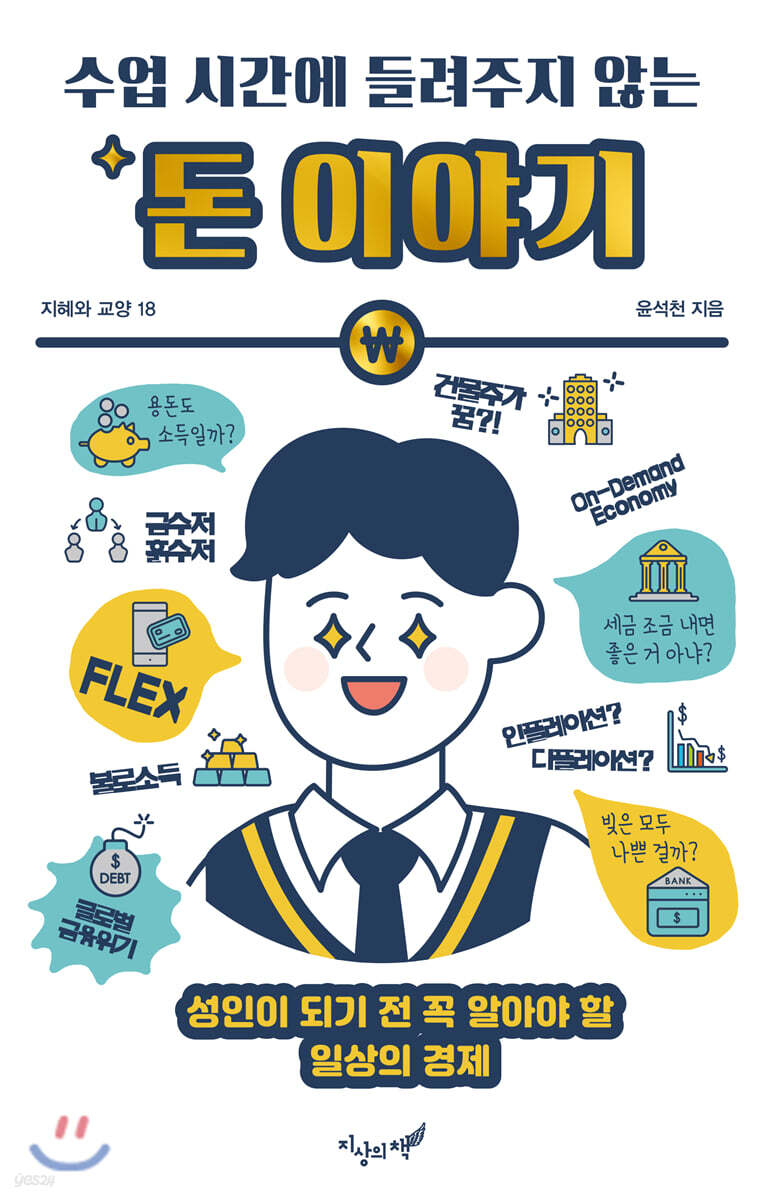

Money stories we don't tell you in class

|

Description

Book Introduction

If you don't know money, you can never earn or spend it well!

For teenagers who always lack pocket money

The Money Story They Don't Tell You in Class

· "2020 Teen Keywords #FLEX #Unboxing"

Over 100,000 illegal loan advertisements detected over the past five years

· "The OECD average financial literacy score is 64.9, while Koreans in their 20s score 61.8."

· "Only 2.4% of students choose economics on the CSAT, the lowest among social studies subjects."

An economic expert shares everyday economic stories with South Korean youth, who desperately need financial education!

There are quite a few people in their 20s who are stuck in the swamp of 'bad credit'.

The number of young people who are unable to handle their debt and file for personal bankruptcy is increasing every year, and luxury FLEX is popular among teenagers.

Despite the worsening situation, financial education for young people in our country remains inadequate.

In today's world, where proper financial education is more urgent than ever, a book has been published that addresses the shortcomings of school education, which focuses on theory and conceptual explanations.

"Money Stories We Don't Teach You in Class" is a "daily economic story" written for young people by economic commentator Seok-Cheon Yoon, who has long provided economic knowledge to readers through columns and lectures.

The big and small things that young people encounter on a daily basis, or issues they may have encountered at least once through articles or social media, have been transformed by seasoned critics into the raw materials that sometimes form macroeconomics, sometimes microeconomics, and ultimately reborn as interesting economic stories.

This book is expected to play a significant role in breaking the stereotype that "economics is difficult and boring" and in overcoming the reality that economics is neglected in the college entrance exam.

"Money Stories We Don't Tell You in Class" is divided into four parts.

The four economic activities that form the basis of the economy are spending, earning, borrowing, and lending.

Part 1, “Writing,” focuses on “consumption” and “market economy.”

As you learn about the fundamentals of economic activity—the act of spending money—and the reasons why luxury has become commonplace today, the factors that determine price, the process of forming monopolistic markets, and their harmful effects, readers will find themselves re-evaluating their own consumption habits.

In Part 2, “Earn,” we look at “income.”

Readers will learn about the types of income, the process of making money, and the mistakes people make when obsessed with making money.

The keywords in Part 3, “Borrow,” are “credit” and “loan.”

We explore the value of credit in modern society and the possibilities, risks, and curious duality of borrowing money.

The last part 4, “Out,” talks about “taxes.”

Through this chapter, young readers will learn that they too are citizens who pay taxes, and they will look into the other side of tax cuts and increases.

For teenagers who always lack pocket money

The Money Story They Don't Tell You in Class

· "2020 Teen Keywords #FLEX #Unboxing"

Over 100,000 illegal loan advertisements detected over the past five years

· "The OECD average financial literacy score is 64.9, while Koreans in their 20s score 61.8."

· "Only 2.4% of students choose economics on the CSAT, the lowest among social studies subjects."

An economic expert shares everyday economic stories with South Korean youth, who desperately need financial education!

There are quite a few people in their 20s who are stuck in the swamp of 'bad credit'.

The number of young people who are unable to handle their debt and file for personal bankruptcy is increasing every year, and luxury FLEX is popular among teenagers.

Despite the worsening situation, financial education for young people in our country remains inadequate.

In today's world, where proper financial education is more urgent than ever, a book has been published that addresses the shortcomings of school education, which focuses on theory and conceptual explanations.

"Money Stories We Don't Teach You in Class" is a "daily economic story" written for young people by economic commentator Seok-Cheon Yoon, who has long provided economic knowledge to readers through columns and lectures.

The big and small things that young people encounter on a daily basis, or issues they may have encountered at least once through articles or social media, have been transformed by seasoned critics into the raw materials that sometimes form macroeconomics, sometimes microeconomics, and ultimately reborn as interesting economic stories.

This book is expected to play a significant role in breaking the stereotype that "economics is difficult and boring" and in overcoming the reality that economics is neglected in the college entrance exam.

"Money Stories We Don't Tell You in Class" is divided into four parts.

The four economic activities that form the basis of the economy are spending, earning, borrowing, and lending.

Part 1, “Writing,” focuses on “consumption” and “market economy.”

As you learn about the fundamentals of economic activity—the act of spending money—and the reasons why luxury has become commonplace today, the factors that determine price, the process of forming monopolistic markets, and their harmful effects, readers will find themselves re-evaluating their own consumption habits.

In Part 2, “Earn,” we look at “income.”

Readers will learn about the types of income, the process of making money, and the mistakes people make when obsessed with making money.

The keywords in Part 3, “Borrow,” are “credit” and “loan.”

We explore the value of credit in modern society and the possibilities, risks, and curious duality of borrowing money.

The last part 4, “Out,” talks about “taxes.”

Through this chapter, young readers will learn that they too are citizens who pay taxes, and they will look into the other side of tax cuts and increases.

- You can preview some of the book's contents.

Preview

index

To begin with

I believe in the power of critical thinking.

Write part 1

What is the economy?

human irrationality

The mind to 'FLEX'

Is it worth calling?

Why SPA brand clothes are cheap

Why are people so excited about new products?

The Inconvenient Truth About School Uniform Prices

Oligopoly breeds collusion

Can't we just use them together?

The era of 'access' rather than 'ownership'

I'll run when you call me

How will we work in the future?

Earn part 2

Making money

Golden spoon and dirt spoon

Predators of the economic ecosystem: conglomerates

The 21st Century Bubble: Cryptocurrency

There is no goose that lays golden eggs.

Korea is a financially illiterate country

Why Saving Early Is Important

Rolling the snowball, compounding investments

How on earth did he become rich?

unearned income capitalism

What is the difference between investing and speculation?

A world where being a building owner has become a dream

Part 3: Borrow

The virtue of a monetary economy: credit

Plastic money has appeared

To become a smart consumer

Is all debt bad?

There are classes in financial institutions too.

Young people struggling with debt

financial debt defaulters

Do we really have to help people who are ruined?

Debt that has grown like a mountain

A society that encourages debt

Feeling Rich, the Wealth Effect

Stabilize prices! The central bank's mission.

Could the Great Depression come again?

The world economy is at risk!

Why Did the 2008 Financial Crisis Happen?

Lessons from the Financial Crisis

Part 4

People who want to pay more taxes

Why Donations Can't Be Seen as Just Beautiful

Is it a good idea to pay a little tax?

The truth behind the tax cuts

Indirect and direct taxes

Indirect tax, the more you earn, the lower your burden

Why Direct Taxes Need to Be Strengthened

The role of government in a market economy

Conflicts over public goods

Prevent market failure!

Privatization? Isn't that a good thing?

If Samsung fails, will the country fail?

In conclusion

I hope you can use your economic knowledge as a weapon to live a life free from the pressures of money.

I believe in the power of critical thinking.

Write part 1

What is the economy?

human irrationality

The mind to 'FLEX'

Is it worth calling?

Why SPA brand clothes are cheap

Why are people so excited about new products?

The Inconvenient Truth About School Uniform Prices

Oligopoly breeds collusion

Can't we just use them together?

The era of 'access' rather than 'ownership'

I'll run when you call me

How will we work in the future?

Earn part 2

Making money

Golden spoon and dirt spoon

Predators of the economic ecosystem: conglomerates

The 21st Century Bubble: Cryptocurrency

There is no goose that lays golden eggs.

Korea is a financially illiterate country

Why Saving Early Is Important

Rolling the snowball, compounding investments

How on earth did he become rich?

unearned income capitalism

What is the difference between investing and speculation?

A world where being a building owner has become a dream

Part 3: Borrow

The virtue of a monetary economy: credit

Plastic money has appeared

To become a smart consumer

Is all debt bad?

There are classes in financial institutions too.

Young people struggling with debt

financial debt defaulters

Do we really have to help people who are ruined?

Debt that has grown like a mountain

A society that encourages debt

Feeling Rich, the Wealth Effect

Stabilize prices! The central bank's mission.

Could the Great Depression come again?

The world economy is at risk!

Why Did the 2008 Financial Crisis Happen?

Lessons from the Financial Crisis

Part 4

People who want to pay more taxes

Why Donations Can't Be Seen as Just Beautiful

Is it a good idea to pay a little tax?

The truth behind the tax cuts

Indirect and direct taxes

Indirect tax, the more you earn, the lower your burden

Why Direct Taxes Need to Be Strengthened

The role of government in a market economy

Conflicts over public goods

Prevent market failure!

Privatization? Isn't that a good thing?

If Samsung fails, will the country fail?

In conclusion

I hope you can use your economic knowledge as a weapon to live a life free from the pressures of money.

Detailed image

Into the book

Economics is a discipline that deals with the 'efficient allocation of limited resources.'

We live in a finite world.

There is nothing infinite in this world.

Everything has an end, especially resources.

Therefore, mankind has been pondering how to efficiently share limited resources.

That is the history of mankind and the history of economics.

Economics is the study of how to use and share money well.

Therefore, it can be said that the term 'economy' was created based on the act of 'writing'.

At this time, ‘writing’ is called ‘consumption’.

---From "What is Economy"

SPA brands became well-known in Korea when the Japanese casual apparel company Uniqlo opened a store. The expansion and globalization of SPA brands was possible because they effectively reflected the characteristics of modern society.

Today is an era where individuality is valued.

It is a world where diversity of desires is respected.

And it changes quickly.

As mentioned earlier, humans have a desire to be like others, but they also have a nature to seek differences.

While we value trends, when they become too commonplace, we seek out new styles. SPA brands understand and capitalize on this human desire and nature.

---From "Why SPA brand clothes are cheap"

Collusion denies the capitalist market economic system.

It prevents fair competition and undermines the fundamental economic principle of efficient resource allocation.

So the government is banning this by law.

It regulates through the Fair Trade Act, imposes fines, and holds people criminally liable.

The Fair Trade Commission detects dozens of cases of corporate collusion every year and imposes fines.

Yet collusion is hardly eradicated.

---From "Oligocracy breeds collusion"

How can we trust each other in individual transactions? If we can't trust our counterparts, can a transaction be concluded? It's no small task to verify the trustworthiness of each transaction partner.

Unless this problem is resolved, peer-to-peer transactions will be difficult to activate.

In this case, someone needs to verify the credit of both parties.

What we need is a so-called 'trust broker'.

They verify the identity of the person providing the shared item and verify that the item being shared belongs to that person.

At the same time, it verifies the consumer's payment method and payment ability.

It guarantees trust in transactions between individuals.

The reason peer-to-peer transactions and the sharing economy are possible is because of these trusted intermediaries.

Trusted intermediaries are none other than service operating companies like Uber or Airbnb.

---From "The Era of 'Access', Not 'Ownership'"

The on-demand economy refers to the technology that provides goods and services immediately when consumers want them, and the economic activities of companies that utilize it.

The supply of goods and services takes place through digital networks.

Industries like food delivery, designated driving, cleaning, and laundry were once offline businesses.

However, these industries are evolving in new ways with the advent of apps and the web.

The on-demand economy is an economic category that allows you to use the services you want immediately by simply ordering them, using the latest IT technology.

---From "I'll Run When You Call"

In 2009, the top 1% of the world's wealthiest people owned 44% of the world's wealth.

In 2014, this proportion increased to 48%, and in 2016 to 50%.

There are also projections that it will monopolize 64% by 2030.

Korea is not much different.

In 2016, the top 1% held 12.2% of the income, while the top 10% held 43.3%.

Income concentration refers to the proportion of total income that is earned by a given class.

This means that the top 10% of income earners account for 43.3% of all income, or nearly half.

According to the World Inequality Database, this ranks 9th among major OECD and G20 countries.

This means that income inequality in Korea is that severe.

---From "Golden Spoon and Dirt Spoon"

To benefit from compound interest, you need to save for a long period of time.

Therefore, the earlier you start saving, the better.

Saving is a habit.

If you save a little bit every month or every day, you can accumulate a lump sum over the course of a year.

Deposit that money in a time deposit and save it little by little over the course of a year to build up the lump sum.

After one year, when the deposit matures, you withdraw the money and combine it with the money you have saved up so far and sign up for a new term deposit.

If you save consistently like this starting in your early teens, you'll have a pretty large sum of money by your mid-twenties.

---From "Rolling the Snowball, Compound Interest Investment"

Capitalism is already changing into 'Rentier Capitalism'.

This term is translated as 'rent-seeking capitalism', but more bluntly, it can be called 'unearned capitalism' or 'predatory capitalism'.

It is a term that refers to capitalism dominated by those who monopolize property (physical goods, financial assets, intellectual property, etc.) and take most of the profits without making a productive social contribution, and it represents today's reality.

We live in a finite world.

There is nothing infinite in this world.

Everything has an end, especially resources.

Therefore, mankind has been pondering how to efficiently share limited resources.

That is the history of mankind and the history of economics.

Economics is the study of how to use and share money well.

Therefore, it can be said that the term 'economy' was created based on the act of 'writing'.

At this time, ‘writing’ is called ‘consumption’.

---From "What is Economy"

SPA brands became well-known in Korea when the Japanese casual apparel company Uniqlo opened a store. The expansion and globalization of SPA brands was possible because they effectively reflected the characteristics of modern society.

Today is an era where individuality is valued.

It is a world where diversity of desires is respected.

And it changes quickly.

As mentioned earlier, humans have a desire to be like others, but they also have a nature to seek differences.

While we value trends, when they become too commonplace, we seek out new styles. SPA brands understand and capitalize on this human desire and nature.

---From "Why SPA brand clothes are cheap"

Collusion denies the capitalist market economic system.

It prevents fair competition and undermines the fundamental economic principle of efficient resource allocation.

So the government is banning this by law.

It regulates through the Fair Trade Act, imposes fines, and holds people criminally liable.

The Fair Trade Commission detects dozens of cases of corporate collusion every year and imposes fines.

Yet collusion is hardly eradicated.

---From "Oligocracy breeds collusion"

How can we trust each other in individual transactions? If we can't trust our counterparts, can a transaction be concluded? It's no small task to verify the trustworthiness of each transaction partner.

Unless this problem is resolved, peer-to-peer transactions will be difficult to activate.

In this case, someone needs to verify the credit of both parties.

What we need is a so-called 'trust broker'.

They verify the identity of the person providing the shared item and verify that the item being shared belongs to that person.

At the same time, it verifies the consumer's payment method and payment ability.

It guarantees trust in transactions between individuals.

The reason peer-to-peer transactions and the sharing economy are possible is because of these trusted intermediaries.

Trusted intermediaries are none other than service operating companies like Uber or Airbnb.

---From "The Era of 'Access', Not 'Ownership'"

The on-demand economy refers to the technology that provides goods and services immediately when consumers want them, and the economic activities of companies that utilize it.

The supply of goods and services takes place through digital networks.

Industries like food delivery, designated driving, cleaning, and laundry were once offline businesses.

However, these industries are evolving in new ways with the advent of apps and the web.

The on-demand economy is an economic category that allows you to use the services you want immediately by simply ordering them, using the latest IT technology.

---From "I'll Run When You Call"

In 2009, the top 1% of the world's wealthiest people owned 44% of the world's wealth.

In 2014, this proportion increased to 48%, and in 2016 to 50%.

There are also projections that it will monopolize 64% by 2030.

Korea is not much different.

In 2016, the top 1% held 12.2% of the income, while the top 10% held 43.3%.

Income concentration refers to the proportion of total income that is earned by a given class.

This means that the top 10% of income earners account for 43.3% of all income, or nearly half.

According to the World Inequality Database, this ranks 9th among major OECD and G20 countries.

This means that income inequality in Korea is that severe.

---From "Golden Spoon and Dirt Spoon"

To benefit from compound interest, you need to save for a long period of time.

Therefore, the earlier you start saving, the better.

Saving is a habit.

If you save a little bit every month or every day, you can accumulate a lump sum over the course of a year.

Deposit that money in a time deposit and save it little by little over the course of a year to build up the lump sum.

After one year, when the deposit matures, you withdraw the money and combine it with the money you have saved up so far and sign up for a new term deposit.

If you save consistently like this starting in your early teens, you'll have a pretty large sum of money by your mid-twenties.

---From "Rolling the Snowball, Compound Interest Investment"

Capitalism is already changing into 'Rentier Capitalism'.

This term is translated as 'rent-seeking capitalism', but more bluntly, it can be called 'unearned capitalism' or 'predatory capitalism'.

It is a term that refers to capitalism dominated by those who monopolize property (physical goods, financial assets, intellectual property, etc.) and take most of the profits without making a productive social contribution, and it represents today's reality.

---From "Unearned Income Capitalism"

Publisher's Review

Break away from the rigid teaching method of explaining theories or concepts.

Everyday economic stories familiar to teenagers

Any economic agent in a capitalist society will know the importance of studying economics.

However, for today's youth in South Korea, economics is a rather boring and unpopular subject that does not spark interest.

When they need money, they get an allowance from their parents and don't pay taxes themselves, so it's hard for them to feel interested in the subject. Since even school classes are mostly about theory and explanations of concepts, it's perhaps natural for young people to turn away from the economy.

However, with misinformation and the clutches of high-interest private finance companies ubiquitous online, and young people all too easily exposed to these temptations, the importance of financial education is only growing.

Accordingly, the first step in youth economic education should be to spark their interest in economics and voluntarily encourage them to feel the need to study it. There is no more effective way to do this than by explaining economics through stories closely related to real-life situations.

The first significance of “Money Stories We Don’t Tell You in Class” lies here.

This book explains money, finance, and economics using materials familiar to readers.

It analyzes the prices of school uniforms that teenagers wear every day and the current state of the school uniform market, explaining monopolies and collusion ("The Inconvenient Truth About School Uniform Prices"), reveals the relationship between allowance and income ("Earning Money"), and explains the characteristics of check cards and credit cards, teaching about smart spending and credit management ("How to Become a Smart Consumer").

Familiar information easily accessible on the Internet, mainly on social media, also becomes the subject of the 'money story' covered in this book.

For example, it explains the difference between investment and speculation using topics such as the currently burning stock market, the real estate issue that is a constant topic of news, and virtual currency that has frustrated many people ("What is the difference between investment and speculation?"), and it even examines the causes and mechanisms of skyrocketing real estate prices ("The debt that has suddenly grown like a mountain").

In addition, we will look into the so-called 'flex craze' that is sweeping the nation among young students and learn about the act of luxury and the hearts of the people involved ("The Heart of 'FLEX'").

'Throughout the forest and trees'

Let's look at both macroeconomics and microeconomics!

When analyzing modern economic phenomena, we can see that numerous factors are intertwined.

By examining the sharing economy and the on-demand economy through Part 1 of this book, "Writing," we see that while these new forms of distribution systems provide convenient services to consumers, they are also creating various problems in the economic market as well as the labor market.

To accurately understand these complex phenomena, which defy simple interpretation or solutions, we must be able to see the microscopic structure and the problems that arise from that structure, while also being able to draw a macroscopic picture of the overall economy.

"The Money Story They Don't Tell You in Class" is a book that covers both microeconomics and macroeconomics.

When analyzing central banks and prices ("Stabilize Prices! The Central Bank's Mission") and financial crises and the Great Depression ("The World Economy is at Risk!"), he approaches them from a typical macroeconomic perspective.

Meanwhile, how pricing is determined, how competition in the market takes place ("What's the price?"), and how companies stimulate consumption ("Why are people so enthusiastic about new products?") are examined from a microeconomics perspective.

Author Seok-Cheon Yoon, who has depicted the future of economic society based on rational reasoning, has diversified the story by covering the background of the national tax policy, banking policy, failure of price control, and the Great Depression, while also explaining the survival strategies of SPA brands and the monopoly of the school uniform market.

And between the stories, the book also includes passages from classic economics books such as John Maynard Keynes' Theory of the Leisure Class and Adam Smith's The Wealth of Nations, providing a bridge for young readers to delve deeper into the world of economics.

This book does not provide a textbook-like explanation of the definitions or theoretical background of macroeconomics or microeconomics.

However, readers who follow the story of this book will naturally become interested in the overall flow of our country's economy and economic policies.

You will also gain the ability to infer and reason about why similar products have such different prices, what the sales strategies of companies that market expensive products are, and how companies that sell their products at low prices reduce their costs.

Hot Stories

A compilation of the hottest economic issues in South Korea in 2020!

· The emergence of cryptocurrencies in 2017 sent people into a frenzy.

People who saw the price rise several times overnight began to speculate, and eventually even teenagers gathered their money and invested it in virtual currency.

But as the public jumped in, the cryptocurrency quickly crashed, and the frenzied enthusiasm quickly cooled after causing huge losses for countless people.

Why do we lose so much by being dazzled by things that are not even visible in their true form?

· The global economy has entered chaos since the coronavirus outbreak.

Small business owners were the first to be hit.

Millions of people lost their jobs, and the global economy recorded negative growth.

Ironically, there is a market that is booming in this situation.

It's the stock market.

The real economy is collapsing, but the asset market is booming. Why is this happening?

· FLEX is a craze.

The FLEX targets for teenagers are mainly expensive luxury brands that even adults have difficulty purchasing, such as Maison Margiela, Balenciaga, Gucci, Valentino, and Thom Browne.

FLEX, which officially launched in 2019, has a different feel from the YOLO movement of a few years ago. Unlike YOLO, which emphasized the importance of enjoying life because you only live once, FLEX is focused entirely on consumption and ostentation.

What exactly is FLEX stimulating? Why and how did the laws of supply and demand advocated in [Introduction to Economics] break down?

These are all topics covered in “Money Stories We Don’t Tell You in Class” and are recent phenomena.

The third significance of this book is that, above all, it focuses on economic phenomena that are currently occurring.

Stories like these, which touch our very skin, will show us that economics is a very practical discipline, and will make readers feel the need to study economics and finance.

The author advises that we should not simply accept the recent economic phenomena and world stories covered in this book, but rather be skeptical.

When you ask yourself, “Why should I do that?” or “Is it really so?” over and over again, your thinking becomes deeper and broader.

And because through that process, we get one step closer to the truth, and the healthy counterarguments and beliefs born in that way will enrich our lives.

"Money Stories We Don't Teach You in Class" can be called an "out-of-school textbook" that provides practical economic knowledge to the youth of South Korea, a country often labeled a "financially illiterate nation."

I hope that this book will help the teenagers of this country realize the importance of understanding money and finance and become healthy economic actors.

I hope that, as the author wishes, you can use your economic knowledge as a weapon to live a life free from the pressures of money.

Everyday economic stories familiar to teenagers

Any economic agent in a capitalist society will know the importance of studying economics.

However, for today's youth in South Korea, economics is a rather boring and unpopular subject that does not spark interest.

When they need money, they get an allowance from their parents and don't pay taxes themselves, so it's hard for them to feel interested in the subject. Since even school classes are mostly about theory and explanations of concepts, it's perhaps natural for young people to turn away from the economy.

However, with misinformation and the clutches of high-interest private finance companies ubiquitous online, and young people all too easily exposed to these temptations, the importance of financial education is only growing.

Accordingly, the first step in youth economic education should be to spark their interest in economics and voluntarily encourage them to feel the need to study it. There is no more effective way to do this than by explaining economics through stories closely related to real-life situations.

The first significance of “Money Stories We Don’t Tell You in Class” lies here.

This book explains money, finance, and economics using materials familiar to readers.

It analyzes the prices of school uniforms that teenagers wear every day and the current state of the school uniform market, explaining monopolies and collusion ("The Inconvenient Truth About School Uniform Prices"), reveals the relationship between allowance and income ("Earning Money"), and explains the characteristics of check cards and credit cards, teaching about smart spending and credit management ("How to Become a Smart Consumer").

Familiar information easily accessible on the Internet, mainly on social media, also becomes the subject of the 'money story' covered in this book.

For example, it explains the difference between investment and speculation using topics such as the currently burning stock market, the real estate issue that is a constant topic of news, and virtual currency that has frustrated many people ("What is the difference between investment and speculation?"), and it even examines the causes and mechanisms of skyrocketing real estate prices ("The debt that has suddenly grown like a mountain").

In addition, we will look into the so-called 'flex craze' that is sweeping the nation among young students and learn about the act of luxury and the hearts of the people involved ("The Heart of 'FLEX'").

'Throughout the forest and trees'

Let's look at both macroeconomics and microeconomics!

When analyzing modern economic phenomena, we can see that numerous factors are intertwined.

By examining the sharing economy and the on-demand economy through Part 1 of this book, "Writing," we see that while these new forms of distribution systems provide convenient services to consumers, they are also creating various problems in the economic market as well as the labor market.

To accurately understand these complex phenomena, which defy simple interpretation or solutions, we must be able to see the microscopic structure and the problems that arise from that structure, while also being able to draw a macroscopic picture of the overall economy.

"The Money Story They Don't Tell You in Class" is a book that covers both microeconomics and macroeconomics.

When analyzing central banks and prices ("Stabilize Prices! The Central Bank's Mission") and financial crises and the Great Depression ("The World Economy is at Risk!"), he approaches them from a typical macroeconomic perspective.

Meanwhile, how pricing is determined, how competition in the market takes place ("What's the price?"), and how companies stimulate consumption ("Why are people so enthusiastic about new products?") are examined from a microeconomics perspective.

Author Seok-Cheon Yoon, who has depicted the future of economic society based on rational reasoning, has diversified the story by covering the background of the national tax policy, banking policy, failure of price control, and the Great Depression, while also explaining the survival strategies of SPA brands and the monopoly of the school uniform market.

And between the stories, the book also includes passages from classic economics books such as John Maynard Keynes' Theory of the Leisure Class and Adam Smith's The Wealth of Nations, providing a bridge for young readers to delve deeper into the world of economics.

This book does not provide a textbook-like explanation of the definitions or theoretical background of macroeconomics or microeconomics.

However, readers who follow the story of this book will naturally become interested in the overall flow of our country's economy and economic policies.

You will also gain the ability to infer and reason about why similar products have such different prices, what the sales strategies of companies that market expensive products are, and how companies that sell their products at low prices reduce their costs.

Hot Stories

A compilation of the hottest economic issues in South Korea in 2020!

· The emergence of cryptocurrencies in 2017 sent people into a frenzy.

People who saw the price rise several times overnight began to speculate, and eventually even teenagers gathered their money and invested it in virtual currency.

But as the public jumped in, the cryptocurrency quickly crashed, and the frenzied enthusiasm quickly cooled after causing huge losses for countless people.

Why do we lose so much by being dazzled by things that are not even visible in their true form?

· The global economy has entered chaos since the coronavirus outbreak.

Small business owners were the first to be hit.

Millions of people lost their jobs, and the global economy recorded negative growth.

Ironically, there is a market that is booming in this situation.

It's the stock market.

The real economy is collapsing, but the asset market is booming. Why is this happening?

· FLEX is a craze.

The FLEX targets for teenagers are mainly expensive luxury brands that even adults have difficulty purchasing, such as Maison Margiela, Balenciaga, Gucci, Valentino, and Thom Browne.

FLEX, which officially launched in 2019, has a different feel from the YOLO movement of a few years ago. Unlike YOLO, which emphasized the importance of enjoying life because you only live once, FLEX is focused entirely on consumption and ostentation.

What exactly is FLEX stimulating? Why and how did the laws of supply and demand advocated in [Introduction to Economics] break down?

These are all topics covered in “Money Stories We Don’t Tell You in Class” and are recent phenomena.

The third significance of this book is that, above all, it focuses on economic phenomena that are currently occurring.

Stories like these, which touch our very skin, will show us that economics is a very practical discipline, and will make readers feel the need to study economics and finance.

The author advises that we should not simply accept the recent economic phenomena and world stories covered in this book, but rather be skeptical.

When you ask yourself, “Why should I do that?” or “Is it really so?” over and over again, your thinking becomes deeper and broader.

And because through that process, we get one step closer to the truth, and the healthy counterarguments and beliefs born in that way will enrich our lives.

"Money Stories We Don't Teach You in Class" can be called an "out-of-school textbook" that provides practical economic knowledge to the youth of South Korea, a country often labeled a "financially illiterate nation."

I hope that this book will help the teenagers of this country realize the importance of understanding money and finance and become healthy economic actors.

I hope that, as the author wishes, you can use your economic knowledge as a weapon to live a life free from the pressures of money.

GOODS SPECIFICS

- Publication date: October 12, 2020

- Page count, weight, size: 256 pages | 376g | 145*225*20mm

- ISBN13: 9791190123907

- ISBN10: 1190123908

You may also like

카테고리

korean

korean

![ELLE 엘르 스페셜 에디션 A형 : 12월 [2025]](http://librairie.coreenne.fr/cdn/shop/files/b8e27a3de6c9538896439686c6b0e8fb.jpg?v=1766436872&width=3840)