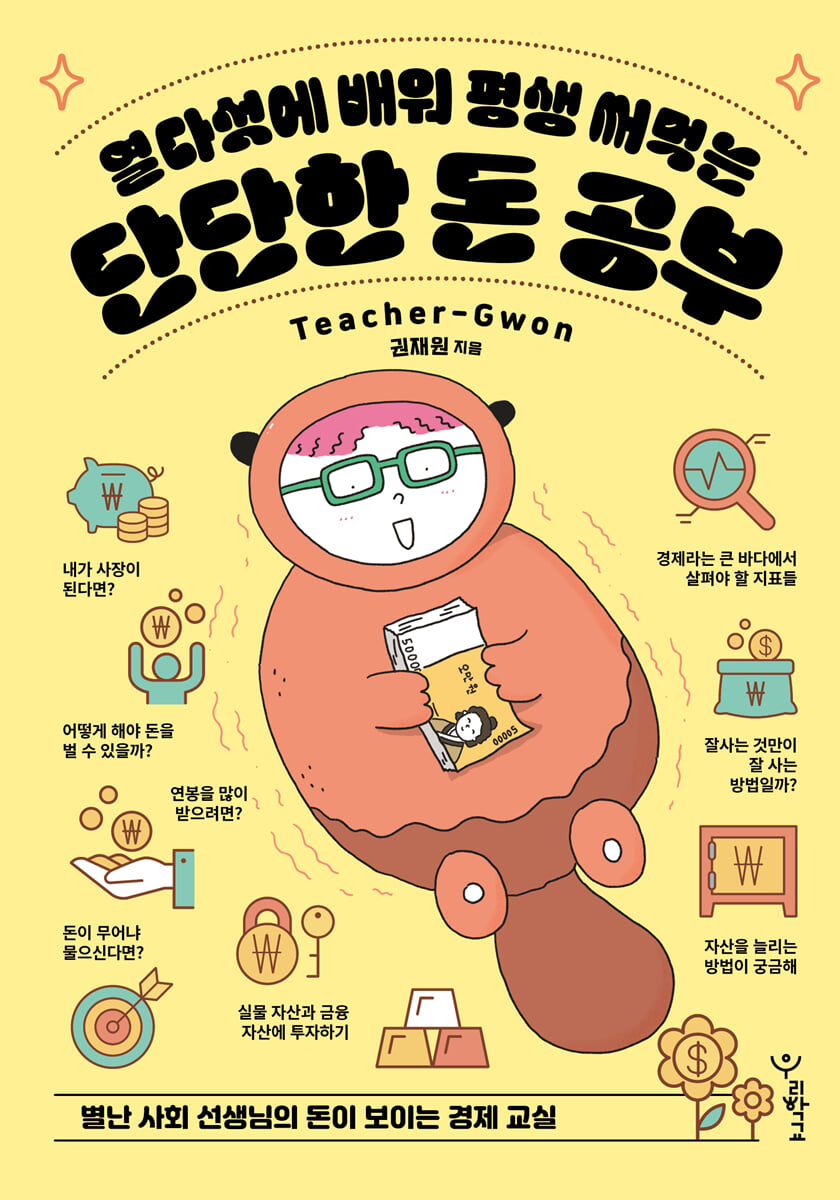

A solid financial education that you can learn at fifteen and use for the rest of your life.

|

Description

Book Introduction

Parents are quick to complain, “That damn money is the enemy,” but they are also likely to nag their children, saying, “Don’t worry about money and just study,” or “If you’re greedy for money, you’ll be useless.”

However, both adults who hate money and children who are curious about money should actively study money rather than treating it as a taboo.

Perhaps it would be more rational and economical to start thinking about money at an earlier age, before you experience unnecessary frustration or the vain desire to get rich quick.

In that sense, fifteen is the 'perfect' age to study money and economics.

Fifteen is an age that is inseparable from the economy, as it is the age at which one begins to be classified as an economically active population.

Starting out at fifteen without knowing anything about money might be a reckless and risky choice, especially when you're just entering the world of business.

If you don't know about money, you can't get close to money, and if you don't become friendly with money, you can live a life that is swayed by money.

"Solid Money Study that You Can Learn at Fifteen and Use for a Lifetime" is a book that examines the economy with a focus on money, written by Jaewon Kwon, a current social studies teacher and author of numerous humanities books for teenagers.

Whether we earn money or not, we can never be free from money in our entire lives.

Let's start a solid study of money that will be useful throughout our lives, so that we can approach money as a tool for our happiness, and wisely save, grow, and spend it.

However, both adults who hate money and children who are curious about money should actively study money rather than treating it as a taboo.

Perhaps it would be more rational and economical to start thinking about money at an earlier age, before you experience unnecessary frustration or the vain desire to get rich quick.

In that sense, fifteen is the 'perfect' age to study money and economics.

Fifteen is an age that is inseparable from the economy, as it is the age at which one begins to be classified as an economically active population.

Starting out at fifteen without knowing anything about money might be a reckless and risky choice, especially when you're just entering the world of business.

If you don't know about money, you can't get close to money, and if you don't become friendly with money, you can live a life that is swayed by money.

"Solid Money Study that You Can Learn at Fifteen and Use for a Lifetime" is a book that examines the economy with a focus on money, written by Jaewon Kwon, a current social studies teacher and author of numerous humanities books for teenagers.

Whether we earn money or not, we can never be free from money in our entire lives.

Let's start a solid study of money that will be useful throughout our lives, so that we can approach money as a tool for our happiness, and wisely save, grow, and spend it.

- You can preview some of the book's contents.

Preview

index

1.

Money x Rich People: Are living well and living well the same or different? ....

10

2.

Money x The Identity of Money: If you ask what money is? ....

40

3.

Money x Income: How to make money? ....

58

4.

Money x Startup: What if I were the CEO? ....

72

5.

Money x Labor: How to get a high salary? ....

92

6.

Money x Assets: Aren't property and assets the same thing? ....

112

7.

Money x Investment: Wondering how to increase your wealth....

130

8.

Money x Real Estate and Financial Assets: Investing in Real and Financial Assets....

144

9.

Money x World Economy: Indicators to Watch When Navigating the Great Sea of Economics....

180

10.

Money x Rich People: Is living well the only way to live well? ....

206

Money x Rich People: Are living well and living well the same or different? ....

10

2.

Money x The Identity of Money: If you ask what money is? ....

40

3.

Money x Income: How to make money? ....

58

4.

Money x Startup: What if I were the CEO? ....

72

5.

Money x Labor: How to get a high salary? ....

92

6.

Money x Assets: Aren't property and assets the same thing? ....

112

7.

Money x Investment: Wondering how to increase your wealth....

130

8.

Money x Real Estate and Financial Assets: Investing in Real and Financial Assets....

144

9.

Money x World Economy: Indicators to Watch When Navigating the Great Sea of Economics....

180

10.

Money x Rich People: Is living well the only way to live well? ....

206

Detailed image

.jpg)

Into the book

Money is a very capable problem solver.

Money's greatest strength as a problem solver lies not in its solvability itself, but in its versatility—its ability to solve any problem.

The truth is, money isn't the perfect solution.

But any problem can be solved to some extent.

Of course, there may be problem solvers in the world who are better than money, but there is no problem solver who demonstrates above-average problem solving ability in all areas like money.

--- p.48

Depositing money in a regular bank is like leaving it in an international airport terminal.

Once you put your money in the bank, you can enjoy opportunities for adventure beyond just travel.

It is an adventure that you can embark on with the guidance of a trustworthy travel agency.

However, the results will vary depending on the type of deposit, that is, whether it is a deposit that allows you to withdraw the money while traveling at any time, or a deposit that guarantees you the freedom to travel for a certain period of time.

--- p.56

If income is R and consumption is C, then middle age can be said to be the period when R〉C.

If the first year of middle age is 1 and the retirement age when earned income stops is x, then Ri- Ci = Mi(i=1~x).

In other words, the sum of M1 to Mx must cover all consumption needs after retirement.

Here, the sum of M is called 'asset'.

Of course, this doesn't necessarily have to be money.

It can exist in the form of securities or real estate.

--- p.64

A worker is a kind of one-man business.

It is a company that provides the commodity called labor to the market.

Therefore, the money you spend to increase the value of your labor can be seen as an investment.

Naturally, the higher the expected future wages or benefits, the greater the investment required to obtain that job.

--- p.99

Buying stocks is an investment in the company that issued those stocks.

Even when we buy a bag of chips or a pair of socks, we find out where the product is made, what its expiration date is, and what its ingredients are.

However, if you buy stocks based on baseless rumors without even researching what kind of company it is, that is not investing, but speculation.

You should research the stock's value and carefully consider what kind of company it is and its condition before investing.

--- p.158

Recently, many ETFs that appropriately mix similar types of stocks are being sold.

For example, it is known that semiconductor materials have a promising future, but it is not easy for ordinary investors to research each and every company that handles semiconductor materials and which of them have good business prospects.

In such cases, you can purchase a semiconductor materials ETF that follows the average stock prices of promising semiconductor companies.

--- p.175

The reason the dollar dominates the world economy is because it is the key currency.

A reserve currency is a currency primarily used in international transactions, especially international financial transactions.

However, there is no international law that requires the US dollar to be the world's reserve currency or to be used in international financial transactions.

Money's greatest strength as a problem solver lies not in its solvability itself, but in its versatility—its ability to solve any problem.

The truth is, money isn't the perfect solution.

But any problem can be solved to some extent.

Of course, there may be problem solvers in the world who are better than money, but there is no problem solver who demonstrates above-average problem solving ability in all areas like money.

--- p.48

Depositing money in a regular bank is like leaving it in an international airport terminal.

Once you put your money in the bank, you can enjoy opportunities for adventure beyond just travel.

It is an adventure that you can embark on with the guidance of a trustworthy travel agency.

However, the results will vary depending on the type of deposit, that is, whether it is a deposit that allows you to withdraw the money while traveling at any time, or a deposit that guarantees you the freedom to travel for a certain period of time.

--- p.56

If income is R and consumption is C, then middle age can be said to be the period when R〉C.

If the first year of middle age is 1 and the retirement age when earned income stops is x, then Ri- Ci = Mi(i=1~x).

In other words, the sum of M1 to Mx must cover all consumption needs after retirement.

Here, the sum of M is called 'asset'.

Of course, this doesn't necessarily have to be money.

It can exist in the form of securities or real estate.

--- p.64

A worker is a kind of one-man business.

It is a company that provides the commodity called labor to the market.

Therefore, the money you spend to increase the value of your labor can be seen as an investment.

Naturally, the higher the expected future wages or benefits, the greater the investment required to obtain that job.

--- p.99

Buying stocks is an investment in the company that issued those stocks.

Even when we buy a bag of chips or a pair of socks, we find out where the product is made, what its expiration date is, and what its ingredients are.

However, if you buy stocks based on baseless rumors without even researching what kind of company it is, that is not investing, but speculation.

You should research the stock's value and carefully consider what kind of company it is and its condition before investing.

--- p.158

Recently, many ETFs that appropriately mix similar types of stocks are being sold.

For example, it is known that semiconductor materials have a promising future, but it is not easy for ordinary investors to research each and every company that handles semiconductor materials and which of them have good business prospects.

In such cases, you can purchase a semiconductor materials ETF that follows the average stock prices of promising semiconductor companies.

--- p.175

The reason the dollar dominates the world economy is because it is the key currency.

A reserve currency is a currency primarily used in international transactions, especially international financial transactions.

However, there is no international law that requires the US dollar to be the world's reserve currency or to be used in international financial transactions.

--- p.193

Publisher's Review

“Are living well and living well the same or different?”

Whether you earn money or not

A solid money lesson for fifteen-year-olds who can't be free from money.

Our country classifies citizens who have reached the age of fifteen as the 'working-age population'.

People aged 15 to 64 are considered the working-age population or economically active population, meaning that they are able to get a job and work by the time they turn 15.

In other words, a fifteen-year-old can be said to be a proper economic person.

Of course, it is rare for a fifteen-year-old to get a job and earn money, but whether they earn money or not, there is probably not a single fifteen-year-old in Korea who is free from money.

Every human being works to earn money, saves money, or spends money.

Moreover, if you are fifteen and have just entered the economically active population, you can say that you are at an age where you should think about and study money more seriously.

If we compare the economy to a large tree, this book, "Solid Money Study that You Can Learn at Fifteen and Use for a Lifetime," examines the various branches that branch out from money, such as labor, income, entrepreneurship, assets, investment, and the global economy, while also providing perspectives and values on money, which correspond to the trunk and roots of the tree.

The book begins with a big question about the terms 'well-being' and 'living well', which we use indiscriminately.

Are living well and living well truly the same? Readers will gain an understanding of various economic concepts related to money while reading this book, and in the final chapter, they can once again reflect on the concept of "living well/living well."

Does having a lot of money guarantee a happy and successful life? In a society where people strive to work little and earn a lot, become wealthy, and accumulate money as easily as breathing, this book will help you realize and solidify the truth that how you save, manage, and spend your money can lead to a life free from the sway of money.

Information at a glance with various infographics!

Discover economic questions and key vocabulary in captivating photos.

"Solid Money Study that You Learn at Fifteen and Use for a Lifetime" is comprised of a total of 10 chapters.

Each chapter begins with an economic question and keyword on the first page, and readers are presented with a total of 44 questions and 84 keywords.

For example, in the chapter dealing with 'Money x Income', economic questions are asked, such as why money does not become a lifelong friend and what can be done to ensure that money always stays with me. Based on this, you will learn various concepts related to income and solidify your knowledge and thoughts about money.

You can also find infographics that provide a quick overview of the changes in currency value, entrepreneurship and sales, labor, funds, real estate, and more explained in the text, along with illustrated pages filled with economic questions and common sense that will broaden your perspective on money.

Hobbies: Packpok, the ISTJ who likes to keep things simple

Back with a more unique and cute look

A quirky social studies teacher's "money-seeing" economics classroom

Starting with 『The Odd Social Studies Teacher's Suspicious Future Class』 in 2019, the Odd Social Studies Teacher, who has been loved by young readers and teachers by showing off his status as one of the self-proclaimed (?) top 3 geniuses in Korea through 『The Odd Social Studies Teacher's History is Geography』, a geography book through history, and 『The Odd Social Studies Teacher's Korean Geography』, has opened an economics class for young people with a new visual.

Although Juno's unique and charming illustrations transformed her into a more unique and cute character, her inner self as a confident and proud social studies teacher with a cool sense of reality has not changed at all.

The author, who is a current social studies teacher and an advisor to the 'Practical Education Teachers' Group' and has written humanities books for teenagers, looked into the career concerns and anxieties and expectations about the future of the teenagers he meets in the educational field every day and prepared 'Solid Money Study Learned at Fifteen and Used for Life'. It will provide common sense and concepts about money to all readers who are fifteen, are about to turn fifteen, and have passed the age of fifteen, and will lay the foundation for solid economic knowledge that can be used for a lifetime.

Whether you earn money or not

A solid money lesson for fifteen-year-olds who can't be free from money.

Our country classifies citizens who have reached the age of fifteen as the 'working-age population'.

People aged 15 to 64 are considered the working-age population or economically active population, meaning that they are able to get a job and work by the time they turn 15.

In other words, a fifteen-year-old can be said to be a proper economic person.

Of course, it is rare for a fifteen-year-old to get a job and earn money, but whether they earn money or not, there is probably not a single fifteen-year-old in Korea who is free from money.

Every human being works to earn money, saves money, or spends money.

Moreover, if you are fifteen and have just entered the economically active population, you can say that you are at an age where you should think about and study money more seriously.

If we compare the economy to a large tree, this book, "Solid Money Study that You Can Learn at Fifteen and Use for a Lifetime," examines the various branches that branch out from money, such as labor, income, entrepreneurship, assets, investment, and the global economy, while also providing perspectives and values on money, which correspond to the trunk and roots of the tree.

The book begins with a big question about the terms 'well-being' and 'living well', which we use indiscriminately.

Are living well and living well truly the same? Readers will gain an understanding of various economic concepts related to money while reading this book, and in the final chapter, they can once again reflect on the concept of "living well/living well."

Does having a lot of money guarantee a happy and successful life? In a society where people strive to work little and earn a lot, become wealthy, and accumulate money as easily as breathing, this book will help you realize and solidify the truth that how you save, manage, and spend your money can lead to a life free from the sway of money.

Information at a glance with various infographics!

Discover economic questions and key vocabulary in captivating photos.

"Solid Money Study that You Learn at Fifteen and Use for a Lifetime" is comprised of a total of 10 chapters.

Each chapter begins with an economic question and keyword on the first page, and readers are presented with a total of 44 questions and 84 keywords.

For example, in the chapter dealing with 'Money x Income', economic questions are asked, such as why money does not become a lifelong friend and what can be done to ensure that money always stays with me. Based on this, you will learn various concepts related to income and solidify your knowledge and thoughts about money.

You can also find infographics that provide a quick overview of the changes in currency value, entrepreneurship and sales, labor, funds, real estate, and more explained in the text, along with illustrated pages filled with economic questions and common sense that will broaden your perspective on money.

Hobbies: Packpok, the ISTJ who likes to keep things simple

Back with a more unique and cute look

A quirky social studies teacher's "money-seeing" economics classroom

Starting with 『The Odd Social Studies Teacher's Suspicious Future Class』 in 2019, the Odd Social Studies Teacher, who has been loved by young readers and teachers by showing off his status as one of the self-proclaimed (?) top 3 geniuses in Korea through 『The Odd Social Studies Teacher's History is Geography』, a geography book through history, and 『The Odd Social Studies Teacher's Korean Geography』, has opened an economics class for young people with a new visual.

Although Juno's unique and charming illustrations transformed her into a more unique and cute character, her inner self as a confident and proud social studies teacher with a cool sense of reality has not changed at all.

The author, who is a current social studies teacher and an advisor to the 'Practical Education Teachers' Group' and has written humanities books for teenagers, looked into the career concerns and anxieties and expectations about the future of the teenagers he meets in the educational field every day and prepared 'Solid Money Study Learned at Fifteen and Used for Life'. It will provide common sense and concepts about money to all readers who are fifteen, are about to turn fifteen, and have passed the age of fifteen, and will lay the foundation for solid economic knowledge that can be used for a lifetime.

GOODS SPECIFICS

- Date of issue: July 7, 2024

- Page count, weight, size: 220 pages | 346g | 140*200*14mm

- ISBN13: 9791167552686

You may also like

카테고리

korean

korean

![ELLE 엘르 스페셜 에디션 A형 : 12월 [2025]](http://librairie.coreenne.fr/cdn/shop/files/b8e27a3de6c9538896439686c6b0e8fb.jpg?v=1766436872&width=3840)