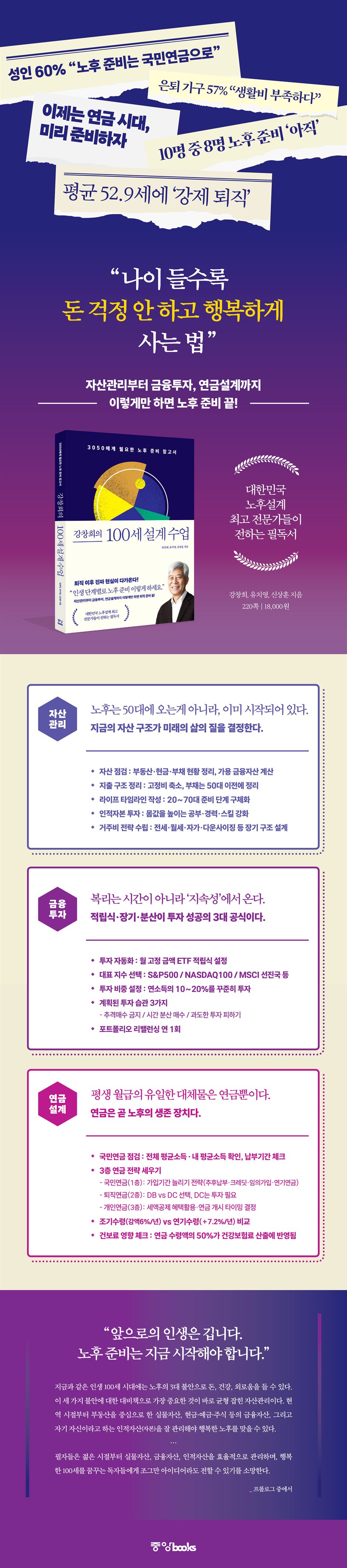

Kang Chang-hee's 100-Year Design Class

|

Description

Book Introduction

“After retirement, the real reality sets in!”

From asset management to financial investment and pension planning

Just do this and you're ready for retirement!

The question that people in their 30s to 50s are most curious about

Three experts offer clear solutions.

We are now living in a super-aged society, an era where people live to be 100, and retirement ages are getting earlier.

In an age like today, we need to start planning our lives for retirement early.

Pensions and assets that support retirement cannot be built in a short period of time, and especially with pensions, the sooner you start saving, the more benefits you can receive.

"Kang Chang-hee's 100-Year Plan Class" is a book in which three of Korea's top retirement planning experts present specific action guidelines that each generation must know, step by step, from asset restructuring to financial investment, pension planning, and a lifelong active life.

It will serve as the most realistic and reliable second act blueprint for life, not only for those planning to retire, but also for those in their 20s and 30s who are just starting out in society, to prepare for the uncertain future of old age.

From asset management to financial investment and pension planning

Just do this and you're ready for retirement!

The question that people in their 30s to 50s are most curious about

Three experts offer clear solutions.

We are now living in a super-aged society, an era where people live to be 100, and retirement ages are getting earlier.

In an age like today, we need to start planning our lives for retirement early.

Pensions and assets that support retirement cannot be built in a short period of time, and especially with pensions, the sooner you start saving, the more benefits you can receive.

"Kang Chang-hee's 100-Year Plan Class" is a book in which three of Korea's top retirement planning experts present specific action guidelines that each generation must know, step by step, from asset restructuring to financial investment, pension planning, and a lifelong active life.

It will serve as the most realistic and reliable second act blueprint for life, not only for those planning to retire, but also for those in their 20s and 30s who are just starting out in society, to prepare for the uncertain future of old age.

- You can preview some of the book's contents.

Preview

index

Prologue_The 100-Year-Old Era: Planning for the Future Begins Now

PART1.

Your retirement has already begun.

Preparation for retirement begins with signing up for the 3rd tier pension.

What should I do to prepare for retirement at my age?

What should I do before and after retirement?

Will one house support my old age?

Let's manage financial assets by dividing them by purpose.

Asset Management Strategies for Each Life Stage

Vicarious experience is important at every critical juncture in life.

How to realize your dream of being an active member for life?

Where, with whom and how will you live in your old age?

Providing proper self-reliance education to children

PART 2: The Magic Money Roll That Never Fails

Make money with lump sum investing

Increase returns with long-term investments

Investment Habits That Never Fail

How did Manager M invest since 2000 and prepare well for retirement?

Agent Z's failed trading story

Building financial knowledge

The mindset of a long-term investor

Simple 3-Stock Asset Allocation for Beginners

How to Protect Your Assets

Moving from lump-sum investing to asset allocation

Essential strategies for those in their 40s and 50s

High Risk, High Reward, How to Use Experts

Making the Most of Investment Discretionary and Investment Advisory Services

High-yield investment success stories

PART3.

Pension design for a secure retirement

Pension: Why You Need to Prepare in Advance

How to Use the National Pension Supplement System to Increase Pension Amounts

How to receive national pension that suits your circumstances

How to Choose and Manage a Retirement Pension Plan

How to Choose and Manage a Personal Pension Plan for a Comfortable Retirement

How to manage your own pension assets

How to easily manage your pension assets

The Difference Between a Pension Account and an ISA

Tax-saving tips using pension accounts

How to receive pension assets that are right for me

How to receive pension from a pension account that suits your circumstances

How to Design a Pension for the 100-Year-Old Era

Try investing in leveraged ETFs

Triple your income with leveraged ETF savings and maintain it.

PART1.

Your retirement has already begun.

Preparation for retirement begins with signing up for the 3rd tier pension.

What should I do to prepare for retirement at my age?

What should I do before and after retirement?

Will one house support my old age?

Let's manage financial assets by dividing them by purpose.

Asset Management Strategies for Each Life Stage

Vicarious experience is important at every critical juncture in life.

How to realize your dream of being an active member for life?

Where, with whom and how will you live in your old age?

Providing proper self-reliance education to children

PART 2: The Magic Money Roll That Never Fails

Make money with lump sum investing

Increase returns with long-term investments

Investment Habits That Never Fail

How did Manager M invest since 2000 and prepare well for retirement?

Agent Z's failed trading story

Building financial knowledge

The mindset of a long-term investor

Simple 3-Stock Asset Allocation for Beginners

How to Protect Your Assets

Moving from lump-sum investing to asset allocation

Essential strategies for those in their 40s and 50s

High Risk, High Reward, How to Use Experts

Making the Most of Investment Discretionary and Investment Advisory Services

High-yield investment success stories

PART3.

Pension design for a secure retirement

Pension: Why You Need to Prepare in Advance

How to Use the National Pension Supplement System to Increase Pension Amounts

How to receive national pension that suits your circumstances

How to Choose and Manage a Retirement Pension Plan

How to Choose and Manage a Personal Pension Plan for a Comfortable Retirement

How to manage your own pension assets

How to easily manage your pension assets

The Difference Between a Pension Account and an ISA

Tax-saving tips using pension accounts

How to receive pension assets that are right for me

How to receive pension from a pension account that suits your circumstances

How to Design a Pension for the 100-Year-Old Era

Try investing in leveraged ETFs

Triple your income with leveraged ETF savings and maintain it.

Detailed image

Publisher's Review

The 100-year era

Your retirement has already begun.

It's hard enough to just survive today, so when I'm told to think about retirement, I feel lost.

But if you look at the statistics, the situation is not easy at all.

The average net worth of households in their 50s, the age group with the most wealth and nearing retirement in Korea, is about 500 million won, and most of that is tied up in the single house they live in.

The financial assets available for actual living expenses are much smaller than you might think, and even those can be quickly depleted.

Moreover, retirement is coming earlier and life expectancy is increasing towards 100 years.

This book, in this harsh reality, soberly examines how we can prepare for the long retirement ahead, so that it is not a matter of survival but rather a life of happiness.

The authors view retirement not simply as a matter of money, but as a matter of the entire asset structure.

Because one apartment and a few deposits are not enough.

Therefore, it presents a framework for balanced asset management that addresses not only physical assets such as real estate and financial assets, but also human assets such as oneself.

This book presents the real reality beyond numbers and graphs, with concrete examples, from the structure of the three-tier pension system (national pension, retirement pension, and private pension), to asset reallocation to escape real estate concentration, to a glimpse into our future through Japan's long-term housing price decline and demographic changes.

Therefore, this book is not a financial management secret book that tells you where to invest to get a certain percentage of profit.

Instead, it unfolds a grand map of future planning that spans your entire life.

For those in their 20s and 30s, we help lay the foundation for 3-tier pension plans and human capital accumulation. For those in their 50s, who are nearing retirement, we provide step-by-step guidance on asset restructuring, debt consolidation, and even how to live after retirement.

This book is not a vague hope, but a practical future planning class that helps you prepare for the future step by step from a realistic perspective.

Solving the anxiety of old age

The definitive guide to asset, investment, and pension planning

This book covers three key elements of retirement planning: assets, investments, and pensions.

In the first part, we will take a broad look at how to prepare for the three major anxieties of old age: money, health, and loneliness, under the premise that "your old age has already begun."

We provide detailed guidance on how to check your household's financial structure by drawing up an asset status chart, how to adjust the proportion of real estate and financial assets, and how to plan for the latter half of your life with the goal of a lifetime of active service.

The second part, "The Magical Money Roll That Never Fails," covers more practical investment principles.

The key here is not simply to impart investment knowledge, but to help people realize that the starting point for retirement planning is investing without losing money.

It explains the fundamentals of why lump-sum investing is advantageous, how the purchase price actually decreases when prices fall, and how compound interest increases assets. It also explains why long-term survival is more important than short-term profits.

It also specifically points out common mistakes beginners make, such as why index ETFs are more advantageous for beginners than individual stocks, why indices are essential in an era of shortening corporate lifespans, and how to establish buying principles that are not swayed by volatility.

In particular, the basic asset allocation principle of "weighting bonds as much as your age and the rest in growth assets" and the method of readjusting the risk and stability ratios after your financial assets grow to 100 million to 200 million won are essential safety measures when you can no longer afford large losses as you approach retirement.

Dividing your savings, trading, and asset management into separate pockets is a practical structure that allows even those with limited investment experience to systematically grow their money.

As you follow this section, you'll understand why your investments have been shaky so far and how you can steadily build your assets going forward.

The third part, "Pension Planning for a Secure Retirement," literally covers the core strategies for creating lifetime income.

The biggest anxiety about retirement is ultimately, "How long will my income last?" This part answers that question.

It presents a realistic standard for what pension plays what role and when, starting from the concept of a three-tier pension structure.

How to receive more and longer national pension, the risks of receiving a lump sum retirement pension, the differences between IRP and pension savings, and tips for maximizing tax deductions will help you realize how much your life 20 to 30 years from now can change just by choosing a pension.

In particular, it is a rare practical guide that guides you on 'how to use your pension' by showing specific figures based on an annual withdrawal rate of around 4%, and explaining how to combine life annuities and self-annuity to avoid running out of pension funds even when using them for a long time.

While most books on pensions simply explain the institutional aspects of pensions, this section will be particularly helpful to readers nearing retirement, as it plans for life after pension commencement.

This book is not a financial management book to be read once and put away, but rather a reference guide for preparing for retirement that you can revisit as your life changes.

If you are a fresh graduate, you can start with the section on your 20s and 30s, and if you are in your 50s and nearing retirement, you can start with the section on asset restructuring and pension planning.

If you choose a chapter that suits your age and circumstances and read it, you will experience your vague anxieties turning into concrete plans.

We all retire someday, but not everyone enjoys a happy retirement.

Life ahead is getting longer, and the longer you delay preparing, the more difficult it becomes.

This is precisely why you need to start preparing for retirement step by step, starting from this moment.

Your retirement has already begun.

It's hard enough to just survive today, so when I'm told to think about retirement, I feel lost.

But if you look at the statistics, the situation is not easy at all.

The average net worth of households in their 50s, the age group with the most wealth and nearing retirement in Korea, is about 500 million won, and most of that is tied up in the single house they live in.

The financial assets available for actual living expenses are much smaller than you might think, and even those can be quickly depleted.

Moreover, retirement is coming earlier and life expectancy is increasing towards 100 years.

This book, in this harsh reality, soberly examines how we can prepare for the long retirement ahead, so that it is not a matter of survival but rather a life of happiness.

The authors view retirement not simply as a matter of money, but as a matter of the entire asset structure.

Because one apartment and a few deposits are not enough.

Therefore, it presents a framework for balanced asset management that addresses not only physical assets such as real estate and financial assets, but also human assets such as oneself.

This book presents the real reality beyond numbers and graphs, with concrete examples, from the structure of the three-tier pension system (national pension, retirement pension, and private pension), to asset reallocation to escape real estate concentration, to a glimpse into our future through Japan's long-term housing price decline and demographic changes.

Therefore, this book is not a financial management secret book that tells you where to invest to get a certain percentage of profit.

Instead, it unfolds a grand map of future planning that spans your entire life.

For those in their 20s and 30s, we help lay the foundation for 3-tier pension plans and human capital accumulation. For those in their 50s, who are nearing retirement, we provide step-by-step guidance on asset restructuring, debt consolidation, and even how to live after retirement.

This book is not a vague hope, but a practical future planning class that helps you prepare for the future step by step from a realistic perspective.

Solving the anxiety of old age

The definitive guide to asset, investment, and pension planning

This book covers three key elements of retirement planning: assets, investments, and pensions.

In the first part, we will take a broad look at how to prepare for the three major anxieties of old age: money, health, and loneliness, under the premise that "your old age has already begun."

We provide detailed guidance on how to check your household's financial structure by drawing up an asset status chart, how to adjust the proportion of real estate and financial assets, and how to plan for the latter half of your life with the goal of a lifetime of active service.

The second part, "The Magical Money Roll That Never Fails," covers more practical investment principles.

The key here is not simply to impart investment knowledge, but to help people realize that the starting point for retirement planning is investing without losing money.

It explains the fundamentals of why lump-sum investing is advantageous, how the purchase price actually decreases when prices fall, and how compound interest increases assets. It also explains why long-term survival is more important than short-term profits.

It also specifically points out common mistakes beginners make, such as why index ETFs are more advantageous for beginners than individual stocks, why indices are essential in an era of shortening corporate lifespans, and how to establish buying principles that are not swayed by volatility.

In particular, the basic asset allocation principle of "weighting bonds as much as your age and the rest in growth assets" and the method of readjusting the risk and stability ratios after your financial assets grow to 100 million to 200 million won are essential safety measures when you can no longer afford large losses as you approach retirement.

Dividing your savings, trading, and asset management into separate pockets is a practical structure that allows even those with limited investment experience to systematically grow their money.

As you follow this section, you'll understand why your investments have been shaky so far and how you can steadily build your assets going forward.

The third part, "Pension Planning for a Secure Retirement," literally covers the core strategies for creating lifetime income.

The biggest anxiety about retirement is ultimately, "How long will my income last?" This part answers that question.

It presents a realistic standard for what pension plays what role and when, starting from the concept of a three-tier pension structure.

How to receive more and longer national pension, the risks of receiving a lump sum retirement pension, the differences between IRP and pension savings, and tips for maximizing tax deductions will help you realize how much your life 20 to 30 years from now can change just by choosing a pension.

In particular, it is a rare practical guide that guides you on 'how to use your pension' by showing specific figures based on an annual withdrawal rate of around 4%, and explaining how to combine life annuities and self-annuity to avoid running out of pension funds even when using them for a long time.

While most books on pensions simply explain the institutional aspects of pensions, this section will be particularly helpful to readers nearing retirement, as it plans for life after pension commencement.

This book is not a financial management book to be read once and put away, but rather a reference guide for preparing for retirement that you can revisit as your life changes.

If you are a fresh graduate, you can start with the section on your 20s and 30s, and if you are in your 50s and nearing retirement, you can start with the section on asset restructuring and pension planning.

If you choose a chapter that suits your age and circumstances and read it, you will experience your vague anxieties turning into concrete plans.

We all retire someday, but not everyone enjoys a happy retirement.

Life ahead is getting longer, and the longer you delay preparing, the more difficult it becomes.

This is precisely why you need to start preparing for retirement step by step, starting from this moment.

GOODS SPECIFICS

- Date of issue: December 5, 2025

- Page count, weight, size: 220 pages | 378g | 148*210*14mm

- ISBN13: 9788927881407

- ISBN10: 8927881400

You may also like

카테고리

korean

korean

![ELLE 엘르 스페셜 에디션 A형 : 12월 [2025]](http://librairie.coreenne.fr/cdn/shop/files/b8e27a3de6c9538896439686c6b0e8fb.jpg?v=1766436872&width=3840)