Wall Street Dad's Second Round Investment Lesson

|

Description

Book Introduction

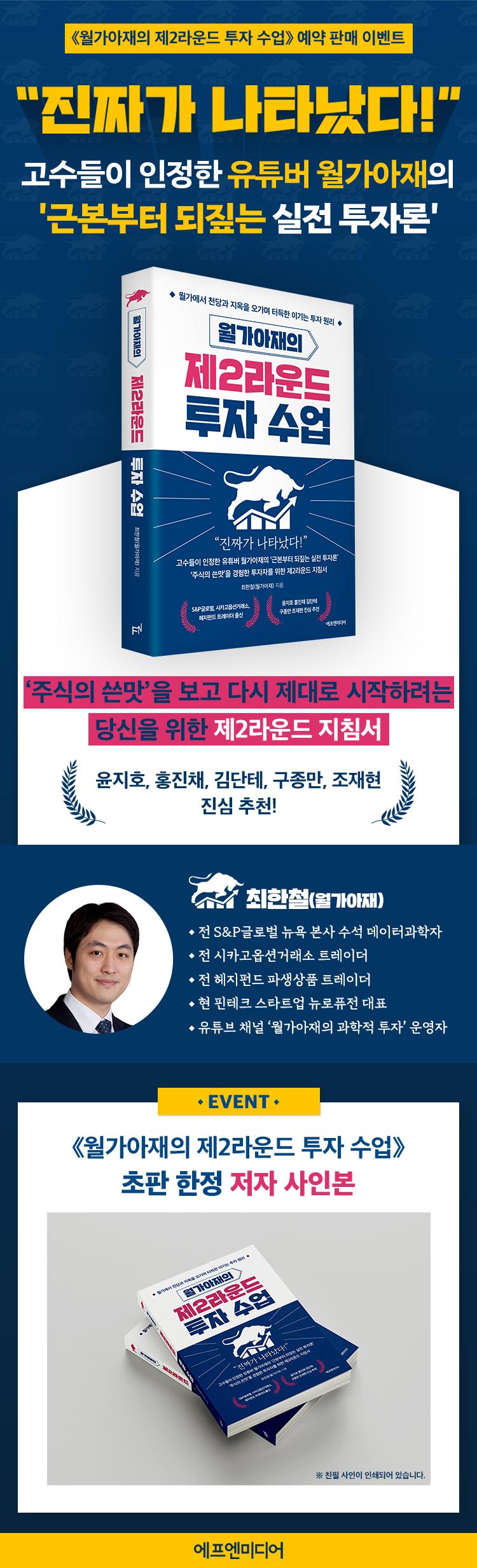

Winning investment theories from a seasoned Wall Street expert. A Round 2 Guide for Those Who Have Experienced Heartbreaking Losses and Are Starting Over An introductory investment book written by "Wall Street Dad," a YouTuber with a distinguished career, including stints at the Chicago Board Options Exchange and as a hedge fund trader before working as a senior data scientist at S&P Global. This is a "second round" investment guide for those who, like the "Donghak Ants" of 2020, started investing in stocks during a bull market, made profits, then suffered painful losses during a bear market, and now want to start over. The author suggests three axioms for individual investors to win in the stock market, where uncertainty prevails: probability advantage, financial strength advantage, and moderation advantage. He emphasizes that these should be kept in mind before starting an investment. Next, we delve into the pros and cons of index investing, value investing, chart trading, and quantitative investing, and teach you how to avoid the pitfalls of various investment strategies. It also reminds us that the ultimate goal of investment is not economic freedom itself, but 'happiness', and empirically explains why happy people are good investors. This book is evaluated as “a very rare book written for beginner investors by a ‘real expert’ who has been through a lot on Wall Street” (Dong-ju Kim, CEO of Uprise Investment Consulting) and “a practical investment theory that goes back to the fundamentals” (Jin-chae Hong, CEO of Raccoon Asset Management). Unlike other financial management books, this book is characterized by its lack of excessive optimism or praise or blind faith in specific techniques. |

- You can preview some of the book's contents.

Preview

index

Recommended Reading | Practical Investment Theory from the Ground Up | Hong Jin-chae

Prologue | Round 2: A Guide for Investors Who Have Experienced the Bitterness of the Market

Qualifications for Part 1

Chapter 1: The Nature of Economic Freedom

Four Elements of Economic Freedom

Excessive praise for capital income

The most superior third source of income

Chapter 2: Three Axioms for Winning in Investing

First, probabilistic advantage

Reality converges to probability in the long run.

Second, the advantage of financial power

The Gambler's Fallacy and the Principle of Independent Trials

Third, the superiority of moderation

Invest like a casino operator

Chapter 3 Are You Qualified to Make Money Through Investing?

Are you the hunter or the hunted?

Put yourself in the shoes of your trading counterparty

How to Establish an Investment Philosophy

Part 2: The Truth and Falsehood of Five Investment Strategies

Chapter 4: Index Tracking: Why Stocks Outperform Other Commodities

Index tracking strategy

The essence of returns pursued by index-tracking strategies

Hold for the long term in an accumulation manner

Excessive praise for index tracking is taboo.

Is there a better way to track indices?

The biggest advantage of index-tracking strategies: peace of mind.

'Efficiently Inefficient' Market

Chapter 5: Value Investing: The Principle of Maximizing Excess Returns

The nature of excess returns

Step 1: Stock Search: Finding Undervalued Companies

Step 2: Valuation: Identifying Market Mistakes

Phase 3 Research: Where Humans Can Beat Algorithms

Step 4: Portfolio Management: Diversification and Risk Management

Chapter 6: Chart Trading: Practical Chart Utilization in the Algorithmic Age

The essence of chart patterns

Academia, Poker, and the Selling of Chart Signals

Why shouldn't I trade charts?

The Advantages of Algorithmic Trading

Are technical indicators useless?

Chapter 7: Quantitative Investment and Algorithmic Trading

Ultra-high-frequency trading: decisions made in milliseconds

Short-term algorithmic trading is being consumed by high-frequency trading.

The Rise of Quantamental and Alternative Data: "Mid- to Long-Term Quantitative Investment"

The Pitfalls of Backtesting and the Truth and Lies of the Magic Formula

The Difference Between Alpha, Beta, and Smart Beta

The yield trap

Data, data, data

The limitations of quants based on the number of data points

But if you want to become a quantitative investor…

Part 3: The Path to Financial Freedom

Chapter 8: The Path Forward for Individual Investors

Fundamentals of Investment

The true meaning of excess profits that others do not know

Avoid automated algorithmic trading.

Enjoy the benefits of civilization

Sources of probabilistic advantage that individuals pursue

Areas like individual coffee shops that still exist

Chapter 9: The Nature of Investment and Dichotomous Thinking

The power of probabilistic thinking

The inside of the matrix is sweeter

Uncertainty favors those who strive

Chapter 10: Do you truly dream of financial freedom to be happy?

The opposite of suffering is not freedom.

Optimize for happiness, not money

The Importance of the Simple Act of Writing a Diary

The Benefits of Meditation in Investing

Necessary and sufficient conditions for happiness

Epilogue: To investors suffering from losses

Prologue | Round 2: A Guide for Investors Who Have Experienced the Bitterness of the Market

Qualifications for Part 1

Chapter 1: The Nature of Economic Freedom

Four Elements of Economic Freedom

Excessive praise for capital income

The most superior third source of income

Chapter 2: Three Axioms for Winning in Investing

First, probabilistic advantage

Reality converges to probability in the long run.

Second, the advantage of financial power

The Gambler's Fallacy and the Principle of Independent Trials

Third, the superiority of moderation

Invest like a casino operator

Chapter 3 Are You Qualified to Make Money Through Investing?

Are you the hunter or the hunted?

Put yourself in the shoes of your trading counterparty

How to Establish an Investment Philosophy

Part 2: The Truth and Falsehood of Five Investment Strategies

Chapter 4: Index Tracking: Why Stocks Outperform Other Commodities

Index tracking strategy

The essence of returns pursued by index-tracking strategies

Hold for the long term in an accumulation manner

Excessive praise for index tracking is taboo.

Is there a better way to track indices?

The biggest advantage of index-tracking strategies: peace of mind.

'Efficiently Inefficient' Market

Chapter 5: Value Investing: The Principle of Maximizing Excess Returns

The nature of excess returns

Step 1: Stock Search: Finding Undervalued Companies

Step 2: Valuation: Identifying Market Mistakes

Phase 3 Research: Where Humans Can Beat Algorithms

Step 4: Portfolio Management: Diversification and Risk Management

Chapter 6: Chart Trading: Practical Chart Utilization in the Algorithmic Age

The essence of chart patterns

Academia, Poker, and the Selling of Chart Signals

Why shouldn't I trade charts?

The Advantages of Algorithmic Trading

Are technical indicators useless?

Chapter 7: Quantitative Investment and Algorithmic Trading

Ultra-high-frequency trading: decisions made in milliseconds

Short-term algorithmic trading is being consumed by high-frequency trading.

The Rise of Quantamental and Alternative Data: "Mid- to Long-Term Quantitative Investment"

The Pitfalls of Backtesting and the Truth and Lies of the Magic Formula

The Difference Between Alpha, Beta, and Smart Beta

The yield trap

Data, data, data

The limitations of quants based on the number of data points

But if you want to become a quantitative investor…

Part 3: The Path to Financial Freedom

Chapter 8: The Path Forward for Individual Investors

Fundamentals of Investment

The true meaning of excess profits that others do not know

Avoid automated algorithmic trading.

Enjoy the benefits of civilization

Sources of probabilistic advantage that individuals pursue

Areas like individual coffee shops that still exist

Chapter 9: The Nature of Investment and Dichotomous Thinking

The power of probabilistic thinking

The inside of the matrix is sweeter

Uncertainty favors those who strive

Chapter 10: Do you truly dream of financial freedom to be happy?

The opposite of suffering is not freedom.

Optimize for happiness, not money

The Importance of the Simple Act of Writing a Diary

The Benefits of Meditation in Investing

Necessary and sufficient conditions for happiness

Epilogue: To investors suffering from losses

Detailed image

Into the book

Even the most accomplished traders and investors on Wall Street have a winning percentage of less than 60% on a single trade.

Stock investing is a positive-sum game when viewed in terms of absolute returns, but it is clearly a zero-sum game when viewed in terms of market average returns.

If the market average return is 10%, then for me to make 12%, someone else would have to make a return that is 2% lower than the market average.

That's the definition of average.

Adding brokerage fees to this makes it a negative-sum game relative to the market average.

---From the "Prologue"

For example, rent in Manhattan, New York is set very efficiently.

If an apartment rents for $3,400 a month and the apartment next door rents for $3,200 a month, there's a 99% chance that the apartment in the latter is $200 cheaper, whether it has worse traffic, is built older, or whatever.

In that sense, Manhattan's rental apartment market is a market where prices are set 'efficiently.'

In a market like this, it's rare to find a good apartment at a very low price.

---From "Chapter 1: The Essence of Economic Freedom"

In blackjack, the casino's odds of winning are 51.50%, which means that the casino player's odds of winning are 48.50% (100 - 51.50).

However, this win rate assumes that the player makes the mathematically optimal choice at every moment.

If a player makes a mathematically suboptimal choice, such as having a hunch or not taking an extra card due to superstitious logic, the casino's odds edge increases further.

In other words, the figure of 51.50% is the minimum winning percentage that casinos can secure in blackjack, and it can be seen that it increases as the number of irrational users increases.

---From "Chapter 2: Three Axioms for Winning in Investment"

One time, I was buying a put option and a Goldman Sachs broker called me and tried to sell a large number of similar put options.

"What the heck? I'm buying options because they seem like they'll go up, but why is this guy trying to sell?" I thought to myself, pondering the situation again, and discovered a flaw in my trading logic.

---From "Chapter 3: Are You Qualified to Make Money Through Investment?"

If Young-hoon, the second-generation chaebol, and Cheol-hoon, struggling with an apartment loan, both asked for a loan, who would you lend to? Of course, it would be Young-hoon.

Loan interest rates are determined by the supply and demand for money.

Financially stable people can borrow money at low interest rates because there are many people willing to lend money to them, while people with a lot of debt and a high risk of bankruptcy have to find people willing to lend money to them even at high interest rates because there are few people willing to lend money to them.

The same goes for the expected return on investment products.

The higher the risk, the more investors avoid the product, and the lower the demand, the lower the price.

Because the price is lower, the expected return is higher.

---From "Chapter 4 Index Tracking"

Who's right? Who made a mistake? You can't find the answer by simply comparing the numbers 87 and 105.

A less labor-intensive method is to ask several classmates for the answer.

If most of your classmates answered 87, then 87 is probably correct.

Let's try something a little more challenging this time.

Let's take a look at each person's solution process one by one and see what steps they took to arrive at the answer of 87 or 105.

Then we will be able to see in more detail where and what went wrong, who is right and who is wrong.

---From "Chapter 5 Value Investing"

Is it truly algorithmic trading or a game for individual investors to simply look at charts, trace patterns from memory, and click their mouse? Imagine sitting as the tenth player at a poker table with nine other players.

Six of them have terminals that tell them the odds of each hand, one of the remaining three is a huge player, one is a value investor, and the last one is another individual investor who trades charts.

Do you want to play a game like this? I wouldn't do it even if I died and came back to life.

---From "Chapter 6 Chart Trading"

For example, to know Walmart's sales, traditionally, you would have to refer to the quarterly earnings report, but now you can use satellite data taken of Walmart's parking lot to track the number of vehicle visits, estimate sales in advance, and enter positions accordingly.

Similarly, satellite imagery data can be used to estimate the depth (shadow length) of oil tanks that store crude oil submerged in the water, which can be used as a signal for oil trading.

There are even trading signals that utilize Wikipedia search volumes.

These data are called alternative data, and have been growing explosively in recent years.

---From "Chapter 7 Quantitative Investment and Algorithmic Trading"

Then, I worked as a data scientist at Lazard, Kensho Technologies, and S&P Global, and I had a lot of regrets.

Applying machine learning and deep learning in practice requires many small but important nuances beyond simply loading and running pre-built Python libraries.

When my model's accuracy was stuck at 88% and I didn't know how to improve it further, what helped me move forward wasn't some fancy deep learning knowledge, but a deep mathematical understanding of the model I was using, and an understanding of basic and tedious basic statistics, linear algebra, calculus, and regression analysis.

---From "Chapter 8: The Path Individual Investors Should Take"

If you persevere in uncertain markets with a probabilistic mindset, you will ultimately come to deeply appreciate the existence of uncertainty in the world.

Because of the existence of uncertainty and the fact that no methodology in the world can perfectly determine the fair value of a stock or perfectly predict which stocks will rise, opinions among market participants vary, and some people make excess profits while others suffer excess losses.

If there is a holy grail that can perfectly predict the market, then the market is efficient, and in an efficient market, no matter how hard we try, we cannot become rich through stock investing.

---From "Chapter 9: The Essence of Investment and Dichotomous Thinking"

Let's say there's an office worker who hates going to work so much.

I really hate seeing my boss and I'm so stressed out, but I relieve that stress by enjoying hobbies and leisure activities on the weekends.

In this case, moving to a company that is less stressful, more comfortable to work for, but pays a little less may be better for your long-term happiness.

---From "Chapter 10: Do You Really Dream of Financial Freedom to Be Happy?"

The university I attended was in a hot spring town called Beppu, and at sunset, my roommates and I would go to a hot spring bathhouse run by a nearby family home.

I often miss the days when I would pay 100 yen to my grandmother, who was always watching dramas, to take a bath, and then buy a half-price lunch box called "Closing Waribiki" from a nearby convenience store and eat it with a glass of beer.

At times like this, I think again about what truly makes me happy and what I am missing out on.

Stock investing is a positive-sum game when viewed in terms of absolute returns, but it is clearly a zero-sum game when viewed in terms of market average returns.

If the market average return is 10%, then for me to make 12%, someone else would have to make a return that is 2% lower than the market average.

That's the definition of average.

Adding brokerage fees to this makes it a negative-sum game relative to the market average.

---From the "Prologue"

For example, rent in Manhattan, New York is set very efficiently.

If an apartment rents for $3,400 a month and the apartment next door rents for $3,200 a month, there's a 99% chance that the apartment in the latter is $200 cheaper, whether it has worse traffic, is built older, or whatever.

In that sense, Manhattan's rental apartment market is a market where prices are set 'efficiently.'

In a market like this, it's rare to find a good apartment at a very low price.

---From "Chapter 1: The Essence of Economic Freedom"

In blackjack, the casino's odds of winning are 51.50%, which means that the casino player's odds of winning are 48.50% (100 - 51.50).

However, this win rate assumes that the player makes the mathematically optimal choice at every moment.

If a player makes a mathematically suboptimal choice, such as having a hunch or not taking an extra card due to superstitious logic, the casino's odds edge increases further.

In other words, the figure of 51.50% is the minimum winning percentage that casinos can secure in blackjack, and it can be seen that it increases as the number of irrational users increases.

---From "Chapter 2: Three Axioms for Winning in Investment"

One time, I was buying a put option and a Goldman Sachs broker called me and tried to sell a large number of similar put options.

"What the heck? I'm buying options because they seem like they'll go up, but why is this guy trying to sell?" I thought to myself, pondering the situation again, and discovered a flaw in my trading logic.

---From "Chapter 3: Are You Qualified to Make Money Through Investment?"

If Young-hoon, the second-generation chaebol, and Cheol-hoon, struggling with an apartment loan, both asked for a loan, who would you lend to? Of course, it would be Young-hoon.

Loan interest rates are determined by the supply and demand for money.

Financially stable people can borrow money at low interest rates because there are many people willing to lend money to them, while people with a lot of debt and a high risk of bankruptcy have to find people willing to lend money to them even at high interest rates because there are few people willing to lend money to them.

The same goes for the expected return on investment products.

The higher the risk, the more investors avoid the product, and the lower the demand, the lower the price.

Because the price is lower, the expected return is higher.

---From "Chapter 4 Index Tracking"

Who's right? Who made a mistake? You can't find the answer by simply comparing the numbers 87 and 105.

A less labor-intensive method is to ask several classmates for the answer.

If most of your classmates answered 87, then 87 is probably correct.

Let's try something a little more challenging this time.

Let's take a look at each person's solution process one by one and see what steps they took to arrive at the answer of 87 or 105.

Then we will be able to see in more detail where and what went wrong, who is right and who is wrong.

---From "Chapter 5 Value Investing"

Is it truly algorithmic trading or a game for individual investors to simply look at charts, trace patterns from memory, and click their mouse? Imagine sitting as the tenth player at a poker table with nine other players.

Six of them have terminals that tell them the odds of each hand, one of the remaining three is a huge player, one is a value investor, and the last one is another individual investor who trades charts.

Do you want to play a game like this? I wouldn't do it even if I died and came back to life.

---From "Chapter 6 Chart Trading"

For example, to know Walmart's sales, traditionally, you would have to refer to the quarterly earnings report, but now you can use satellite data taken of Walmart's parking lot to track the number of vehicle visits, estimate sales in advance, and enter positions accordingly.

Similarly, satellite imagery data can be used to estimate the depth (shadow length) of oil tanks that store crude oil submerged in the water, which can be used as a signal for oil trading.

There are even trading signals that utilize Wikipedia search volumes.

These data are called alternative data, and have been growing explosively in recent years.

---From "Chapter 7 Quantitative Investment and Algorithmic Trading"

Then, I worked as a data scientist at Lazard, Kensho Technologies, and S&P Global, and I had a lot of regrets.

Applying machine learning and deep learning in practice requires many small but important nuances beyond simply loading and running pre-built Python libraries.

When my model's accuracy was stuck at 88% and I didn't know how to improve it further, what helped me move forward wasn't some fancy deep learning knowledge, but a deep mathematical understanding of the model I was using, and an understanding of basic and tedious basic statistics, linear algebra, calculus, and regression analysis.

---From "Chapter 8: The Path Individual Investors Should Take"

If you persevere in uncertain markets with a probabilistic mindset, you will ultimately come to deeply appreciate the existence of uncertainty in the world.

Because of the existence of uncertainty and the fact that no methodology in the world can perfectly determine the fair value of a stock or perfectly predict which stocks will rise, opinions among market participants vary, and some people make excess profits while others suffer excess losses.

If there is a holy grail that can perfectly predict the market, then the market is efficient, and in an efficient market, no matter how hard we try, we cannot become rich through stock investing.

---From "Chapter 9: The Essence of Investment and Dichotomous Thinking"

Let's say there's an office worker who hates going to work so much.

I really hate seeing my boss and I'm so stressed out, but I relieve that stress by enjoying hobbies and leisure activities on the weekends.

In this case, moving to a company that is less stressful, more comfortable to work for, but pays a little less may be better for your long-term happiness.

---From "Chapter 10: Do You Really Dream of Financial Freedom to Be Happy?"

The university I attended was in a hot spring town called Beppu, and at sunset, my roommates and I would go to a hot spring bathhouse run by a nearby family home.

I often miss the days when I would pay 100 yen to my grandmother, who was always watching dramas, to take a bath, and then buy a half-price lunch box called "Closing Waribiki" from a nearby convenience store and eat it with a glass of beer.

At times like this, I think again about what truly makes me happy and what I am missing out on.

---From the "Epilogue"

Publisher's Review

“Beware of excessive praise for capital gains, remember the probabilistic advantage!”

The Essence of Financial Freedom and Three Axioms for Winning in Investing

Part 1 lists skills, risk, inefficiency, and time as the elements for achieving financial freedom, and says that you need at least two of them to save 1 billion to 10 billion won.

It's a way to build up your skills, get a high-paying job, and then spend time accumulating wealth.

However, many people, rather than developing their skills or finding market inefficiencies, end up ruined by making high-risk investments such as 'junk stocks' or 'coins' in the hope of getting rich quickly.

The theme of Chapter 1 is the nature of economic freedom.

It analyzes the current state and problems of excessive praise for capital income, discusses the media's gaslighting behavior that incites fear with terms like "FIRE tribe," "instant beggars," and "inferior slow lane," and discusses the truth and falsehood of the "magic of compound interest."

It rediscovers the outstanding value of labor income, often overshadowed by the praise for capital income, and the power of frugality, a risk-free source of income that is often overlooked.

This is a place to firmly establish the core of financial technology before discussing full-scale investment.

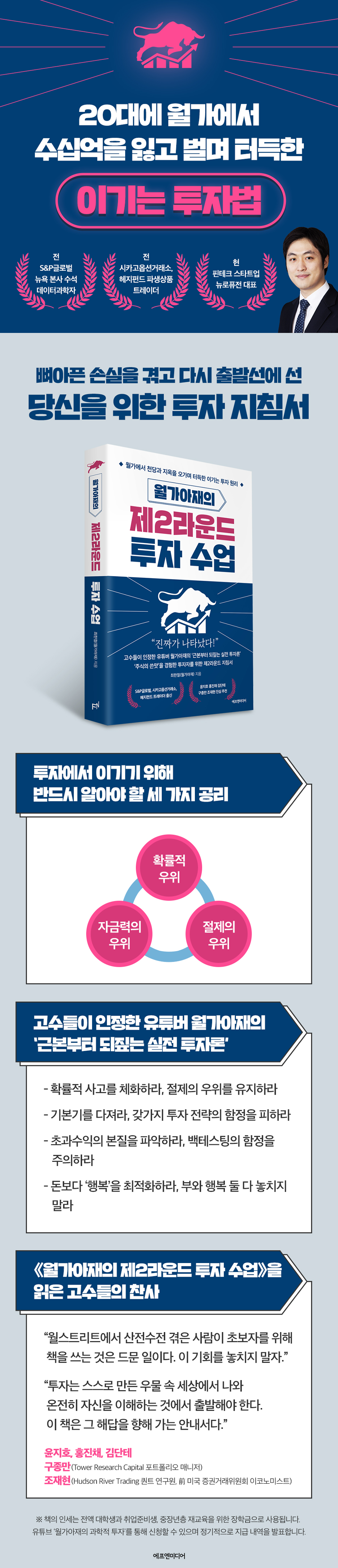

Chapter 2 discusses three common axioms in the world of investment, emphasizing that you must know them before starting to invest.

The three are probabilistic advantage, financial advantage, and psychological (restraint) advantage.

Using casinos as an example, it explains why casino operators always achieve consistent cumulative profits.

For example, in casino games such as blackjack and roulette, the casino operator's theoretical winning percentage is at least 51.5%, and the actual winning percentage is higher because they have an advantage in money and psychological battles.

Casino players, on the other hand, have a theoretical win rate of up to 48.5%, with actual win rates being lower.

The author explains how to apply this principle to investing, emphasizing that investors should ultimately invest like casino operators.

The author argues that investments that do not do so may be gambling rather than investing.

"Know the nature of excess returns, and beware of the traps of backtesting!"

The Truth and Fiction of Five Strategies, From Value Investing to Algorithms and Mid- to Long-Term Quantitative Investing

In Part 2, we'll examine five representative investment strategies: index tracking, value investing, chart trading, algorithmic trading, and mid- to long-term quantum investing.

The key is that you need to understand the essence and philosophy of each strategy to achieve consistent returns from your investments, but most don't.

The author reveals the pros and cons and underlying philosophy of each strategy, offering guidance on how individual investors should approach it.

The first is an index-tracking strategy, also known as index investing.

Index investing is a passive investment that simply tracks index returns. The author explains the nature of returns using index funds and index ETFs as examples.

It is true that index funds and index ETFs always rank in the top 20% in terms of long-term returns because their trading fees are significantly lower than other funds.

This is because it is a passive strategy in which the fund manager only has to passively trade when new stocks are added to or removed from the index being tracked.

The author warns that if you fail to recognize the essence of this passive strategy, you risk missing out on its benefits while also taking on the risks of an active strategy.

Many investors who adopt an index-tracking strategy exhibit contradictory behaviors that would be expected in an active strategy, such as investing a lump sum in index products or buying and selling index ETFs in an attempt to time the market.

The proposition that the stock market trend is upward in the long term is also incorrect depending on how one defines "long term," and it warns against indiscriminate optimism about passive strategies.

We've compiled some things to keep in mind when tracking indices, including a comparison of the returns of lump-sum entry and accumulation types and the nature of thematic ETFs.

The core of mutual fund, hedge fund, and index fund strategies are also easily explained.

From the second value investment, we move on to active investment, and in Chapter 5, we first explain the nature of excess returns pursued by active investment.

He emphasized the pursuit of consistent excess returns rather than one-time profits brought about by short-term volatility, and then mathematically solved the strategy of generating excess returns using the 'information index' formula.

Applying this formula from a value investor's perspective, we conclude that to improve investment performance, one must either enhance corporate analysis capabilities, analyze more companies, or increase the rate at which analyzed companies are converted into actual investments.

With these three directions in mind, I'll explain a four-step value investing process.

Step 4: Stock exploration, valuation, research, and portfolio management.

In the first step of stock exploration, we use the information index formula to find undervalued companies.

Step 2 valuation is the essence of value investing, which is to find market mistakes, and deals with absolute valuation and relative valuation methodologies.

The author explains the essence of PER and PSR, which are representative relative valuation methods, step by step, saying that many investors misuse them.

Stage 3 research emphasizes that intuition and reasoning are important areas where people have a significant advantage over algorithms.

In the 4-step portfolio management, it is explained by dividing it into investment diversification and risk management.

Third is chart trading.

In Chapter 6, the author cautions against individual investors attempting to become pure chartists, explaining the nature of chart patterns and the principles of algorithmic trading.

A fundamental limitation of chart trading is that it assumes that past patterns will repeat themselves in the future.

The author discusses the limitations of chart trading through examples of the options market, which he experienced on Wall Street, a thought experiment on the KOSPI index, and cases of index arbitrage.

The author argues that individuals should use charts as technical indicators but not trade them.

The argument is that individuals cannot compete with the rapidly growing cutting-edge technology infrastructure of quant, ultra-high-frequency trading, and algorithmic trading, and that prop trading, particularly ultra-high-frequency trading, is never exposed to the outside world.

Finally, Chapter 7 explores algorithmic trading and mid- to long-term quantitative investing.

Companies like Citadel, DRW, and Jump Trading in the US showcase the incredibly advanced hardware and infrastructure in the field of high-frequency trading.

Interesting examples include ultra-shortwave networks designed to reduce transmission time to one millionth of a second and collocation to achieve speeds up to 99% of the speed of light.

The latest trends in mid- to long-term quantitative investing, including quantamentals and alternative data, are also introduced.

In a reality where false quantitative investment strategies are circulating in the market under the name of "quant," the author emphasizes that it is necessary to understand the content of the text to avoid being deceived.

Using examples of quant errors, we explain the pitfalls of backtesting and the flaws in the magic formula.

However, we did not leave out any points to keep in mind for readers who plan to make quantitative investments.

“Embrace probabilistic thinking, and don’t miss out on either wealth or happiness!”

The Path to Financial Freedom: Where Individual Investors Should Go

Part 3 outlines the path to financial freedom for individual investors.

Chapter 8 emphasizes the importance of building the fundamentals of investing.

The author shares his painful experience of working with fellow PhDs at Lazard Investment Bank, Kensho Technology, and S&P Global, where the difference between them and his colleagues was their lack of fundamental math and statistics skills. He urges both value and quantitative investors to solidify their knowledge of basic accounting and valuation.

While it may be tempting to jump into flashy techniques like deep learning and reinforcement learning, I emphasize that ultimately, improving your investment skills comes down to solid fundamentals.

Chapter 9 deals with embodying probabilistic thinking and avoiding dichotomous thinking, as an extension of the three axioms of "probabilistic superiority" discussed in Chapter 2.

Probabilistic thinking is the opposite of dichotomous thinking. It is a way of thinking that examines a phenomenon in detail and thinks deeply, and it is a way of seeing the forest rather than the trees and the essence rather than the result.

Probabilistic thinking is important because it helps you avoid spending money unnecessarily, getting scammed, or getting into irreversible situations.

The reason for this is explained in detail in the text.

A fundamental way to distinguish between good and bad strategies in the face of market uncertainty also lies in probabilistic thinking.

Chapter 10 is about happiness, the ultimate goal of investment.

Create a pain list and distinguish between pains that can be solved with money and pains that cannot be solved with money.

Ultimately, it makes you realize that not all suffering is due to money.

It explores the relationship between money accumulation and happiness in an interesting way, considering various scenarios such as indulgence in pleasure, giving up present happiness for the future, and thinking that money is the cause of unhappiness.

The conclusion is that the higher the happiness, the more wealth is accumulated in proportion to the passage of time.

In other words, making money can make you happy, but being happy also makes you more likely to make money.

Therefore, the author concludes by emphasizing that optimizing happiness, not money, is a wise choice.

The Essence of Financial Freedom and Three Axioms for Winning in Investing

Part 1 lists skills, risk, inefficiency, and time as the elements for achieving financial freedom, and says that you need at least two of them to save 1 billion to 10 billion won.

It's a way to build up your skills, get a high-paying job, and then spend time accumulating wealth.

However, many people, rather than developing their skills or finding market inefficiencies, end up ruined by making high-risk investments such as 'junk stocks' or 'coins' in the hope of getting rich quickly.

The theme of Chapter 1 is the nature of economic freedom.

It analyzes the current state and problems of excessive praise for capital income, discusses the media's gaslighting behavior that incites fear with terms like "FIRE tribe," "instant beggars," and "inferior slow lane," and discusses the truth and falsehood of the "magic of compound interest."

It rediscovers the outstanding value of labor income, often overshadowed by the praise for capital income, and the power of frugality, a risk-free source of income that is often overlooked.

This is a place to firmly establish the core of financial technology before discussing full-scale investment.

Chapter 2 discusses three common axioms in the world of investment, emphasizing that you must know them before starting to invest.

The three are probabilistic advantage, financial advantage, and psychological (restraint) advantage.

Using casinos as an example, it explains why casino operators always achieve consistent cumulative profits.

For example, in casino games such as blackjack and roulette, the casino operator's theoretical winning percentage is at least 51.5%, and the actual winning percentage is higher because they have an advantage in money and psychological battles.

Casino players, on the other hand, have a theoretical win rate of up to 48.5%, with actual win rates being lower.

The author explains how to apply this principle to investing, emphasizing that investors should ultimately invest like casino operators.

The author argues that investments that do not do so may be gambling rather than investing.

"Know the nature of excess returns, and beware of the traps of backtesting!"

The Truth and Fiction of Five Strategies, From Value Investing to Algorithms and Mid- to Long-Term Quantitative Investing

In Part 2, we'll examine five representative investment strategies: index tracking, value investing, chart trading, algorithmic trading, and mid- to long-term quantum investing.

The key is that you need to understand the essence and philosophy of each strategy to achieve consistent returns from your investments, but most don't.

The author reveals the pros and cons and underlying philosophy of each strategy, offering guidance on how individual investors should approach it.

The first is an index-tracking strategy, also known as index investing.

Index investing is a passive investment that simply tracks index returns. The author explains the nature of returns using index funds and index ETFs as examples.

It is true that index funds and index ETFs always rank in the top 20% in terms of long-term returns because their trading fees are significantly lower than other funds.

This is because it is a passive strategy in which the fund manager only has to passively trade when new stocks are added to or removed from the index being tracked.

The author warns that if you fail to recognize the essence of this passive strategy, you risk missing out on its benefits while also taking on the risks of an active strategy.

Many investors who adopt an index-tracking strategy exhibit contradictory behaviors that would be expected in an active strategy, such as investing a lump sum in index products or buying and selling index ETFs in an attempt to time the market.

The proposition that the stock market trend is upward in the long term is also incorrect depending on how one defines "long term," and it warns against indiscriminate optimism about passive strategies.

We've compiled some things to keep in mind when tracking indices, including a comparison of the returns of lump-sum entry and accumulation types and the nature of thematic ETFs.

The core of mutual fund, hedge fund, and index fund strategies are also easily explained.

From the second value investment, we move on to active investment, and in Chapter 5, we first explain the nature of excess returns pursued by active investment.

He emphasized the pursuit of consistent excess returns rather than one-time profits brought about by short-term volatility, and then mathematically solved the strategy of generating excess returns using the 'information index' formula.

Applying this formula from a value investor's perspective, we conclude that to improve investment performance, one must either enhance corporate analysis capabilities, analyze more companies, or increase the rate at which analyzed companies are converted into actual investments.

With these three directions in mind, I'll explain a four-step value investing process.

Step 4: Stock exploration, valuation, research, and portfolio management.

In the first step of stock exploration, we use the information index formula to find undervalued companies.

Step 2 valuation is the essence of value investing, which is to find market mistakes, and deals with absolute valuation and relative valuation methodologies.

The author explains the essence of PER and PSR, which are representative relative valuation methods, step by step, saying that many investors misuse them.

Stage 3 research emphasizes that intuition and reasoning are important areas where people have a significant advantage over algorithms.

In the 4-step portfolio management, it is explained by dividing it into investment diversification and risk management.

Third is chart trading.

In Chapter 6, the author cautions against individual investors attempting to become pure chartists, explaining the nature of chart patterns and the principles of algorithmic trading.

A fundamental limitation of chart trading is that it assumes that past patterns will repeat themselves in the future.

The author discusses the limitations of chart trading through examples of the options market, which he experienced on Wall Street, a thought experiment on the KOSPI index, and cases of index arbitrage.

The author argues that individuals should use charts as technical indicators but not trade them.

The argument is that individuals cannot compete with the rapidly growing cutting-edge technology infrastructure of quant, ultra-high-frequency trading, and algorithmic trading, and that prop trading, particularly ultra-high-frequency trading, is never exposed to the outside world.

Finally, Chapter 7 explores algorithmic trading and mid- to long-term quantitative investing.

Companies like Citadel, DRW, and Jump Trading in the US showcase the incredibly advanced hardware and infrastructure in the field of high-frequency trading.

Interesting examples include ultra-shortwave networks designed to reduce transmission time to one millionth of a second and collocation to achieve speeds up to 99% of the speed of light.

The latest trends in mid- to long-term quantitative investing, including quantamentals and alternative data, are also introduced.

In a reality where false quantitative investment strategies are circulating in the market under the name of "quant," the author emphasizes that it is necessary to understand the content of the text to avoid being deceived.

Using examples of quant errors, we explain the pitfalls of backtesting and the flaws in the magic formula.

However, we did not leave out any points to keep in mind for readers who plan to make quantitative investments.

“Embrace probabilistic thinking, and don’t miss out on either wealth or happiness!”

The Path to Financial Freedom: Where Individual Investors Should Go

Part 3 outlines the path to financial freedom for individual investors.

Chapter 8 emphasizes the importance of building the fundamentals of investing.

The author shares his painful experience of working with fellow PhDs at Lazard Investment Bank, Kensho Technology, and S&P Global, where the difference between them and his colleagues was their lack of fundamental math and statistics skills. He urges both value and quantitative investors to solidify their knowledge of basic accounting and valuation.

While it may be tempting to jump into flashy techniques like deep learning and reinforcement learning, I emphasize that ultimately, improving your investment skills comes down to solid fundamentals.

Chapter 9 deals with embodying probabilistic thinking and avoiding dichotomous thinking, as an extension of the three axioms of "probabilistic superiority" discussed in Chapter 2.

Probabilistic thinking is the opposite of dichotomous thinking. It is a way of thinking that examines a phenomenon in detail and thinks deeply, and it is a way of seeing the forest rather than the trees and the essence rather than the result.

Probabilistic thinking is important because it helps you avoid spending money unnecessarily, getting scammed, or getting into irreversible situations.

The reason for this is explained in detail in the text.

A fundamental way to distinguish between good and bad strategies in the face of market uncertainty also lies in probabilistic thinking.

Chapter 10 is about happiness, the ultimate goal of investment.

Create a pain list and distinguish between pains that can be solved with money and pains that cannot be solved with money.

Ultimately, it makes you realize that not all suffering is due to money.

It explores the relationship between money accumulation and happiness in an interesting way, considering various scenarios such as indulgence in pleasure, giving up present happiness for the future, and thinking that money is the cause of unhappiness.

The conclusion is that the higher the happiness, the more wealth is accumulated in proportion to the passage of time.

In other words, making money can make you happy, but being happy also makes you more likely to make money.

Therefore, the author concludes by emphasizing that optimizing happiness, not money, is a wise choice.

GOODS SPECIFICS

- Date of issue: February 15, 2023

- Page count, weight, size: 336 pages | 437g | 140*210*17mm

- ISBN13: 9791188754762

- ISBN10: 1188754769

You may also like

카테고리

korean

korean

![ELLE 엘르 스페셜 에디션 A형 : 12월 [2025]](http://librairie.coreenne.fr/cdn/shop/files/b8e27a3de6c9538896439686c6b0e8fb.jpg?v=1766436872&width=3840)